Rise of Smart Devices

The proliferation of smart devices in India is a notable driver for the ethernet phy-chip market. As of November 2025, the number of connected devices is projected to surpass 2 billion, reflecting a growing trend towards automation and smart technology adoption. This surge in smart devices, including IoT applications, home automation systems, and industrial automation, necessitates reliable and efficient networking solutions. Ethernet phy-chips are essential for ensuring seamless communication between these devices and enhancing their functionality and performance. The increasing consumer preference for smart technology, coupled with the rise of smart cities, is likely to propel the demand for ethernet phy-chips. As manufacturers strive to meet the connectivity needs of this expanding ecosystem, the ethernet phy-chip market is expected to experience robust growth.

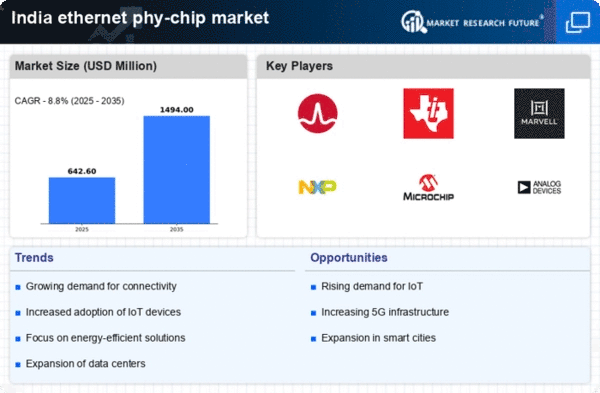

Expansion of Data Centers

The rapid expansion of data centers in India serves as a significant driver for the ethernet phy-chip market. As businesses increasingly migrate to cloud-based solutions, the demand for data centers has surged. By November 2025, the number of data centers in India is projected to grow by over 30%, necessitating advanced networking solutions. Ethernet phy-chips are integral to ensuring efficient data transfer and connectivity within these facilities. The rise of big data analytics and the Internet of Things (IoT) further amplify the need for high-performance networking components. With investments in data center infrastructure expected to reach $10 billion by 2026, the ethernet phy-chip market is likely to benefit from this trend, as companies seek to enhance their operational capabilities and meet the growing data demands.

Emergence of 5G Technology

The emergence of 5G technology in India is poised to be a transformative driver for the ethernet phy-chip market. With the rollout of 5G networks expected to accelerate by November 2025, the demand for high-speed, low-latency connectivity is becoming paramount. Ethernet phy-chips are critical components in supporting the infrastructure required for 5G deployment, facilitating faster data transmission and improved network efficiency. The anticipated increase in mobile data traffic, projected to rise by 50% within the next few years, underscores the necessity for advanced networking solutions. As telecommunications companies invest heavily in 5G infrastructure, the ethernet phy-chip market is likely to benefit from this technological shift, as it aligns with the growing need for enhanced connectivity solutions across various applications, including smart cities, autonomous vehicles, and industrial automation.

Growing Internet Penetration

The increasing internet penetration in India is a pivotal driver for the ethernet phy-chip market. As of November 2025, the internet penetration rate in India has reached approximately 70%, significantly boosting the demand for high-speed data transmission solutions. This surge in connectivity necessitates robust networking infrastructure, where ethernet phy-chips play a crucial role. The expansion of digital services, e-commerce, and online education further fuels this demand. With the government promoting initiatives to enhance digital literacy and access, the ethernet phy-chip market is poised for substantial growth. The rising number of internet users, estimated to exceed 1 billion by 2025, indicates a burgeoning market for ethernet phy-chips, essential for supporting the increasing data traffic and connectivity requirements across various sectors.

Government Initiatives for Digital Infrastructure

Government initiatives aimed at enhancing digital infrastructure in India are significantly impacting the ethernet phy-chip market. Programs such as Digital India and Smart Cities Mission are designed to improve connectivity and technological integration across urban and rural areas. By November 2025, these initiatives are expected to result in a 25% increase in the deployment of networking technologies, including ethernet phy-chips. The government's focus on building a robust digital ecosystem encourages investments in telecommunications and networking infrastructure. This, in turn, creates a favorable environment for the growth of the ethernet phy-chip market, as businesses and service providers seek to upgrade their systems to align with national objectives. The emphasis on digital transformation across various sectors further underscores the importance of ethernet phy-chips in facilitating seamless connectivity.