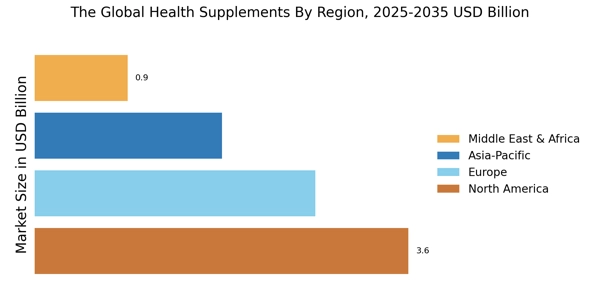

North America : Health Innovation Leader

North America is the largest market for health supplements, accounting for approximately 40% of the global share. The region's growth is driven by increasing health awareness, a rise in preventive healthcare, and a growing aging population. Regulatory support from agencies like the FDA ensures product safety and efficacy, further boosting consumer confidence in health supplements. The demand for natural and organic products is also on the rise, contributing to market expansion. The United States leads the North American market, with key players such as Herbalife, Amway, and GNC Holdings dominating the landscape. Canada follows as the second-largest market, driven by a growing interest in wellness and fitness. The competitive landscape is characterized by a mix of established brands and emerging companies, all vying for market share in a rapidly evolving sector. The presence of major players ensures a diverse range of products catering to various consumer needs.

Europe : Regulatory Framework Strength

Europe is the second-largest market for health supplements, holding approximately 30% of the global share. The region's growth is fueled by increasing consumer awareness regarding health and wellness, along with a shift towards preventive healthcare. Stringent regulations from the European Food Safety Authority (EFSA) ensure product quality and safety, which enhances consumer trust and drives market growth. The demand for plant-based and organic supplements is particularly strong in this region. Leading countries in Europe include Germany, the UK, and France, with Germany being the largest market. The competitive landscape features a mix of local and international brands, including Nature's Bounty and Blackmores. The presence of established players, along with a growing number of startups, contributes to a dynamic market environment. Consumers are increasingly seeking innovative products that align with their health goals, further propelling market growth.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is an emerging powerhouse in the health supplements market, accounting for approximately 20% of the global share. The region's growth is driven by rising disposable incomes, increasing health consciousness, and a growing aging population. Regulatory frameworks are evolving, with countries like Australia and Japan implementing stringent guidelines to ensure product safety and efficacy. The demand for herbal and traditional supplements is particularly strong, reflecting cultural preferences in the region. China and India are the leading markets in Asia-Pacific, with significant contributions from local manufacturers and international brands. The competitive landscape is characterized by a mix of established companies and new entrants, all aiming to capture the growing consumer base. Key players like Usana Health Sciences and Swanson Health Products are expanding their presence, catering to the diverse needs of health-conscious consumers in the region.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa represent a resource-rich frontier for the health supplements market, holding approximately 10% of the global share. The region's growth is driven by increasing urbanization, rising disposable incomes, and a growing awareness of health and wellness. Regulatory bodies are beginning to establish frameworks to ensure product safety, which is crucial for market expansion. The demand for dietary supplements is on the rise, particularly among the younger population seeking healthier lifestyles. Leading countries in this region include South Africa, the UAE, and Nigeria, with South Africa being the largest market. The competitive landscape is still developing, with a mix of local and international brands entering the market. Key players are focusing on innovative products that cater to the unique health needs of consumers in the region, creating a dynamic and competitive environment.