Increasing Energy Security

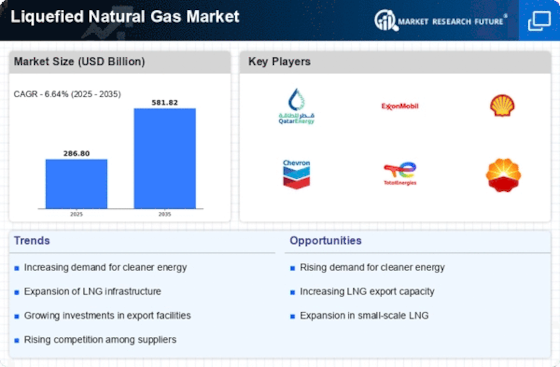

The Liquefied Natural Gas Market LNG Market is experiencing a notable shift towards enhancing energy security among nations. Countries are diversifying their energy sources to reduce dependence on a single supplier, which is particularly relevant in the context of fluctuating geopolitical landscapes. The demand for LNG is projected to rise, with estimates suggesting that by 2025, LNG could account for over 30% of the global natural gas trade. This diversification strategy not only mitigates risks associated with supply disruptions but also aligns with national energy policies aimed at achieving greater resilience in energy supply chains.

Expansion of LNG Infrastructure

The Liquefied Natural Gas Market LNG Market is witnessing significant investments in infrastructure development. The construction of new liquefaction plants, regasification terminals, and transportation networks is essential to meet the growing demand for LNG. Recent data indicates that the global LNG regasification capacity is expected to reach approximately 1,000 million tonnes per year by 2025. This expansion facilitates increased trade flows and enhances the ability of countries to import and export LNG efficiently. As infrastructure improves, it is likely that the market will see a reduction in costs associated with LNG logistics, further stimulating demand.

Rising Demand from Emerging Economies

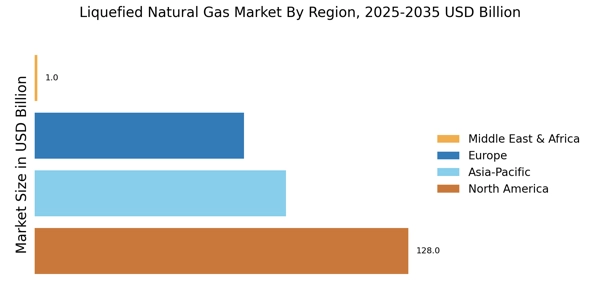

The Liquefied Natural Gas Market LNG Market is significantly impacted by the rising energy demand from emerging economies. Countries in Asia, particularly China and India, are increasingly turning to LNG to meet their growing energy needs. Projections suggest that by 2025, these nations could account for nearly 70% of the global LNG demand growth. This trend is driven by urbanization, industrialization, and a shift towards cleaner energy sources. As these economies continue to expand, the demand for LNG is expected to surge, presenting lucrative opportunities for suppliers and investors in the LNG market.

Environmental Regulations and Policies

The Liquefied Natural Gas Market LNG Market is increasingly influenced by stringent environmental regulations aimed at reducing carbon emissions. Governments are implementing policies that favor cleaner energy sources, with LNG being recognized as a transitional fuel that can help achieve climate goals. For instance, many countries are setting ambitious targets for reducing greenhouse gas emissions, which is likely to drive the adoption of LNG in power generation and transportation sectors. The International Energy Agency has indicated that LNG could play a crucial role in achieving a 1.5-degree Celsius climate target, thereby enhancing its attractiveness in the energy mix.

Technological Advancements in LNG Production

The Liquefied Natural Gas Market LNG Market is benefiting from technological advancements that enhance the efficiency of LNG production and processing. Innovations such as floating LNG technology and improvements in liquefaction processes are reducing costs and increasing output. Recent developments indicate that new technologies could lower the breakeven prices for LNG projects, making them more economically viable. As these technologies mature, they are likely to attract further investment and drive competition within the market. This could lead to a more dynamic LNG landscape, characterized by increased supply and potentially lower prices for consumers.