Research Methodology on HbA1C Testing Market

1 Introduction

The purpose of this research is to investigate the global HbA1C testing market and find out the prospective growth opportunities in this market. This research report is based on extensive secondary research and primary interviews conducted with various stakeholders in the HbA1C testing market. The research report also focuses on the qualitative aspects of the market with the help of comprehensive market analysis, value chain analysis, and Porter's Five-Force Analysis.

2 Research Approach

To conduct this research on the global HbA1C testing market, MRFR has adopted both primary and secondary research approaches. In the secondary research phase, MRFR has collected information from the relevant magazines, journals, reports and papers of the market. This information helps to gain an in-depth understanding and knowledge of the HbA1C testing market. Also, the primary research phase of this research helps to get access to the current market information, along with the key players in this market.

3 Research Methodology

3.1 Primary Research

The primary research of the market comprises both in-depth interviews and quantitative surveys. The primary interview is conducted with stakeholders in the HbA1C testing market, such as suppliers, manufacturers, distributors, and research analysts. The questions asked in the interviews help us to get an insight into the market, along with the strategies adopted by the participants. Apart from the interviews, a quantitative survey is conducted to collect the opinions of the industry exponents on certain issues related to the HbA1C testing market.

3.2 Secondary Research

The secondary research activities undertaken are a review of secondary databases, such as newspapers, magazines, industry reports, and websites, to gain a better understanding of the market dynamics. Also, reference reports of the market are studied, which helps to analyze the present market scenario and trends. It also helps in understanding the competitive landscape of the market.

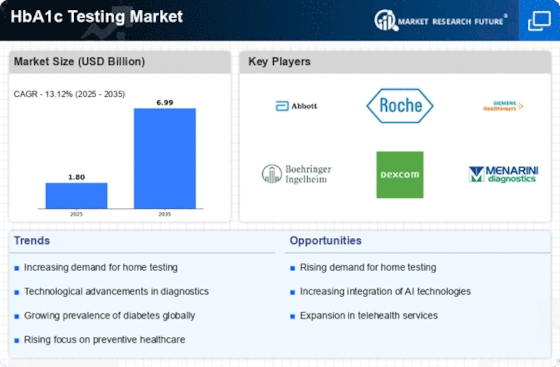

4 Market Size Estimation

The market size estimation is done by collecting data from both primary and secondary research sources. The primary research conducted is used to modify the current market size and the secondary data is used to estimate the actual market size for the HbA1C testing market.

5 Data Triangulation

To get an accurate market size estimation and to find answers to all the research questions, an extensive data triangulation process is followed. This process involves the gathering of data from multiple sources and the integration of the data collected. Different data sources include trade publications, government publications, surveys, press releases, and interviews conducted with industry stakeholders.

6 Market Breakdown and Data Analysis

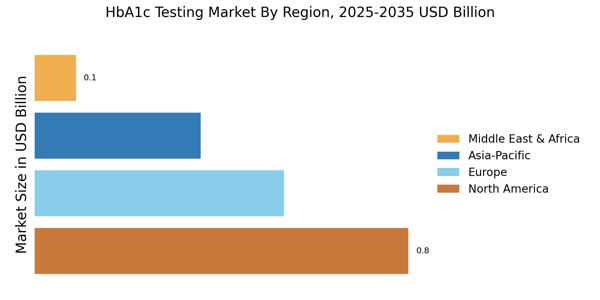

This research report on the global HbA1C testing market is broken down into various segments and sub-segments. After the market breakdown, market analysis is done through a series of data analysis techniques, such as correlation and regression analysis, forecasting, and trend analysis, in order to get an in-depth and unbiased view of the market.

7 Assumptions

The following assumptions are taken into account while conducting this research:

The market data and information gathered from both primary and secondary sources is reliable and accurate.

Geographical regions are considered for the estimation and regional growth rates are looked at for the respective countries included in the study.

The growth rate of the region is assumed based on the present market trend.

Exchange rate, inflation rate, and population growth rate are taken into consideration while calculating the market size.