Market Growth Projections

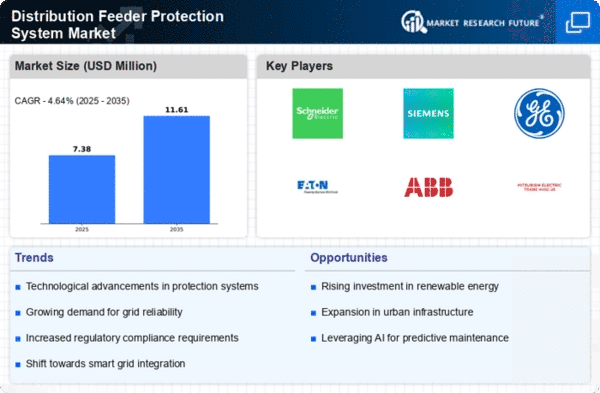

The Global Distribution Feeder Protection System Market Industry is poised for substantial growth, with projections indicating a market size of 3250 USD Million by 2024 and an anticipated increase to 6500 USD Million by 2035. This growth trajectory reflects a CAGR of 6.5% from 2025 to 2035, driven by factors such as technological advancements, regulatory support, and rising investments in renewable energy. The increasing demand for reliable power supply and the focus on energy efficiency further contribute to this positive outlook. As the industry evolves, stakeholders are likely to adapt to emerging trends and challenges, ensuring continued progress in the field.

