Rising Focus on Energy Efficiency

The growing emphasis on energy efficiency is a significant driver in the RTU in Smart Grid Market. Utilities are under pressure to optimize energy consumption and reduce operational costs, which has led to an increased adoption of RTUs. These devices enable utilities to monitor energy usage patterns and identify areas for improvement, thereby facilitating more efficient energy distribution. According to recent studies, the implementation of RTUs can lead to energy savings of up to 15% in certain applications. This focus on efficiency not only benefits utilities but also aligns with broader sustainability goals, making RTUs a critical component in the transition towards more sustainable energy systems.

Growing Demand for Real-Time Data Monitoring

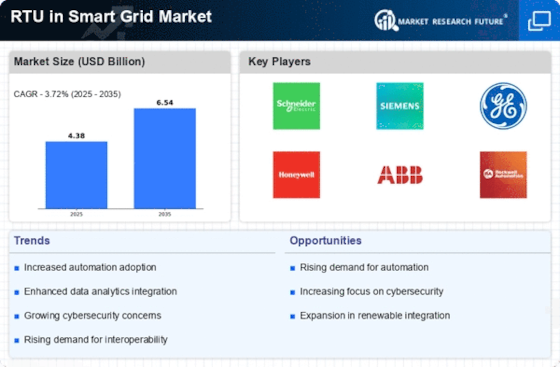

The increasing need for real-time data monitoring in the RTU in Smart Grid Market is driven by the necessity for enhanced operational efficiency and reliability. Utilities are increasingly adopting RTUs to facilitate immediate data acquisition and processing, which allows for timely decision-making. This trend is underscored by the fact that the market for RTUs is projected to grow at a compound annual growth rate of approximately 8% over the next five years. The integration of advanced communication technologies within RTUs enables utilities to monitor grid performance continuously, thereby reducing downtime and improving service delivery. As the demand for reliable energy supply escalates, the role of RTUs in providing critical data insights becomes more pronounced, positioning them as essential components in modern smart grid infrastructures.

Regulatory Support for Smart Grid Initiatives

Regulatory frameworks are increasingly favoring the adoption of smart grid technologies, which significantly impacts the RTU in Smart Grid Market. Governments are implementing policies that promote the modernization of electrical grids, thereby encouraging utilities to invest in RTU systems. For instance, various regions have established funding programs aimed at enhancing grid resilience and efficiency through advanced technologies. This regulatory support is crucial, as it not only facilitates the deployment of RTUs but also ensures compliance with evolving standards for energy management and sustainability. The alignment of regulatory incentives with technological advancements is likely to drive the market forward, as utilities seek to leverage RTUs to meet both operational and regulatory requirements.

Increased Investment in Smart Grid Infrastructure

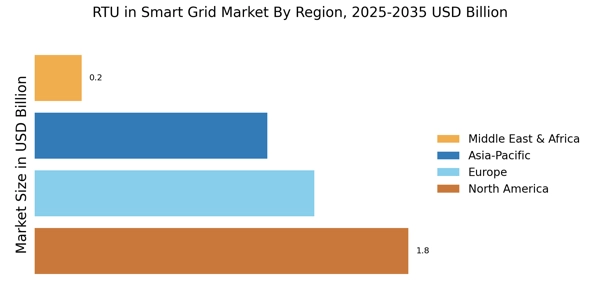

The surge in investment in smart grid infrastructure is a key driver for the RTU in Smart Grid Market. As countries strive to modernize their energy systems, substantial funding is being allocated to enhance grid reliability and resilience. This investment trend is reflected in various initiatives aimed at upgrading aging infrastructure and integrating smart technologies. The RTU market is poised to benefit from this influx of capital, as utilities seek to deploy advanced monitoring and control systems to improve grid performance. With projections indicating that investments in smart grid technologies could reach several billion dollars in the coming years, the demand for RTUs is likely to see a corresponding increase, further solidifying their role in the evolving energy landscape.

Integration of Advanced Communication Technologies

The integration of advanced communication technologies is a pivotal driver in the RTU in Smart Grid Market. The advent of 5G and other high-speed communication networks enhances the capabilities of RTUs, enabling faster data transmission and improved connectivity. This technological evolution allows for more sophisticated monitoring and control of grid operations, which is essential for managing the complexities of modern energy systems. As utilities increasingly rely on real-time data for operational decisions, the demand for RTUs equipped with advanced communication features is expected to rise. The market is witnessing a shift towards RTUs that can seamlessly integrate with existing infrastructure, thereby facilitating a more cohesive and responsive smart grid environment.