North America : Market Leader in Forensic Services

North America continues to lead the Forensic Accounting Services Market, holding a significant market share of 4.25 billion. The growth is driven by increasing regulatory scrutiny, rising fraud cases, and the demand for transparency in financial reporting. Additionally, advancements in technology and data analytics are enhancing service delivery, making forensic accounting more efficient and effective. Regulatory bodies are also emphasizing compliance, further fueling market demand.

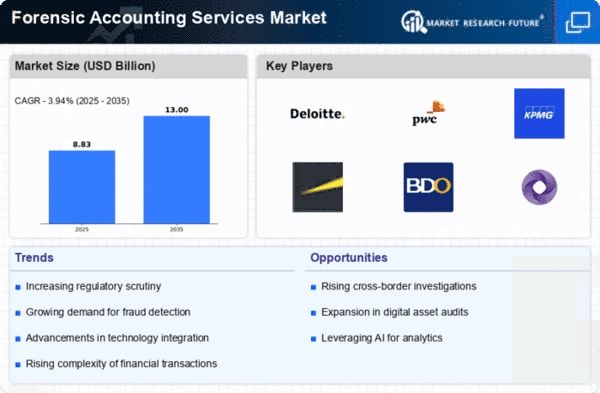

The competitive landscape in North America is robust, with key players like Deloitte, PwC, and KPMG dominating the market. The U.S. is the largest contributor, benefiting from a well-established legal framework and a high demand for forensic services across various sectors. The presence of major firms ensures a competitive environment, driving innovation and service quality. As the market evolves, firms are increasingly focusing on specialized services to meet diverse client needs.

Europe : Emerging Forensic Market Dynamics

Europe's Forensic Accounting Services Market is valued at 2.5 billion, reflecting a growing demand for specialized financial investigations. Factors such as increasing corporate fraud, regulatory compliance requirements, and the need for risk management are driving this growth. The region is witnessing a shift towards digital forensic services, with firms investing in technology to enhance their capabilities. Regulatory frameworks are also evolving, promoting transparency and accountability in financial practices.

Leading countries in Europe include the UK, Germany, and France, where major players like KPMG and EY are well-established. The competitive landscape is characterized by a mix of global firms and local specialists, providing a range of services from fraud investigation to litigation support. The presence of regulatory bodies ensures a structured market environment, fostering growth and innovation in forensic accounting services.

Asia-Pacific : Growing Demand for Forensic Services

The Asia-Pacific Forensic Accounting Services Market is valued at 1.75 billion, driven by rapid economic growth and increasing awareness of financial fraud. Countries like China and India are witnessing a surge in demand for forensic services due to rising corporate governance standards and regulatory scrutiny. The market is also benefiting from advancements in technology, enabling firms to offer more efficient and effective services. Regulatory bodies are increasingly focusing on compliance, which is further propelling market growth.

In this region, key players include local firms and international giants like Deloitte and PwC. The competitive landscape is evolving, with firms expanding their service offerings to include digital forensics and risk management. As the market matures, there is a growing emphasis on specialized services tailored to meet the unique needs of various industries, enhancing the overall service quality in forensic accounting.

Middle East and Africa : Developing Forensic Accounting Landscape

The Middle East and Africa Forensic Accounting Services Market is valued at 0.9 billion, reflecting a nascent but growing demand for forensic services. Factors such as increasing economic activities, regulatory changes, and a rise in financial crimes are driving this growth. The region is witnessing a gradual shift towards adopting forensic accounting practices, with governments emphasizing the need for transparency and accountability in financial transactions. Regulatory bodies are beginning to implement frameworks that support forensic investigations, further enhancing market potential.

Leading countries in this region include South Africa and the UAE, where there is a growing presence of both local and international firms. The competitive landscape is characterized by a mix of established players and emerging firms, focusing on providing tailored forensic services. As awareness of the importance of forensic accounting increases, the market is expected to expand, driven by both regulatory support and demand from various sectors.