North America : Market Leader in Energy Storage

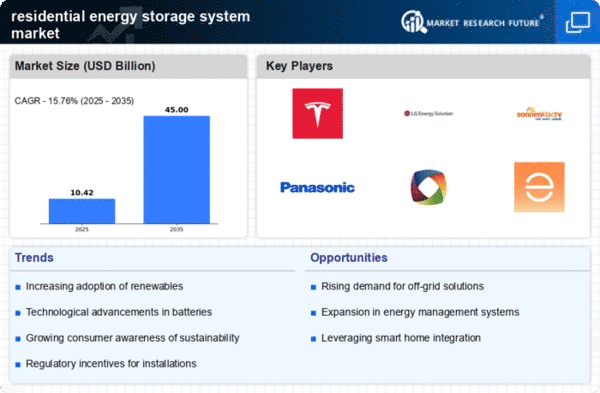

North America is poised to maintain its leadership in the residential energy storage system market, holding a significant market share of 4.5 in 2024. The growth is driven by increasing demand for renewable energy solutions, supportive government policies, and advancements in battery technology. Regulatory incentives, such as tax credits and rebates, further catalyze adoption among homeowners seeking energy independence and cost savings. The competitive landscape is robust, with key players like Tesla, Enphase Energy, and Generac leading the charge. The U.S. market is characterized by a diverse range of offerings, from high-capacity lithium-ion batteries to integrated solar solutions. As states implement more stringent energy regulations, the demand for efficient storage systems is expected to rise, solidifying North America's position as a global leader in this sector.

Europe : Emerging Market with Strong Growth

Europe is rapidly evolving into a significant player in the residential energy storage system market, with a market size of 2.7. The region benefits from ambitious climate goals and a strong push towards renewable energy sources. Regulatory frameworks, such as the European Green Deal, are designed to promote energy efficiency and sustainability, driving demand for residential storage solutions among consumers and businesses alike. Leading countries like Germany and the UK are at the forefront, with companies such as Sonnen and LG Energy Solution making substantial contributions. The competitive landscape is marked by innovation and collaboration, as manufacturers partner with local governments to enhance energy resilience. As Europe transitions to a low-carbon economy, the residential energy storage market is expected to flourish, supported by favorable policies and increasing consumer awareness.

Asia-Pacific : Growing Demand in Emerging Markets

The Asia-Pacific region is witnessing a burgeoning interest in residential energy storage systems, with a market size of 1.8. This growth is fueled by rising energy costs, increasing urbanization, and a shift towards renewable energy sources. Governments are implementing supportive policies and incentives to encourage the adoption of energy storage technologies, which are essential for managing intermittent renewable energy generation. Countries like Japan and China are leading the charge, with major players such as Panasonic and BYD investing heavily in innovative storage solutions. The competitive landscape is dynamic, with a mix of established companies and startups vying for market share. As the region continues to develop its energy infrastructure, the demand for residential energy storage systems is expected to grow significantly, driven by both consumer needs and regulatory support.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region currently presents a nascent market for residential energy storage systems, with a market size of 0.0. Despite the vast potential for solar energy, challenges such as high initial costs, limited infrastructure, and regulatory hurdles hinder widespread adoption. However, increasing awareness of renewable energy benefits is gradually shifting consumer interest towards energy storage solutions. Countries like South Africa and the UAE are beginning to explore energy storage options, with local governments starting to implement supportive policies. The competitive landscape is still developing, with few key players present. As the region seeks to diversify its energy sources and enhance energy security, the residential energy storage market is expected to gain traction in the coming years, albeit slowly.