Increased Focus on Cybersecurity

As cyber threats continue to evolve, the ethernet phy-chip market is witnessing a heightened focus on cybersecurity measures. Organizations are investing in secure networking solutions to protect sensitive data and maintain operational integrity. This trend is particularly relevant in industries such as finance and healthcare, where data breaches can have severe consequences. The ethernet phy-chip market is adapting to these needs by developing chips that incorporate advanced security features. It is anticipated that the market for secure ethernet phy-chips will grow by approximately 15% annually, reflecting the increasing importance of cybersecurity in networking solutions.

Growing Adoption of Cloud Services

The shift towards cloud computing is significantly impacting the ethernet phy-chip market. As businesses migrate their operations to cloud platforms, the demand for reliable and high-speed connectivity solutions intensifies. This trend is particularly evident in sectors such as finance and healthcare, where data integrity and speed are paramount. The ethernet phy-chip market is poised to capitalize on this growth, with estimates suggesting that cloud services will account for over 30% of IT spending in the US by 2025. Consequently, the need for advanced ethernet phy-chips that can support high data throughput and low latency is becoming increasingly critical.

Expansion of Smart Cities Initiatives

The development of smart cities is driving demand for advanced networking solutions, thereby impacting the ethernet phy-chip market. As urban areas increasingly integrate IoT devices and smart technologies, the need for reliable and efficient data transmission becomes critical. The ethernet phy-chip market is likely to benefit from this trend, as municipalities invest in infrastructure that supports smart technologies. By 2025, it is estimated that investments in smart city initiatives will exceed $100 billion in the US, creating substantial opportunities for ethernet phy-chip manufacturers to provide the necessary connectivity solutions.

Advancements in Networking Technologies

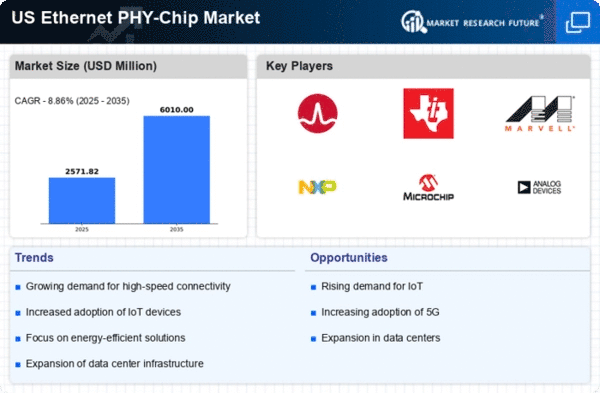

The ethernet phy-chip market is experiencing a surge due to rapid advancements in networking technologies. Innovations such as 5G and Wi-Fi 6 are driving the need for enhanced data transmission capabilities. As organizations increasingly adopt these technologies, the demand for high-performance ethernet phy-chips is likely to rise. In 2025, the market is projected to reach approximately $2 billion, reflecting a compound annual growth rate (CAGR) of around 10%. This growth is indicative of the increasing reliance on robust networking solutions across various sectors, including telecommunications and data centers. The ethernet phy-chip market is thus positioned to benefit from these technological advancements, as they necessitate more efficient and faster data processing capabilities.

Rising Demand for Data Center Infrastructure

The ethernet phy-chip market is significantly influenced by the growing demand for data center infrastructure. As businesses expand their digital operations, the need for efficient data management and storage solutions intensifies. This trend is particularly pronounced in sectors such as e-commerce and streaming services, where high data throughput is essential. The ethernet phy-chip market is expected to see substantial growth, with data center investments projected to reach $200 billion by 2025. This surge in infrastructure spending is likely to drive the demand for advanced ethernet phy-chips that can support the increasing data traffic and connectivity requirements.