Regulatory Support for Grid Modernization

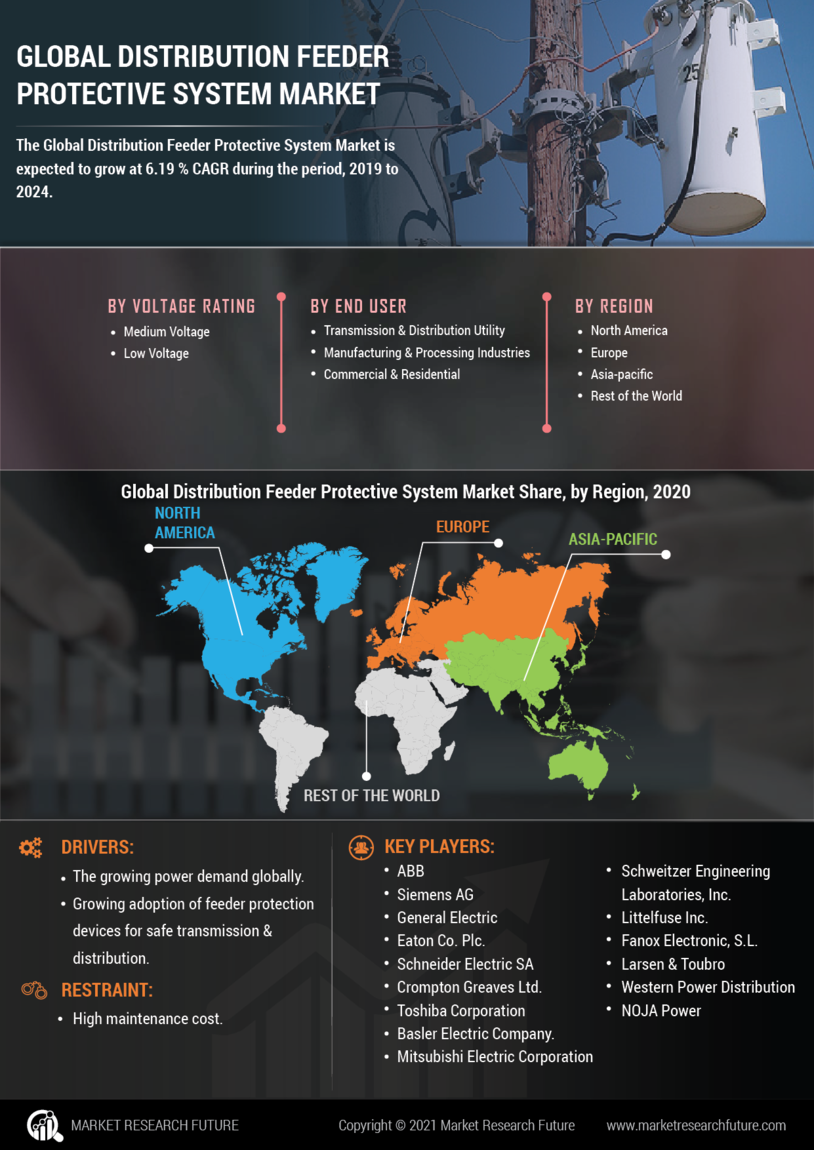

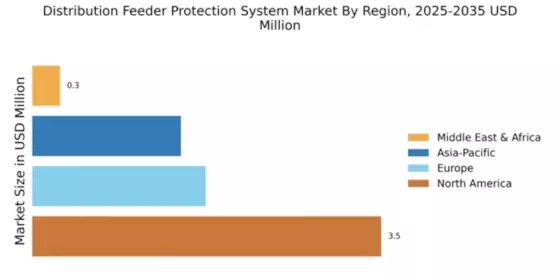

Government policies and regulations are playing a pivotal role in shaping the Global Distribution Feeder Protection System Market Industry. Many countries are implementing stringent standards aimed at enhancing grid reliability and safety. For instance, regulatory bodies in North America and Europe are mandating upgrades to aging infrastructure, which includes the adoption of advanced feeder protection systems. This regulatory push is expected to drive market growth, as utilities seek to comply with new standards. By 2035, the market is anticipated to reach 6500 USD Million, underscoring the importance of regulatory frameworks in promoting the adoption of modern protection solutions.

Increasing Demand for Reliable Power Supply

The Global Distribution Feeder Protection System Market Industry is experiencing heightened demand for reliable power supply solutions. As urbanization accelerates and populations grow, the need for uninterrupted electricity becomes paramount. This trend is particularly evident in developing regions where infrastructure is still evolving. For instance, countries in Asia are investing heavily in modernizing their electrical grids to ensure consistent power delivery. This shift is expected to contribute significantly to the market, with projections indicating a market size of 3250 USD Million by 2024. Such investments in feeder protection systems are crucial for enhancing grid resilience and reliability.

Rising Investments in Renewable Energy Sources

The transition towards renewable energy sources is significantly influencing the Global Distribution Feeder Protection System Market Industry. As more utilities integrate solar, wind, and other renewable sources into their grids, the complexity of managing these diverse energy inputs increases. This necessitates advanced feeder protection systems capable of handling variable power flows and ensuring grid stability. Investments in renewable energy infrastructure are expected to surge, further driving demand for sophisticated protection solutions. The market's growth trajectory is likely to align with the broader energy transition, reinforcing the need for robust protection systems to accommodate the evolving energy landscape.

Technological Advancements in Protection Systems

Technological innovations are driving the Global Distribution Feeder Protection System Market Industry forward. The integration of smart technologies, such as IoT and AI, enhances the capabilities of feeder protection systems, allowing for real-time monitoring and predictive maintenance. These advancements not only improve system efficiency but also reduce operational costs. For example, utilities are increasingly adopting automated protection relays that can quickly identify faults and isolate affected areas, minimizing downtime. As a result, the market is projected to grow at a CAGR of 6.5% from 2025 to 2035, reflecting the increasing reliance on advanced technologies in power distribution.

Growing Focus on Energy Efficiency and Sustainability

There is a growing emphasis on energy efficiency and sustainability within the Global Distribution Feeder Protection System Market Industry. Utilities are increasingly adopting measures to reduce energy losses and enhance overall system performance. This focus is driven by both regulatory requirements and consumer demand for greener energy solutions. Advanced feeder protection systems play a crucial role in achieving these goals by optimizing power distribution and minimizing waste. As utilities strive to meet sustainability targets, the market is poised for growth, with projections indicating a substantial increase in investment in protection systems over the coming years.