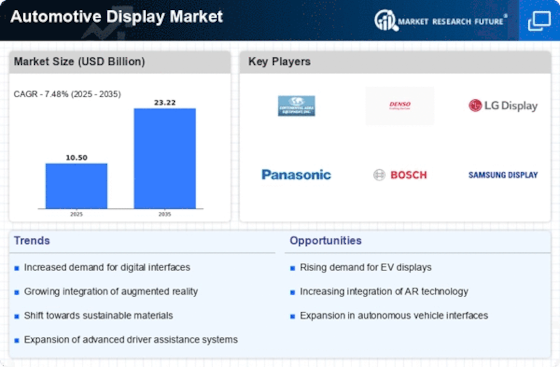

Rising Demand for Electric Vehicles

The increasing adoption of electric vehicles (EVs) is a pivotal driver for the Automotive Display Market. As consumers become more environmentally conscious, the demand for EVs has surged, leading to a corresponding need for advanced display technologies. In 2025, it is estimated that the market for EVs will account for approximately 30% of total vehicle sales, necessitating sophisticated displays that provide essential information such as battery status, navigation, and energy consumption. This shift towards electrification not only enhances the driving experience but also aligns with the broader trend of integrating technology into vehicles, thereby propelling the Automotive Screen Market forward.

Growing Interest in Autonomous Vehicles

The growing interest in autonomous vehicles is poised to be a transformative driver for the Automotive Display Market Growth. As the automotive sector moves towards automation, the need for advanced display systems that convey critical information to passengers becomes paramount. In 2025, the market for displays in autonomous vehicles is projected to expand significantly, with estimates suggesting a potential increase of 25% in demand. These displays will not only provide navigation and operational data but also serve as interfaces for passenger interaction, enhancing the overall travel experience. This evolution in vehicle functionality is likely to catalyze innovation and investment in the Automotive Screen Market.

Enhanced Driver and Passenger Experience

The Automotive Display Landscape is significantly influenced by the growing emphasis on enhancing the driver and passenger experience. Modern vehicles are increasingly equipped with infotainment systems that integrate navigation, entertainment, and communication features. In 2025, the market for automotive infotainment systems is projected to reach USD 30 billion, reflecting a robust demand for high-quality displays that facilitate user interaction. These displays are designed to be intuitive and user-friendly, allowing for seamless connectivity with smartphones and other devices. As manufacturers strive to differentiate their offerings, the focus on creating immersive experiences is likely to drive innovation within the In-Car Display Market.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly influencing the Automotive Display Sector. Governments worldwide are implementing stringent regulations aimed at improving vehicle safety and reducing distractions for drivers. In 2025, it is anticipated that regulations will mandate the inclusion of advanced driver-assistance systems (ADAS) that rely heavily on display technologies. This shift necessitates the development of displays that provide clear and concise information without overwhelming the driver. As manufacturers adapt to these regulations, the demand for specialized displays that meet safety standards is likely to rise, thereby driving growth within the In-Car Display Market.

Technological Advancements in Display Technologies

Technological advancements play a crucial role in shaping the Automotive Display Industry. Innovations such as OLED and LCD technologies have revolutionized the way information is presented in vehicles. In 2025, the market for OLED displays in automotive applications is expected to grow at a CAGR of 15%, driven by their superior image quality and energy efficiency. Furthermore, the integration of augmented reality (AR) displays is gaining traction, providing drivers with real-time information overlaid on their field of vision. These advancements not only enhance safety but also improve the overall aesthetic appeal of vehicle interiors, thereby propelling the Vehicle Display Market into a new era of sophistication.