Regulatory Support

Government regulations play a crucial role in shaping the Global Driver Assistance System Market Industry. Many countries are implementing stringent safety standards that mandate the inclusion of advanced driver-assistance features in new vehicles. For example, the European Union has proposed regulations requiring all new cars to be equipped with certain ADAS functionalities by 2024. This regulatory push not only enhances road safety but also stimulates market growth as manufacturers strive to comply with these requirements. Consequently, the market is likely to see increased investments in ADAS technologies, further propelling its expansion.

Emerging Markets Growth

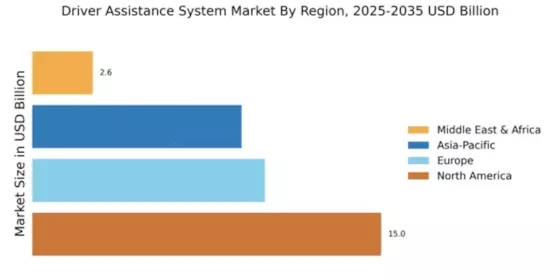

Emerging markets are presenting new opportunities for the Global Driver Assistance System Market Industry. As economies in regions such as Asia-Pacific and Latin America continue to develop, there is a rising demand for vehicles equipped with advanced safety features. This trend is driven by increasing disposable incomes and a growing middle class that prioritizes vehicle safety. Manufacturers are recognizing this potential and are tailoring their products to meet the needs of these markets. The projected growth of the market to 123.0 USD Billion by 2035 indicates the significant impact of emerging markets on the overall industry.

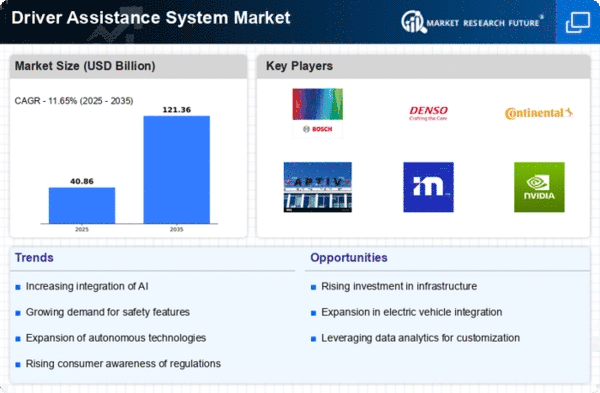

Market Growth Projections

The Global Driver Assistance System Market Industry is poised for substantial growth, with projections indicating a market value of 36.6 USD Billion in 2024 and an anticipated increase to 123.0 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 11.65% from 2025 to 2035. Such projections reflect the increasing integration of advanced driver-assistance technologies in vehicles, driven by consumer demand, regulatory support, and technological advancements. The market's expansion is likely to be influenced by various factors, including the rising focus on vehicle safety and the growing adoption of connected vehicle technologies.

Consumer Demand for Safety

There is a growing consumer demand for enhanced vehicle safety features, which significantly influences the Global Driver Assistance System Market Industry. As awareness of road safety increases, consumers are increasingly seeking vehicles equipped with advanced safety technologies. This trend is evident in the rising sales of vehicles with ADAS features, as consumers prioritize safety in their purchasing decisions. The market is responding to this demand, with manufacturers integrating more driver assistance technologies into their offerings. This shift is expected to contribute to the market's growth, aligning with the projected increase in market value to 123.0 USD Billion by 2035.

Technological Advancements

The Global Driver Assistance System Market Industry is experiencing rapid technological advancements, particularly in sensor technologies and artificial intelligence. These innovations enhance vehicle safety and efficiency, leading to increased adoption rates. For instance, advanced driver-assistance systems (ADAS) utilize cameras, radar, and lidar to provide features such as lane-keeping assistance and adaptive cruise control. As these technologies become more sophisticated, they are expected to drive the market's growth, with projections indicating a market value of 36.6 USD Billion in 2024 and a substantial increase to 123.0 USD Billion by 2035, reflecting a compound annual growth rate of 11.65% from 2025 to 2035.

Integration of Connectivity Features

The integration of connectivity features in vehicles is transforming the Global Driver Assistance System Market Industry. With the rise of the Internet of Things (IoT), vehicles are becoming more connected, allowing for real-time data exchange between vehicles and infrastructure. This connectivity enhances the functionality of driver assistance systems, enabling features such as vehicle-to-vehicle communication and real-time traffic updates. As consumers increasingly demand connected vehicles, manufacturers are investing in these technologies, which is likely to drive market growth. The anticipated market value of 36.6 USD Billion in 2024 reflects this trend.