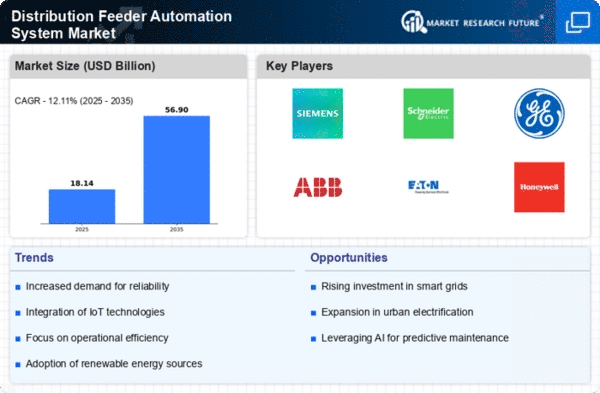

Market Growth Projections

The Distribution Feeder Automation System Market is poised for substantial growth in the coming years. Projections indicate that the market will reach 5.18 USD Billion by 2024 and is expected to expand to 11.6 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 7.64% from 2025 to 2035. Such figures underscore the increasing importance of automation in the distribution sector, driven by factors such as regulatory support, technological advancements, and the integration of renewable energy sources.

Growing Demand for Smart Grids

The Distribution Feeder Automation System Market is witnessing an increasing demand for smart grid technologies. These systems enhance the reliability and efficiency of electricity distribution networks. As utilities seek to modernize their infrastructure, the integration of automation systems becomes essential. The market is projected to reach 5.18 USD Billion in 2024, reflecting a significant investment in smart grid solutions. This transition not only improves operational efficiency but also facilitates better management of renewable energy sources, thereby aligning with global sustainability goals.

Regulatory Support for Automation

Regulatory frameworks across various countries are increasingly supporting the adoption of automation in the power distribution sector. Governments are implementing policies that encourage utilities to invest in advanced technologies, including distribution feeder automation systems. This regulatory push is expected to drive growth in the Distribution Feeder Automation System Industry, as utilities aim to comply with new standards and improve service reliability. The anticipated growth trajectory suggests that the market could expand to 11.6 USD Billion by 2035, driven by favorable regulations and incentives.

Integration of Renewable Energy Sources

The integration of renewable energy sources into the power grid is a critical driver for the Global Distribution Feeder Automation System Market. As more countries commit to reducing carbon emissions, the need for systems that can effectively manage distributed energy resources becomes paramount. Automation systems facilitate the seamless integration of solar, wind, and other renewable sources, ensuring grid stability and reliability. This trend is likely to accelerate investments in automation technologies, further propelling the market's growth as utilities adapt to the evolving energy landscape.

Technological Advancements in Automation

Technological advancements are significantly influencing the Distribution Feeder Automation System Market. Innovations in communication technologies, data analytics, and artificial intelligence are enhancing the capabilities of automation systems. These advancements enable utilities to implement more sophisticated monitoring and control mechanisms, leading to improved grid management. As these technologies continue to evolve, they are expected to attract substantial investments, thereby driving market growth. The ongoing development of smart technologies is likely to play a crucial role in shaping the future of distribution feeder automation.

Increased Focus on Operational Efficiency

Utilities are under constant pressure to enhance operational efficiency and reduce costs. The Distribution Feeder Automation System Market is responding to this need by providing solutions that optimize the performance of distribution networks. Automation systems enable real-time monitoring and control, which can lead to significant reductions in operational expenditures. As a result, utilities are likely to invest heavily in these technologies, contributing to a projected CAGR of 7.64% from 2025 to 2035. This focus on efficiency not only benefits utilities but also improves service reliability for consumers.