Expansion of End-User Industries

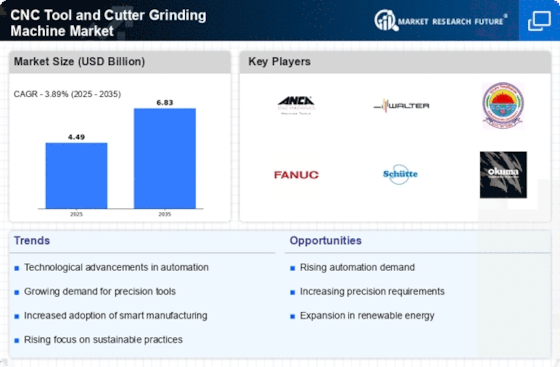

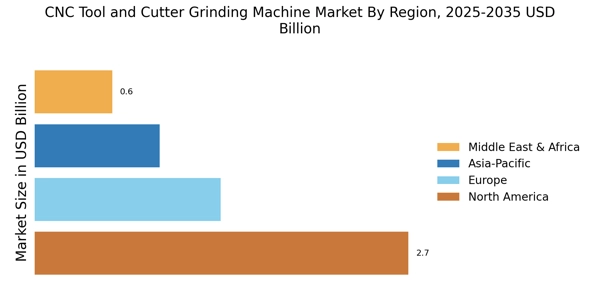

The CNC Tool and Cutter Grinding Machine Market is experiencing growth due to the expansion of end-user industries such as aerospace, automotive, and electronics. These sectors are increasingly investing in advanced manufacturing technologies to meet rising consumer demands and improve production efficiency. For instance, the aerospace industry is projected to grow at a CAGR of 4.5% through 2027, driving the need for high-precision cutting tools. As these industries expand, the demand for CNC tool and cutter grinding machines is likely to increase, as they are essential for producing the high-quality tools required for complex manufacturing processes. Furthermore, the ongoing trend towards lightweight materials in automotive and aerospace applications necessitates the use of specialized cutting tools, further fueling the market for CNC grinding machines.

Growth of Automation in Manufacturing

The CNC Tool and Cutter Grinding Machine Market is significantly influenced by the ongoing growth of automation in manufacturing processes. As companies strive to enhance productivity and reduce operational costs, the adoption of automated systems becomes increasingly prevalent. According to recent data, the automation market is projected to grow at a compound annual growth rate of 9% through 2027. This shift towards automation necessitates the use of advanced CNC grinding machines that can operate with minimal human intervention while maintaining high levels of precision. The ability to automate tool grinding machinery processes not only improves efficiency but also reduces the likelihood of human error, thereby enhancing product quality. As a result, manufacturers are increasingly investing in CNC tool and cutter grinding machines to remain competitive in an automated landscape.

Rising Demand for Precision Engineering

The CNC Tool and Cutter Grinding Machine Market experiences a notable surge in demand for precision engineering across various sectors, including aerospace, automotive, and medical devices. As industries increasingly prioritize accuracy and efficiency, the need for high-quality cutting tools becomes paramount. This trend is reflected in the projected growth of the CNC tool market, which is expected to reach USD 5 billion by 2026. The ability of CNC machines to produce intricate designs with minimal human intervention enhances their appeal, thereby driving market expansion. Furthermore, the integration of advanced software solutions with CNC machines allows for real-time monitoring and adjustments, further solidifying their role in precision engineering. Consequently, manufacturers are investing in CNC tool and cutter grinding machines to meet the evolving demands of precision-driven industries.

Emergence of Smart Manufacturing Technologies

The CNC Tool and Cutter Grinding Machine Market is being reshaped by the emergence of smart manufacturing technologies, which integrate the Internet of Things (IoT) and artificial intelligence (AI) into production processes. These technologies enable real-time data collection and analysis, allowing manufacturers to optimize their operations and improve decision-making. The smart manufacturing market is anticipated to grow significantly, with estimates suggesting a value of USD 400 billion by 2025. As manufacturers adopt these technologies, the demand for CNC tool and cutter grinding machines equipped with smart capabilities is likely to increase. Such machines can provide predictive maintenance alerts, reducing downtime and enhancing overall productivity. This trend towards smart manufacturing not only improves operational efficiency but also positions companies to respond swiftly to market changes.

Increasing Focus on Tool Life and Performance

The CNC Tool and Cutter Grinding Machine Market is witnessing a growing emphasis on tool life and performance, driven by the need for cost-effective manufacturing solutions. As industries face rising material costs and competitive pressures, the longevity and efficiency of cutting tools become critical factors. Recent studies indicate that extending tool life by just 20% can lead to substantial cost savings for manufacturers. This trend encourages the adoption of advanced CNC grinding machines that can produce high-performance tools with enhanced durability. Additionally, the integration of innovative materials and coatings in tool manufacturing further supports this focus on performance. Consequently, manufacturers are increasingly turning to CNC tool and cutter grinding machines to optimize tool life and ensure consistent performance in demanding applications.