North America : Leading Renewable Energy Market

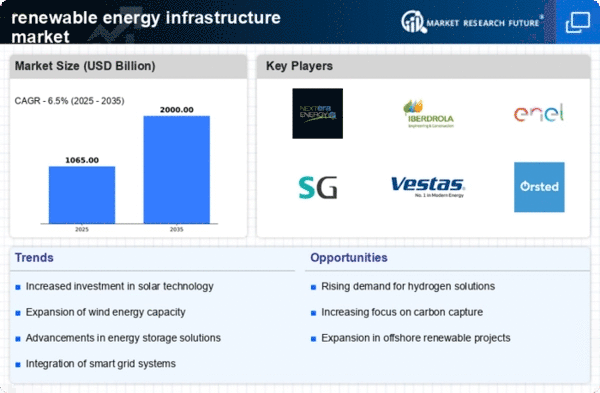

North America is poised to maintain its leadership in the renewable energy infrastructure market, holding a market size of $400.0 billion as of December 2025. Key growth drivers include robust government incentives, technological advancements, and increasing consumer demand for sustainable energy solutions. Regulatory frameworks, such as the Investment Tax Credit (ITC), further catalyze investments in solar and wind energy, enhancing market dynamics. The competitive landscape is characterized by major players like NextEra Energy, Brookfield Renewable Partners, and First Solar, which are driving innovation and expanding capacity. The U.S. and Canada are leading countries in this region, with significant investments in wind and solar projects. The presence of established companies and a favorable regulatory environment positions North America as a hub for renewable energy infrastructure development.

Europe : Sustainable Energy Transition Leader

Europe is at the forefront of the renewable energy infrastructure market, with a market size of $300.0 billion projected for December 2025. The region's growth is driven by ambitious climate targets, such as the European Green Deal, which aims for carbon neutrality by 2050. Increasing investments in offshore wind and solar energy, along with supportive policies, are key catalysts for this transition, making Europe a global leader in sustainable energy. Countries like Germany, Spain, and Denmark are leading the charge, with significant contributions from companies like Iberdrola and Siemens Gamesa. The competitive landscape is marked by innovation and collaboration among key players, enhancing the region's capacity to meet energy demands sustainably. As Europe continues to invest in renewable technologies, it solidifies its position as a pioneer in the global energy transition.

Asia-Pacific : Emerging Renewable Energy Hub

The Asia-Pacific region is rapidly emerging as a significant player in the renewable energy infrastructure market, with a projected market size of $250.0 billion by December 2025. Key growth drivers include increasing energy demand, government initiatives promoting clean energy, and technological advancements in renewable technologies. Countries are implementing policies to reduce carbon emissions, which is further fueling investments in solar and wind energy projects across the region. Leading countries such as China, India, and Japan are at the forefront of this transformation, with major companies like Enel and Vestas Wind Systems actively participating in the market. The competitive landscape is dynamic, with a mix of local and international players driving innovation and capacity expansion. As the region continues to prioritize renewable energy, it is set to play a crucial role in the global energy landscape.

Middle East and Africa : Emerging Renewable Energy Frontier

The Middle East and Africa region is gradually emerging in the renewable energy infrastructure market, with a market size of $50.0 billion anticipated by December 2025. The growth is driven by increasing energy needs, government initiatives to diversify energy sources, and investments in solar and wind projects. Countries are recognizing the importance of sustainable energy to meet future demands, leading to a shift in energy policies and investments. Leading countries like South Africa and the UAE are making significant strides in renewable energy adoption, with key players such as EDP Renewables and Orsted contributing to the market. The competitive landscape is evolving, with both local and international firms entering the market to capitalize on the growing demand for renewable energy solutions. As the region continues to develop its renewable energy capabilities, it is poised for substantial growth in the coming years.