North America : Innovation and Market Leadership

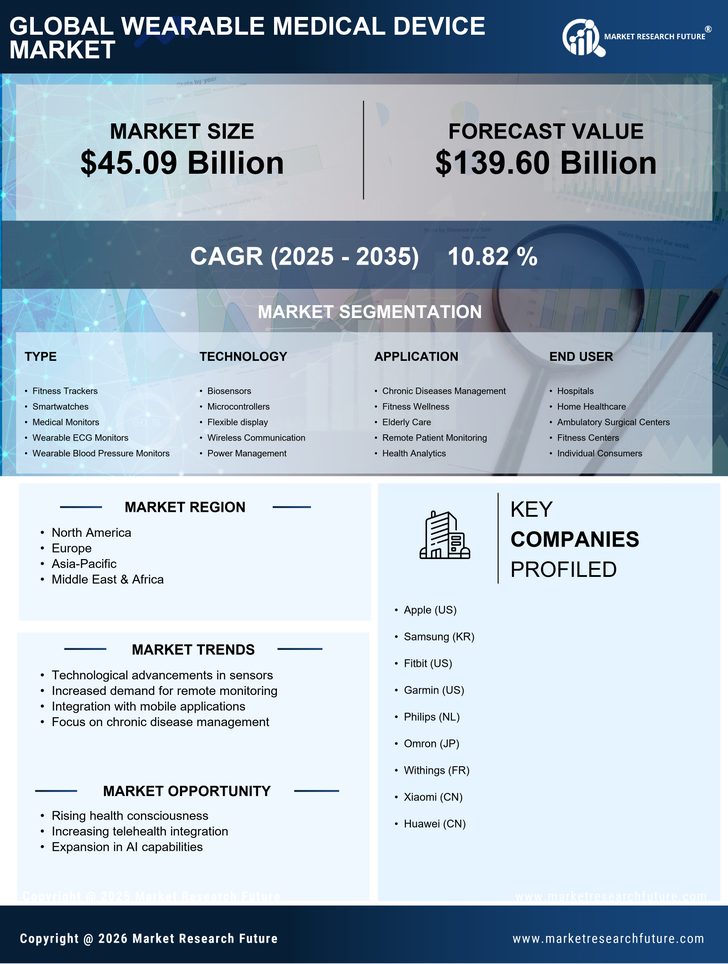

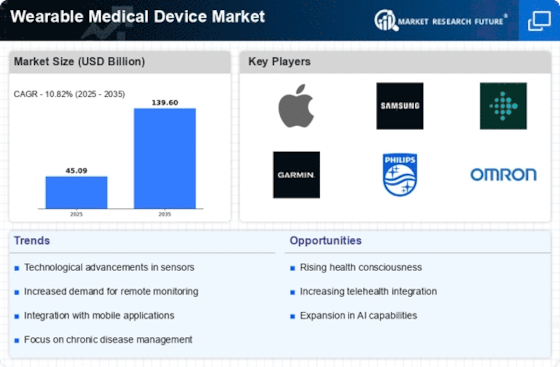

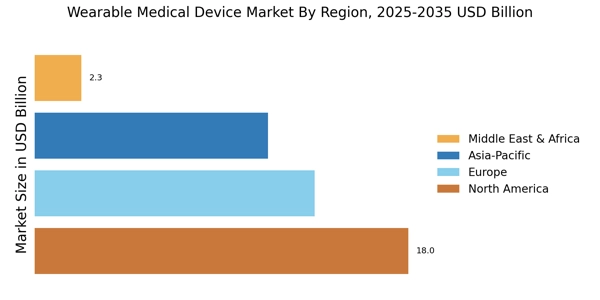

North America accounted for the largest share of the global Wearable Medical Device Market size, reaching USD 18 billion in 2024. North America leads the wearable medical device market, driven by technological advancements and a high prevalence of chronic diseases. The region holds approximately 40% of the global market share, with the U.S. being the largest contributor, followed by Canada at around 10%. Regulatory support from agencies like the FDA has accelerated product approvals, fostering innovation and consumer adoption.

The competitive landscape is robust, featuring key players such as Apple, Fitbit, and Garmin. These companies leverage advanced technologies to enhance user experience and health monitoring capabilities. The presence of established healthcare infrastructure and increasing consumer awareness further propels market growth. As a result, North America remains a focal point for investment and development in wearable medical devices.

Europe : Regulatory Framework and Growth

Europe is witnessing significant growth in the wearable medical device market, driven by an aging population and increasing health awareness. The region accounts for approximately 30% of the global market share, with Germany and the UK being the largest markets. Stringent regulations from the European Medicines Agency (EMA) ensure product safety and efficacy, which boosts consumer confidence and market demand.

Leading countries like Germany, France, and the UK are home to major players such as Philips and Withings. The competitive landscape is characterized by innovation and collaboration among tech companies and healthcare providers. The European market is also seeing a rise in startups focusing on niche wearable technologies, enhancing the overall ecosystem and driving further growth.

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific is rapidly emerging as a powerhouse in the wearable medical device market, driven by increasing disposable incomes and a growing focus on health and fitness. The region holds about 25% of the global market share, with China and Japan leading the way. Government initiatives promoting digital health and telemedicine are also catalyzing market growth, making healthcare more accessible to the population.

China's market is particularly dynamic, with key players like Xiaomi and Huawei making significant inroads. The competitive landscape is marked by a mix of established brands and innovative startups, all vying for market share. As consumer awareness of health monitoring rises, the demand for wearable devices is expected to surge, further solidifying Asia-Pacific's position in the global market.

Middle East and Africa : Emerging Market with Potential

The Middle East and Africa region is gradually emerging in the wearable medical device market, driven by increasing healthcare investments and a rising prevalence of lifestyle diseases. The region currently holds about 5% of the global market share, with South Africa and the UAE being the leading markets. Government initiatives aimed at improving healthcare infrastructure are expected to boost market growth in the coming years.

Countries like South Africa and the UAE are witnessing a surge in demand for wearable devices, supported by a growing middle class and increasing health awareness. The competitive landscape is still developing, with both local and international players entering the market. As the region continues to invest in healthcare technology, the potential for growth in wearable medical devices is significant.