Europe : Transitioning Energy Landscape

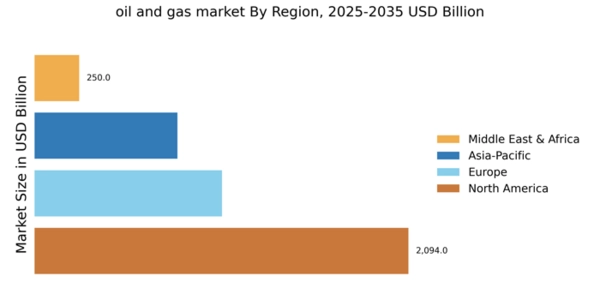

Europe's oil and gas market, valued at 1050.0, is undergoing a significant transformation. The region is focusing on reducing carbon emissions and transitioning to renewable energy sources. Regulatory frameworks, such as the European Green Deal, are driving investments in cleaner technologies and energy efficiency. This shift is expected to reshape demand patterns, with a growing emphasis on sustainable practices. Leading countries like Norway, the UK, and Germany are at the forefront of this transition. Major players, including BP and TotalEnergies, are adapting their strategies to align with environmental goals. The competitive landscape is evolving, with increased collaboration between traditional oil companies and renewable energy firms. This dynamic environment presents both challenges and opportunities for growth in the European market.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region, with a market size of 800.0, is witnessing rapid growth in oil and gas demand. Factors such as urbanization, industrialization, and population growth are driving this trend. Countries like China and India are leading the charge, with increasing energy needs fueling investments in exploration and production. Regulatory support for energy security and diversification is also a key driver in this region. The competitive landscape features major players like Gazprom and Eni, alongside local companies expanding their market presence. The region's diverse energy mix is evolving, with a focus on balancing traditional fossil fuels and renewable sources. As Asia-Pacific continues to grow, it presents significant opportunities for both domestic and international investors in the oil and gas sector.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa region, valued at 250.0, remains a critical player in The oil gas market. The region is rich in natural resources, with countries like Saudi Arabia and Nigeria leading in production. The demand for oil and gas is driven by both local consumption and export opportunities, supported by favorable regulatory environments that encourage foreign investment. Saudi Aramco and other national oil companies dominate the landscape, focusing on maximizing production efficiency and sustainability. The competitive dynamics are influenced by geopolitical factors and OPEC regulations, which play a significant role in shaping market conditions. As the region navigates challenges, it continues to be a strategic hub for global energy supply.