Market Analysis

In-depth Analysis of HbA1c Testing Market Industry Landscape

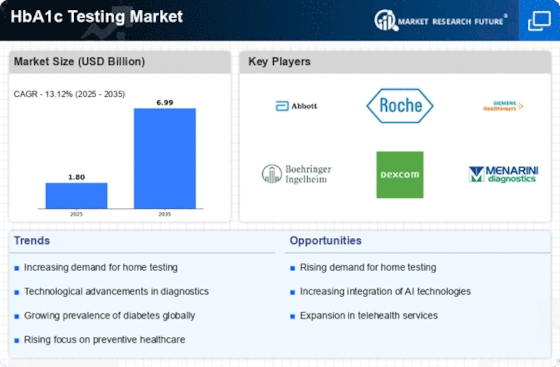

The global HbA1c market is characterized by the active participation of well-established players. These companies consistently engage in various strategic activities like research and development, mergers, acquisitions, and joint ventures to solidify their position in the market. An illustrative example of this trend is evident in the actions of EKF Diagnostics in April 2019. The company entered into a private label distribution agreement with McKesson Medical-Surgical Inc. for its hemoglobin analyzer, the DiaSpect Tm. This collaboration with McKesson, a key player that serves more than 50% of hospitals and 20% of physicians in the United States, showcases a deliberate effort by leading companies to expand their reach and influence in the market. By aligning with such influential distribution partners, companies aim to tap into a broader customer base and enhance their market presence.

The significance of such strategic moves becomes apparent when considering their potential impact on increasing the demand for diagnostic tools in different countries. In the case of EKF Diagnostics, partnering with McKesson serves as a strategic maneuver to leverage the vast network and extensive reach of McKesson in the healthcare industry. This strategic alliance is anticipated to result in an increased adoption of the DiaSpect Tm hemoglobin analyzer in hospitals and among physicians, consequently contributing to the overall growth of the HbA1c market. The emphasis on research and development, mergers, acquisitions, and partnerships underscores the competitive nature of the HbA1c market. Companies recognize the need to continually innovate and collaborate to stay ahead in the dynamic landscape of diagnostic technologies. These strategic initiatives not only benefit the companies involved but also play a pivotal role in advancing healthcare outcomes by ensuring the availability and accessibility of advanced diagnostic tools.

Leave a Comment