Aging Population

Italy's demographic landscape is characterized by an aging population, which significantly impacts the health supplements market. As the proportion of elderly individuals increases, there is a corresponding rise in the demand for supplements that cater to age-related health concerns. Data indicates that over 23% of the Italian population is aged 65 and older, a figure that is projected to rise in the coming years. This demographic shift suggests a growing market for supplements aimed at enhancing bone health, cognitive function, and overall vitality. Consequently, companies within the health supplements market are likely to focus on developing products tailored to the needs of older consumers, thereby capitalizing on this demographic trend and potentially increasing their market share.

Influence of Social Media

Social media platforms are becoming powerful tools in shaping consumer perceptions and behaviors within the health supplements market in Italy. Influencers and health advocates are increasingly promoting various supplements, which appears to resonate with younger demographics. Data suggests that nearly 40% of Italian consumers aged 18-34 are influenced by social media when making health-related purchases. This trend indicates a shift in marketing strategies, as brands are likely to invest more in digital marketing and influencer partnerships to engage with potential customers. The impact of social media on consumer behavior may lead to increased sales and brand loyalty within the health supplements market, as consumers seek products endorsed by trusted figures in their online communities.

Rising E-commerce Adoption

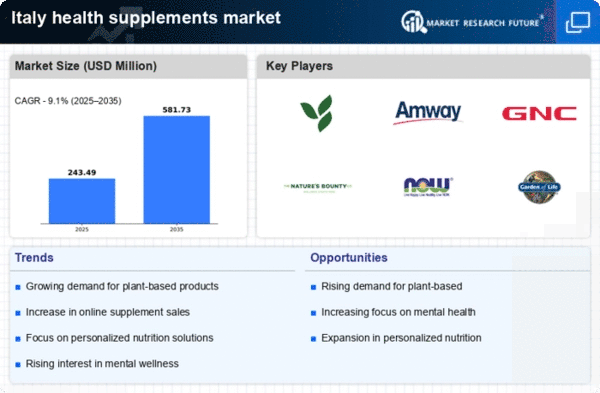

The health supplements market in Italy is witnessing a transformation due to the rapid adoption of e-commerce platforms. With the convenience of online shopping, consumers are increasingly turning to digital channels to purchase health supplements. Recent statistics reveal that online sales of health supplements have surged by approximately 30% in the past year alone. This shift not only broadens the accessibility of products but also allows consumers to compare prices and read reviews, fostering informed purchasing decisions. As e-commerce continues to grow, it is likely to play a pivotal role in shaping the health supplements market, enabling brands to reach a wider audience and enhance their visibility in a competitive landscape.

Growing Health Consciousness

The health supplements market in Italy is experiencing a notable surge in demand, driven by an increasing awareness of health and wellness among consumers. This trend appears to be influenced by a shift towards preventive healthcare, where individuals are proactively seeking ways to enhance their well-being. According to recent data, approximately 60% of Italians are now prioritizing their health, leading to a rise in the consumption of dietary supplements. This growing health consciousness is likely to propel the health supplements market, as consumers are more inclined to invest in products that support their nutritional needs and overall health. Furthermore, the Italian government has been promoting healthy lifestyles, which may further encourage the adoption of health supplements, thereby expanding the market's reach and potential.

Regulatory Support for Natural Products

The health supplements market in Italy is benefiting from a favorable regulatory environment that supports the use of natural ingredients. Recent legislative changes have streamlined the approval process for health supplements, making it easier for companies to introduce new products. This regulatory support appears to encourage innovation and the development of high-quality supplements that meet consumer demand for natural and organic options. As a result, the market is likely to see an influx of products that align with these preferences, potentially driving growth. Furthermore, the Italian government has been promoting the use of natural health products, which may further enhance consumer trust and acceptance of health supplements, thereby expanding the market's potential.