Top Industry Leaders in the Ethernet PHY Chip Market

Competitive Landscape of Ethernet PHY Chip Market

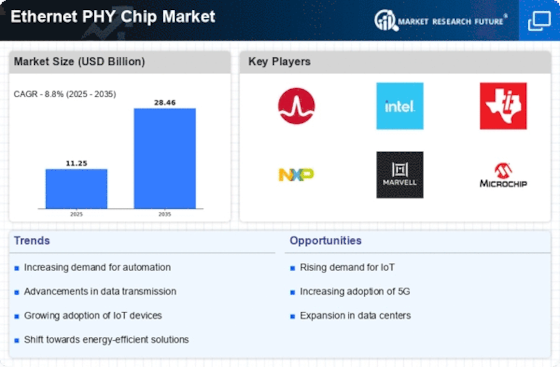

The Ethernet Physical Layer (PHY) chip market, powering the backbone of wired network connections, is experiencing a surge in demand driven by the relentless growth of data traffic and the proliferation of connected devices. This dynamic landscape presents a thrilling opportunity for established players and ambitious newcomers, but navigating it requires a clear understanding of the competitive forces at play.

Some of the Ethernet PHY Chip companies listed below:

- Netgear

- Onsemi

- Cadence

- Marvell Technologies Inc.

- Texas Instruments Incorporated

- Davison Semiconductor Inc

- Cisco

- NXP Semiconductors

- Renesas Electronics Corp

- Microchip Technology Inc.

- Barefoot Networks

- Silicon Laboratories

Strategies Adopted by Key Players:

- Vertical Integration: Gaining control over key aspects of the supply chain, from raw materials to finished devices, can improve efficiency and cost competitiveness.

- Strategic Partnerships: Collaborating with other players in the ecosystem, such as silicon foundries, system developers, and IP providers, can accelerate innovation and market penetration.

- Focus on Niche Markets: Targeting specific application areas with tailored PHY solutions, like low-power consumer options or high-speed data center chips, can create a competitive advantage in a fragmented market.

- Constant Innovation: Investing in R&D to push the boundaries of performance, power efficiency, integration levels, and emerging technologies like PAM4 keeps companies ahead of the curve.

- Cost Optimization: Continuously improving manufacturing processes and device design to reduce production costs and offer competitive pricing attracts customers.

- Customer-Centric Approach: Providing excellent customer support, technical training, and design assistance builds strong relationships and fosters brand loyalty.

Factors for Market Share Analysis:

- Product Portfolio: Offering a diverse range of PHY chips, from low-power, single-port options for consumer electronics to high-performance, multi-port solutions for data centers, caters to broader customer needs and expands market reach.

- Technological Innovation: Pioneering advancements in areas like energy efficiency, data transmission speeds, and advanced features like Power-over-Ethernet (PoE) creates a competitive edge.

- Manufacturing Prowess: Possessing robust and scalable manufacturing capabilities, including wafer fabrication, chip testing, and packaging techniques, ensures cost-effectiveness and high-quality production.

- Brand Reputation: Establishing a strong brand synonymous with reliability, performance, and technical expertise fosters trust and loyalty, attracting market share.

- Distribution Network: Building a robust distribution network and establishing strong relationships with key system integrators and Original Equipment Manufacturers (OEMs) facilitates access to targeted customer segments.

- Pricing Strategy: Balancing competitive pricing with profitability requires careful consideration of production costs, market dynamics, and customer value perception.

New and Emerging Companies:

- Barefoot Networks: A disruptor in the data center space, Barefoot offers high-performance, programmable PHY chips with lower power consumption, potentially challenging established players.

- SiBEAM Inc.: Focusing on millimeter-wave (mmWave) technology, SiBEAM provides PHY solutions for ultra-high-speed wireless communication, catering to future 5G and beyond applications.

- Innovium Inc.: Specializing in data center infrastructure, Innovium integrates high-performance, low-latency PHY chips into its switches, aiming to carve a niche in this lucrative segment.

- Kandou Bus Technology: Pioneering PAM4 technology, Kandou offers high-speed PHY solutions for data centers and networking infrastructure, pushing the boundaries of data transmission speeds.

- Enpirion: A power management specialist, Enpirion ventures into the PHY market with low-power and energy-efficient solutions for battery-powered devices in the Internet of Things (IoT) space.

Latest Company Updates:

On Aug. 22, 2023, Marvell Technology introduced its first 5 nm multi-GB PHY platform for the next generation of networking technologies. Marvell's 5 nm multi-gigabit (mGig) copper Ethernet PHY platform reduces PHY power by more than 50% and delivers up to 10 Gbps bandwidth for Wi-Fi 7. This addition extends Marvell's existing data infrastructure portfolio and adds more applications to the 5 nm platform.

On Sep. 08, 2021, Microchip introduced Compact 1.6T Ethernet PHY, with Up to 800 GbE connectivity supporting the latest pluggable optics, system backplanes, and packet processors. Routers, switches, and line cards need higher bandwidth, port density, and Gigabit Ethernet (GbE) connectivity with up to 800 can handle escalating data center traffic led by 5G, cloud services, AI, and Machine Learning (ML) applications.

These designs deliver the higher bandwidth needed to overcome the signal integrity challenges associated with the industry's transition to the 112G (GB per second) PAM4 Serializer/Deserializer (SerDes) connectivity.On Jan. 29, 2021, Synopsys, Inc. demonstrated Silicon Proof of DesignWare 112G Ethernet PHY IP in a 5nm FinFET Process for HPC SoCs. DesignWare 112G Ethernet PHY IP in 5nm process delivered significant performance and power and area advantages. On Dec. 09, 2020, Silvaco Inc., a leading supplier of EDA software and design I.P., announced a collaboration with OPENEDGES Technology, Inc., a leading memory subsystem provider I.P., to prove the integration of the OPENEDGES DDR memory controller with Silvaco DDR PHYs. These companies have validated the frictionless interoperability between the OPENEDGES. On Oct. 07, 2020, Texas Instruments (T.I.) introduced a new Ethernet physical layer (PHY) capable of transmitting 10-Mbps Ethernet signals.