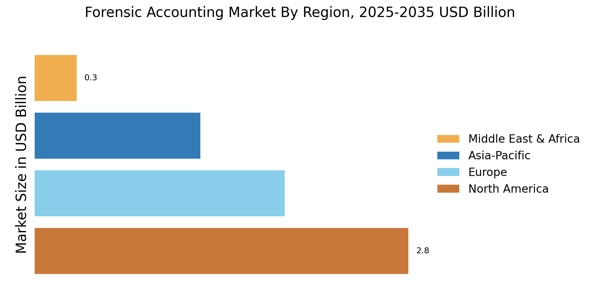

North America : Market Leader in Forensic Accounting Market

North America is the largest market for forensic accounting, holding approximately 45% of the global share. The region's growth is driven by increasing regulatory scrutiny, rising fraud cases, and the demand for transparency in financial reporting. The U.S. and Canada are the primary contributors, with a robust legal framework supporting forensic investigations. The demand for forensic services is further fueled by advancements in technology and data analytics, enhancing investigative capabilities. The competitive landscape in North America is characterized by the presence of major players such as Deloitte, PwC, and EY. These firms leverage their extensive resources and expertise to offer comprehensive forensic accounting services. The market is also witnessing the emergence of specialized firms focusing on niche areas within forensic accounting, thereby intensifying competition. The regulatory environment, including guidelines from the SEC and IRS, further shapes the market dynamics, ensuring compliance and ethical practices.

Europe : Growing Demand for Forensic Services

Europe is witnessing significant growth in the forensic accounting market, accounting for approximately 30% of the global share. The increasing complexity of financial transactions, coupled with stringent regulations, is driving demand for forensic services. Countries like the UK and Germany are at the forefront, with a rising need for fraud detection and prevention measures. Regulatory bodies are emphasizing compliance, which is further propelling the market's expansion across the region. The competitive landscape in Europe features key players such as KPMG, BDO, and Grant Thornton, who are actively enhancing their service offerings. The presence of established firms alongside emerging local players creates a dynamic market environment. Additionally, the European Union's regulations on financial transparency and anti-fraud measures are shaping the strategies of forensic accounting firms, ensuring they remain compliant while meeting client needs.

Asia-Pacific : Emerging Forensic Accounting Market Hub

Asia-Pacific is rapidly emerging as a significant player in the forensic accounting market, holding about 20% of the global share. The region's growth is driven by increasing economic activities, rising incidences of financial fraud, and a growing awareness of forensic accounting's importance. Countries like China and India are leading this growth, supported by government initiatives aimed at enhancing financial integrity and transparency in business practices. The competitive landscape in Asia-Pacific is evolving, with both The Forensic Accounting Market share. Key players such as Crowe and Baker Tilly are expanding their presence, while local firms are gaining traction by offering tailored services. The region's diverse regulatory environment poses challenges, but it also presents opportunities for firms to innovate and adapt their services to meet local demands, thereby enhancing their competitive edge.

Middle East and Africa : Developing Forensic Accounting Market

The Middle East and Africa region is gradually developing its forensic accounting market, currently holding about 5% of the global share. The growth is primarily driven by increasing economic activities, a rise in financial crimes, and the need for compliance with international standards. Countries like South Africa and the UAE are leading the charge, with governments implementing stricter regulations to enhance financial transparency and combat fraud effectively. The competitive landscape in this region is characterized by a mix of international firms and local players. Key players such as RSM and Grant Thornton are establishing a foothold, while local firms are increasingly focusing on specialized forensic services. The regulatory environment is evolving, with initiatives aimed at improving financial governance, which is expected to further stimulate market growth and attract investment in forensic accounting services.