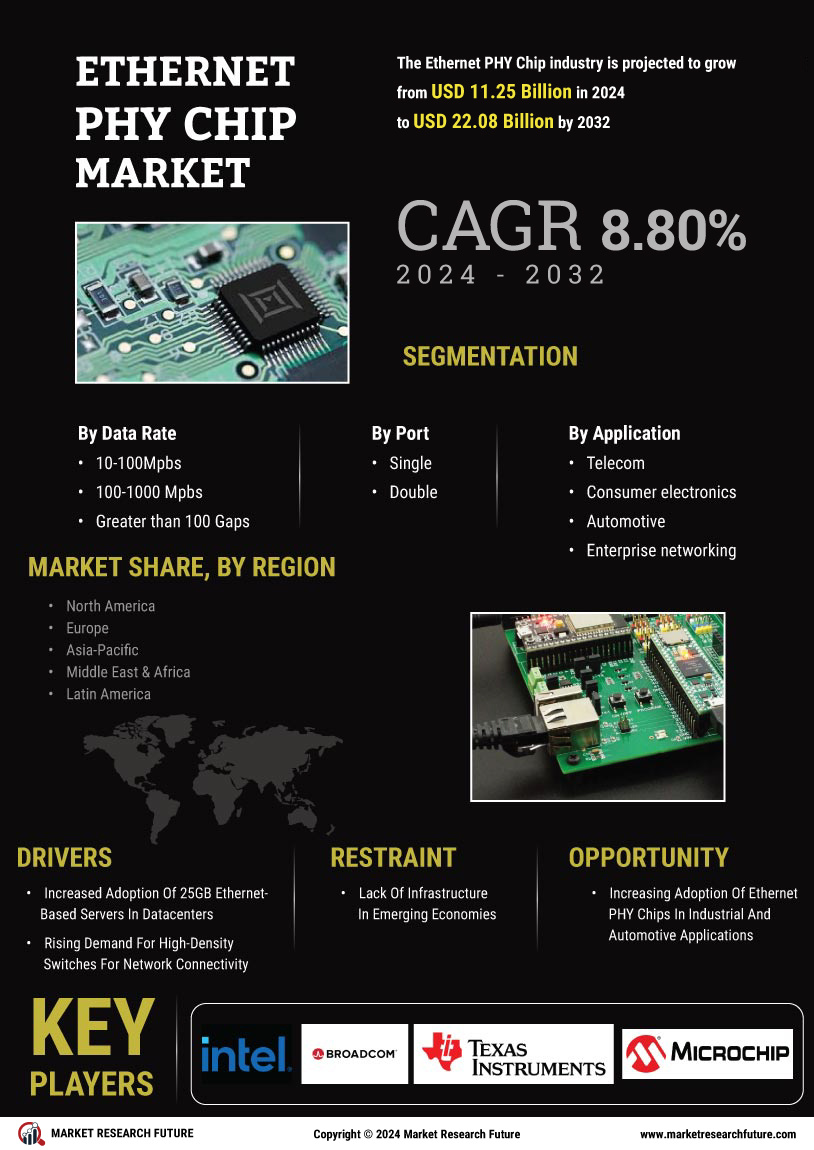

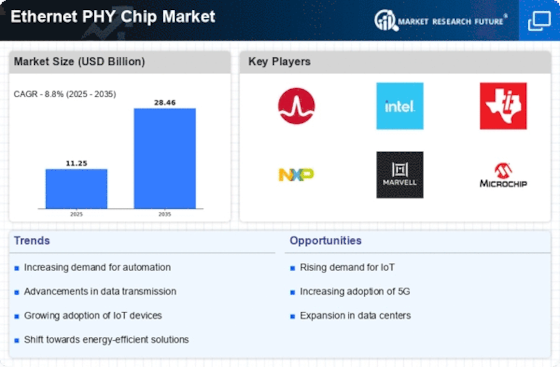

イーサネットPHYチップ市場は、急速な技術革新と高速接続に対する需要の高まりによって、現在、動的な競争環境が特徴です。ブロードコム(米国)、インテル(米国)、マーベルテクノロジー(米国)などの主要プレーヤーが最前線に立ち、それぞれが市場ポジションを強化するための独自の戦略を採用しています。ブロードコム(米国)は高性能ネットワーキングソリューションの革新に注力し、インテル(米国)は先進的な半導体技術の統合に対するコミットメントを強調しています。マーベルテクノロジー(米国)は、ターゲットを絞った買収を通じてポートフォリオを戦略的に拡大し、データインフラにおける能力を強化しています。これらの戦略は、技術革新と戦略的パートナーシップによってますます形成される競争環境に寄与しています。

ビジネスタクティクスに関しては、企業は製造のローカライズとサプライチェーンの最適化を進め、運営効率を高めています。イーサネットPHYチップ市場は、確立されたプレーヤーと新興企業が市場シェアを争う中程度に分散した状態にあるようです。主要プレーヤーの集団的影響力は重要であり、彼らは技術的専門知識と市場のリーチを活用して競争優位を確立しています。この競争構造は、成功のために革新と戦略的コラボレーションが不可欠な環境を育んでいます。

2025年8月、ブロードコム(米国)は、5Gアプリケーション向けに設計された最新のイーサネットPHYチップの発売を発表しました。これはデータ伝送速度を大幅に向上させると期待されています。この戦略的な動きは、高速ネットワーキングソリューションにおけるリーダーシップポジションを維持するというブロードコムのコミットメントを強調しています。特に5G技術の需要が急増する中で、このチップの導入はブロードコムの製品ポートフォリオを強化するだけでなく、急速に進化する通信セクターにおいて競合他社に対して有利な位置を確保します。

2025年9月、インテル(米国)は、イーサネットPHYチップの生産能力を増加させることを目的とした新しい製造施設への投資計画を発表しました。この投資は、国内製造能力を強化するというインテルの戦略的焦点を反映しており、サプライチェーンの信頼性を高め、海外生産への依存を減少させる可能性があります。製造拠点を拡大することで、インテルは高性能ネットワーキングソリューションに対する増大する需要に応え、潜在的なサプライチェーンの脆弱性にも対処することを目指しています。

2025年7月、マーベルテクノロジー(米国)は、リーディングソフトウェア定義ネットワーキング企業の買収を完了しました。これは、イーサネットPHYチップの提供を強化することが期待されています。この買収は戦略的に重要であり、マーベルがハードウェアソリューションに高度なソフトウェア機能を統合することを可能にし、顧客により包括的なネットワーキングソリューションを提供します。この動きは、ハードウェアとソフトウェアの統合がイーサネットPHYチップ市場においてますます重要になっているという広範なトレンドを示しています。

2025年10月現在、現在の競争トレンドはデジタル化、持続可能性、人工知能のネットワーキングソリューションへの統合によって大きく影響を受けています。主要プレーヤー間の戦略的アライアンスが市場を形成し、革新を促進し、製品提供を強化しています。今後、競争の差別化は従来の価格競争から技術革新、サプライチェーンの信頼性、持続可能性の取り組みに焦点を移す可能性があります。これらのトレンドを効果的に乗り越えることができる企業は、イーサネットPHYチップ市場で競争優位を確保する可能性が高いです。