Rising Fraud Incidents

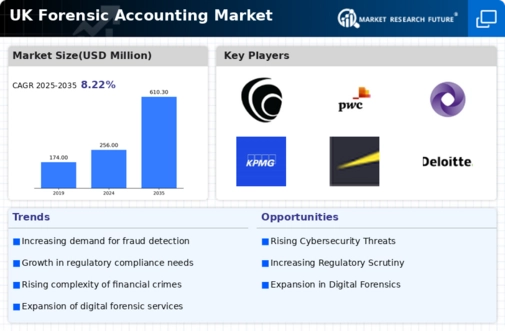

The increasing frequency of fraud cases in the UK has become a pivotal driver for the forensic accounting market. Reports indicate that fraud losses in the UK reached approximately £190 billion annually, highlighting the urgent need for forensic accountants to investigate and mitigate these financial crimes. As businesses and individuals face heightened risks, the demand for forensic accounting services is likely to surge. This trend suggests that companies are increasingly investing in forensic accounting expertise to safeguard their assets and ensure compliance with financial regulations. The forensic accounting market is thus positioned to grow as organizations seek to enhance their fraud detection and prevention strategies.

Increased Regulatory Scrutiny

The tightening of regulatory frameworks in the UK has created a robust demand for forensic accounting services. Regulatory bodies are imposing stricter compliance requirements, compelling organizations to adopt more rigorous financial practices. This environment necessitates the expertise of forensic accountants to ensure adherence to laws and regulations. The forensic accounting market is likely to see growth as companies invest in compliance measures to avoid penalties and reputational damage. With the potential for significant fines and legal repercussions, businesses are increasingly turning to forensic accountants to navigate the complexities of regulatory compliance, thereby driving demand for these services.

Complex Financial Transactions

The growing complexity of financial transactions in the UK is another significant driver for the forensic accounting market. As businesses engage in intricate financial arrangements, including mergers, acquisitions, and international trade, the potential for financial discrepancies increases. Forensic accountants play a crucial role in scrutinizing these transactions to ensure accuracy and compliance with regulations. The forensic accounting market is likely to benefit from this trend, as organizations require specialized skills to navigate the complexities of modern finance. The demand for forensic accounting services is expected to rise, with firms seeking to mitigate risks associated with financial misreporting and fraud.

Technological Advancements in Forensics

Technological advancements are reshaping the forensic accounting market, providing new tools and methodologies for investigation and analysis. The integration of data analytics, artificial intelligence, and blockchain technology is enhancing the capabilities of forensic accountants in detecting fraud and financial irregularities. As these technologies evolve, the forensic accounting market is likely to experience growth, as firms seek to leverage innovative solutions to improve their investigative processes. The adoption of advanced forensic tools can lead to more efficient and accurate outcomes, making forensic accounting services increasingly valuable in the UK market.

Growing Awareness of Financial Accountability

There is a rising awareness among businesses and individuals in the UK regarding the importance of financial accountability and transparency. This cultural shift is driving demand for forensic accounting services, as stakeholders seek to ensure that financial practices are ethical and compliant with regulations. The forensic accounting market is likely to benefit from this trend, as organizations recognize the value of having forensic accountants to provide independent assessments and investigations. This heightened focus on accountability may lead to increased investments in forensic accounting services, as companies aim to build trust with their clients and stakeholders.