North America : Market Leader in Power Infrastructure

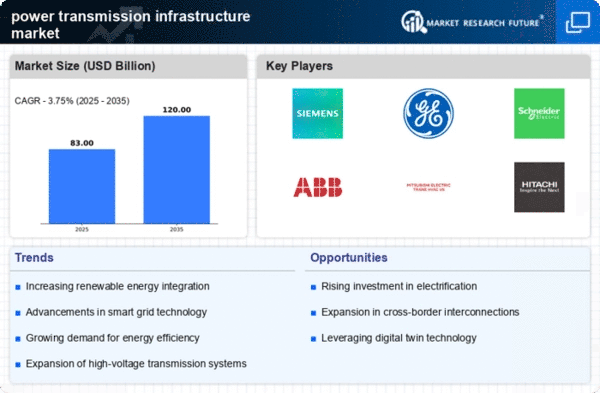

North America is poised to maintain its leadership in the power transmission infrastructure market, holding a significant 40.0% share as of 2024. Key growth drivers include the increasing demand for renewable energy integration, aging infrastructure upgrades, and substantial investments in smart grid technologies. Regulatory support, particularly from the Federal Energy Regulatory Commission (FERC), is fostering innovation and efficiency in the sector. The competitive landscape is characterized by major players such as General Electric (US), Siemens (DE), and ABB (CH), which are actively involved in enhancing grid reliability and efficiency. The U.S. and Canada are leading countries, with substantial investments in infrastructure projects aimed at modernizing the grid. The presence of these key players ensures a robust market environment, driving technological advancements and sustainable practices.

Europe : Emerging Market with Strong Regulations

Europe's power transmission infrastructure market is growing, with a market share of 25.0% as of 2024. The region is driven by stringent regulations aimed at reducing carbon emissions and enhancing energy efficiency. The European Union's Green Deal and various national policies are catalyzing investments in renewable energy sources and grid modernization, creating a favorable environment for market expansion. Leading countries such as Germany, France, and the UK are at the forefront of this transformation, with significant contributions from key players like Schneider Electric (FR) and Nexans (FR). The competitive landscape is marked by a focus on innovation and sustainability, as companies strive to meet regulatory requirements and consumer demand for cleaner energy solutions. This dynamic environment is expected to foster further growth in the coming years.

Asia-Pacific : Rapid Growth in Emerging Economies

The Asia-Pacific region is witnessing rapid growth in the power transmission infrastructure market, holding a 12.0% share as of 2024. Key drivers include urbanization, industrialization, and increasing energy demand, particularly in countries like China and India. Government initiatives aimed at enhancing energy security and expanding grid access are further propelling market growth, supported by investments in renewable energy projects. China is the leading country in this region, with significant contributions from companies like Mitsubishi Electric (JP) and Hitachi (JP). The competitive landscape is evolving, with local players emerging alongside established global firms. This dynamic environment is fostering innovation and collaboration, as stakeholders work to address the challenges of energy distribution and reliability in rapidly growing urban areas.

Middle East and Africa : Emerging Market with Growth Potential

The Middle East and Africa region is at the nascent stage of developing its power transmission infrastructure market, currently holding a 3.0% share as of 2024. The region's growth is driven by increasing energy demand, urbanization, and government initiatives aimed at enhancing energy access. Investments in renewable energy projects and infrastructure upgrades are critical to meeting the rising energy needs of the population. Countries like South Africa and the UAE are leading the charge, with significant investments from both local and international players. The competitive landscape is characterized by a mix of established companies and emerging local firms, creating opportunities for collaboration and innovation. As the region continues to develop, the focus on sustainable energy solutions will be paramount to its growth trajectory.