Expansion of Data Centers

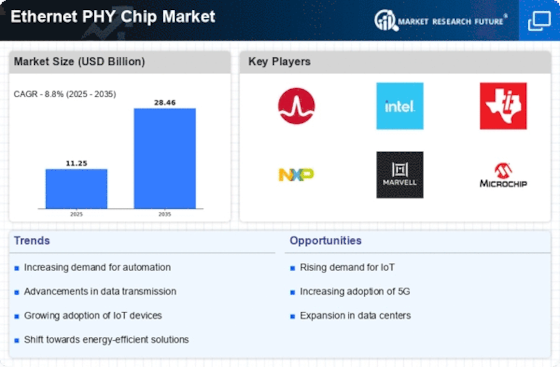

The expansion of data centers is a pivotal driver for the Ethernet PHY Chip Market. As organizations increasingly migrate to cloud-based solutions, the need for efficient data processing and storage solutions intensifies. Ethernet PHY chips play a crucial role in ensuring high-speed connectivity within data centers, facilitating seamless data transfer and communication. According to industry reports, the data center market is expected to grow at a compound annual growth rate of over 10% in the coming years. This growth directly correlates with the rising demand for Ethernet PHY chips, as data centers require advanced networking solutions to handle the increasing volume of data traffic.

Emergence of Edge Computing

The emergence of edge computing is reshaping the Ethernet PHY Chip Market. As organizations seek to process data closer to the source, the need for efficient networking solutions becomes critical. Ethernet PHY chips are essential for enabling high-speed data transfer in edge computing environments, where low latency and reliability are paramount. The edge computing market is expected to grow significantly, driven by the increasing demand for real-time data processing and analytics. This growth suggests that the Ethernet PHY Chip Market will experience heightened demand as businesses invest in edge computing technologies to enhance their operational capabilities.

Growth of Industrial Automation

The growth of industrial automation is a key driver for the Ethernet PHY Chip Market. As industries adopt automation technologies to enhance productivity and efficiency, the demand for reliable networking solutions increases. Ethernet PHY chips are integral to industrial automation systems, providing the necessary connectivity for devices and machinery. The industrial automation market is projected to witness substantial growth, driven by the need for improved operational efficiency and reduced costs. This trend indicates that the Ethernet PHY Chip Market will likely see increased demand as manufacturers and industrial operators seek to implement advanced networking solutions to support their automation initiatives.

Surge in Smart Home Technologies

The surge in smart home technologies is significantly influencing the Ethernet PHY Chip Market. As consumers increasingly adopt smart devices, the need for reliable and high-speed connectivity becomes paramount. Ethernet PHY chips are essential for ensuring that smart home devices communicate effectively and efficiently. The market for smart home devices is projected to reach hundreds of billions of dollars by 2025, indicating a robust demand for the underlying networking technologies. This trend suggests that the Ethernet PHY Chip Market will benefit from the proliferation of smart home technologies, as manufacturers seek to integrate advanced connectivity solutions into their products.

Increasing Adoption of 5G Technology

The increasing adoption of 5G technology is driving the Ethernet PHY Chip Market as it necessitates high-speed data transmission and low latency. 5G networks require robust infrastructure, which includes advanced Ethernet PHY chips to support the enhanced bandwidth and connectivity demands. As telecommunications companies invest heavily in 5G rollouts, the demand for Ethernet PHY chips is expected to rise significantly. This trend is further supported by the anticipated growth in mobile data traffic, projected to reach several zettabytes by 2025. Consequently, the Ethernet PHY Chip Market is likely to experience substantial growth as it aligns with the requirements of next-generation mobile networks.