E-commerce Expansion

The health supplements market in Germany is benefiting from the rapid expansion of e-commerce platforms. With the rise of online shopping, consumers are increasingly turning to digital channels to purchase health supplements. This shift is driven by the convenience and accessibility that e-commerce offers, allowing consumers to compare products, read reviews, and make informed decisions from the comfort of their homes. Recent data indicates that online sales of health supplements have increased by over 15% in the past year, highlighting the growing preference for online purchasing. The health supplements market is adapting to this trend by enhancing online presence and offering exclusive online promotions, thereby attracting a broader customer base.

Growing Health Consciousness

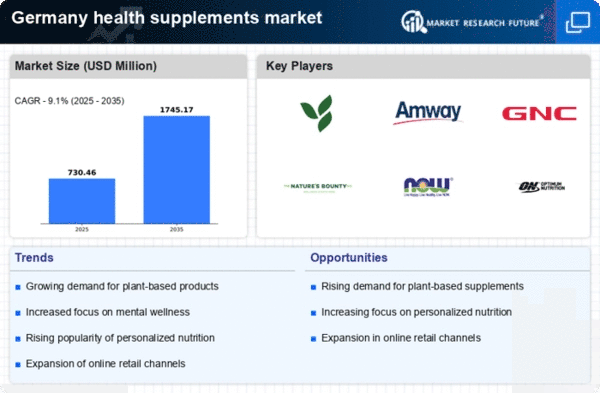

The health supplements market in Germany is experiencing a notable surge due to the increasing health consciousness among consumers. As individuals become more aware of the importance of nutrition and wellness, they are actively seeking products that can enhance their overall health. This trend is reflected in the market data, which indicates that the health supplements market has grown by approximately 8% annually over the past few years. Consumers are particularly interested in supplements that support specific health goals, such as weight management, energy enhancement, and overall vitality. This growing awareness is driving demand for a diverse range of products, including vitamins, minerals, and herbal supplements, thereby contributing to the expansion of the health supplements market.

Aging Population Demographics

Germany's aging population is significantly influencing the health supplements market. As the demographic landscape shifts, there is a rising demand for products that cater to the health needs of older adults. This segment is increasingly focused on maintaining health and preventing age-related ailments, which has led to a greater interest in supplements that support joint health, cognitive function, and cardiovascular wellness. Market analysis suggests that the health supplements market is likely to see a continued increase in sales, with projections indicating a growth rate of around 6% annually as the population ages. This demographic shift presents opportunities for companies to innovate and develop targeted products that meet the specific needs of older consumers.

Influence of Social Media and Influencers

The health supplements market in Germany is being shaped by the influence of social media and health influencers. As consumers increasingly turn to social media platforms for health advice and product recommendations, the role of influencers has become pivotal in shaping purchasing decisions. Many consumers trust endorsements from influencers, which can lead to increased brand awareness and sales. This trend is particularly evident among younger demographics, who are more likely to engage with health content on platforms like Instagram and TikTok. The health supplements market is leveraging this trend by collaborating with influencers to promote products, thereby enhancing visibility and credibility in a competitive market.

Regulatory Developments and Quality Assurance

The health supplements market in Germany is also impacted by regulatory developments aimed at ensuring product safety and quality. The German Federal Institute for Risk Assessment (BfR) plays a crucial role in establishing guidelines and regulations for health supplements. As consumers become more discerning about product quality, companies are compelled to adhere to stringent standards to maintain consumer trust. This focus on quality assurance is likely to drive innovation within the health supplements market, as manufacturers seek to differentiate their products through superior quality and compliance with regulations. The emphasis on safety and efficacy may also lead to increased consumer confidence, potentially boosting market growth.