Rising Demand for LNG

The Global Cryogenic Equipment Market Industry is experiencing a surge in demand for liquefied natural gas (LNG) as countries transition towards cleaner energy sources. This shift is driven by the need to reduce carbon emissions and enhance energy security. The increasing number of LNG terminals and the expansion of LNG infrastructure globally are indicative of this trend. In 2024, the market is projected to reach 13.9 USD Billion, with expectations to grow significantly as LNG becomes a preferred energy source. This demand for LNG is likely to propel the growth of cryogenic equipment, which is essential for the storage and transportation of LNG.

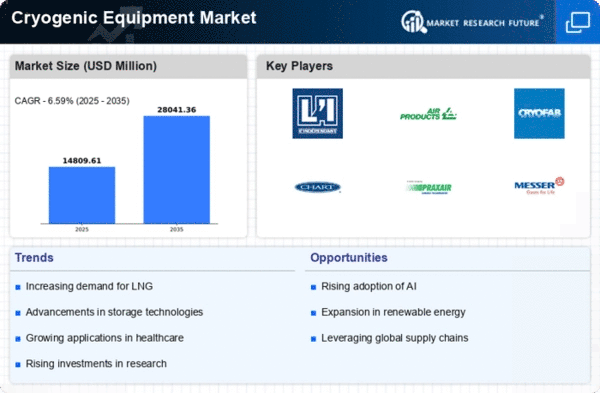

Market Growth Projections

The Global Cryogenic Equipment Market Industry is poised for substantial growth, with projections indicating a market value of 13.9 USD Billion in 2024 and an anticipated increase to 28.0 USD Billion by 2035. This growth trajectory suggests a robust compound annual growth rate (CAGR) of 6.59% from 2025 to 2035. The expansion is driven by various factors, including rising demand for LNG, technological advancements, and increased applications in healthcare and space exploration. These projections highlight the potential for investment and innovation within the cryogenic equipment sector, reflecting a dynamic market landscape.

Technological Advancements

Technological innovations in cryogenic equipment are playing a pivotal role in enhancing efficiency and safety in the Global Cryogenic Equipment Market Industry. Advancements such as improved insulation materials, automated control systems, and enhanced safety features are making cryogenic processes more reliable. These innovations not only reduce operational costs but also increase the lifespan of equipment. As industries such as healthcare and aerospace adopt these technologies, the market is expected to benefit substantially. The anticipated growth from 2024 to 2035, with a projected CAGR of 6.59%, underscores the importance of technological advancements in driving market expansion.

Growth in Healthcare Sector

The Global Cryogenic Equipment Market Industry is witnessing increased utilization of cryogenic technology in the healthcare sector, particularly in the preservation of biological samples and the storage of vaccines. Cryogenic freezers and storage systems are essential for maintaining the integrity of sensitive materials. As the healthcare sector continues to expand, the demand for cryogenic equipment is likely to rise. The market's value is expected to reach 28.0 USD Billion by 2035, reflecting the growing reliance on cryogenic solutions in medical applications. This trend indicates a robust future for the cryogenic equipment market, driven by healthcare advancements.

Expansion of Space Exploration

The Global Cryogenic Equipment Market Industry is significantly influenced by the expansion of space exploration initiatives. As space agencies and private companies invest in advanced rocket technologies, the need for cryogenic propellants is increasing. Cryogenic fuels, such as liquid hydrogen and liquid oxygen, are critical for launching spacecraft. The ongoing projects and missions planned for the coming years are likely to drive demand for cryogenic equipment. This sector's growth could contribute to the overall market expansion, aligning with the projected CAGR of 6.59% from 2025 to 2035, as investments in space exploration continue to rise.

Environmental Regulations and Sustainability

The Global Cryogenic Equipment Market Industry is being shaped by stringent environmental regulations aimed at promoting sustainability. Governments worldwide are implementing policies that encourage the adoption of cleaner technologies, including cryogenic processes. These regulations are fostering a shift towards more sustainable practices in various industries, including energy and manufacturing. As companies seek to comply with these regulations, the demand for cryogenic equipment is likely to increase. This trend aligns with the market's projected growth, as industries adapt to meet environmental standards while enhancing operational efficiency.