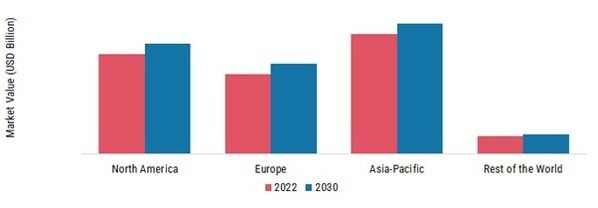

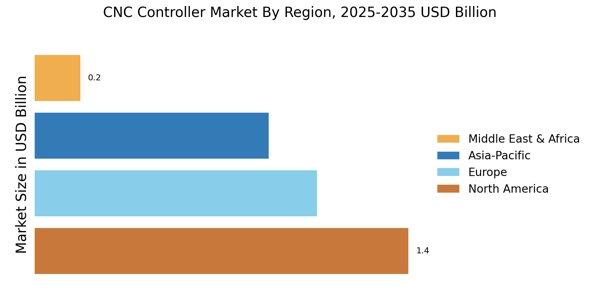

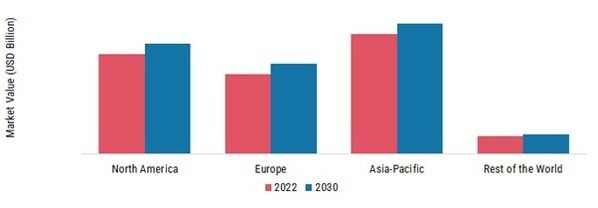

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia-Pacific region is a key player in the CNC Controller Market, driven by the presence of numerous manufacturing companies and the increasing investment in the business and manufacturing processes. The region has a large number of well-established and emerging companies operating in the CNC Controller Market, providing a wide range of products and services to cater to the increasing demand.

Additionally, the region is home to some of the largest manufacturing industries, such as automotive, aerospace, electronics, and machinery, which have driven the demand for advanced and high-performance CNC controllers. The increasing investment in the manufacturing sector and the growth of these industries has driven the demand for CNC controllers in the Asia-Pacific region, contributing to the growth of the market.

Further, the major countries studied in the market report are The U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil

Figure 3: GLOBAL CNC CONTROLLER MARKET SHARE BY REGION 2022 (%)

Europe is the third-largest market for CNC Controllers. The region has a high demand for advanced and high-performance CNC controllers, driven by the increasing investment in the manufacturing sector and the growing adoption of automated technologies. The region has a well-developed infrastructure and a high level of industrialization, which has enabled the companies to manufacture and provide high-quality CNC controllers to cater to the growing demand. The presence of well-established companies and a large number of advanced technology-driven industries, such as aerospace, automotive, electronics, and machinery, is driving the demand for CNC controllers in Europe.

Further, the German CNC Controller Market held the largest market share, and the UK CNC Controller Market was the fastest-growing market in the European region.

North America is the second-largest market for CNC Controllers. The region is characterized by the presence of well-established companies and a large number of advanced technology-driven industries, such as aerospace, automotive, electronics, and machinery. The region has a high demand for advanced and high-performance CNC controllers, driven by the increasing investment in the manufacturing sector and the growing adoption of automated technologies. Additionally, the region is characterized by a high level of consumer awareness and the growing demand for advanced and high-performance CNC controllers.

The increasing investment in the manufacturing sector and the growth of the automotive and aerospace industries in the region have driven the demand for CNC controllers, contributing to the growth of the market in North America. Moreover, the U.S. CNC Controller Market held the largest market share, and the Canadian CNC Controller Market was the fastest-growing market in the North American region.