Expansion of IoT Devices

The Colocation Edge Data Center Market is poised for growth due to the rapid expansion of Internet of Things (IoT) devices. As billions of devices connect to the internet, the volume of data generated necessitates localized processing capabilities. Edge data centers serve as critical nodes for managing this data influx, enabling real-time analytics and reducing bandwidth costs. The increasing deployment of IoT applications across sectors such as healthcare, manufacturing, and smart cities further underscores the need for colocation services. It is estimated that by 2025, there will be over 75 billion connected IoT devices, creating a substantial opportunity for colocation edge data centers to support this burgeoning ecosystem.

Adoption of 5G Technology

The rollout of 5G technology is a pivotal driver for the Colocation Edge Data Center Market. With its promise of ultra-fast data speeds and enhanced connectivity, 5G is expected to transform various sectors, including telecommunications, entertainment, and transportation. This technology necessitates a robust infrastructure capable of handling increased data traffic and low latency requirements. Edge data centers are ideally positioned to support 5G networks by providing localized data processing and storage solutions. Analysts predict that the 5G market will reach a valuation of several hundred billion dollars by the end of the decade, thereby creating a fertile ground for colocation services that can meet the demands of this advanced connectivity paradigm.

Growing Focus on Data Security

In an era where data breaches and cyber threats are increasingly prevalent, the Colocation Edge Data Center Market is witnessing a growing focus on data security. Organizations are prioritizing the protection of sensitive information, which has led to a surge in demand for secure colocation services. Edge data centers offer enhanced security features, including physical security measures and advanced cybersecurity protocols, which are essential for safeguarding data. As regulatory frameworks evolve and compliance requirements become more stringent, businesses are likely to seek colocation partners that can provide robust security solutions. This trend indicates a potential shift in how organizations approach data management and security, further driving the growth of the colocation edge data center market.

Emergence of Hybrid IT Environments

The Colocation Edge Data Center Market is increasingly influenced by the emergence of hybrid IT environments. Organizations are adopting a mix of on-premises, private cloud, and public cloud solutions to optimize their IT infrastructure. This hybrid approach necessitates the use of colocation edge data centers to facilitate seamless integration and data flow between various environments. As businesses strive for flexibility and scalability, colocation services become essential for managing workloads efficiently. The market for hybrid IT solutions is expected to expand significantly, with many enterprises recognizing the advantages of leveraging edge data centers to enhance their operational capabilities. This trend suggests a promising future for colocation services as organizations navigate their digital transformation journeys.

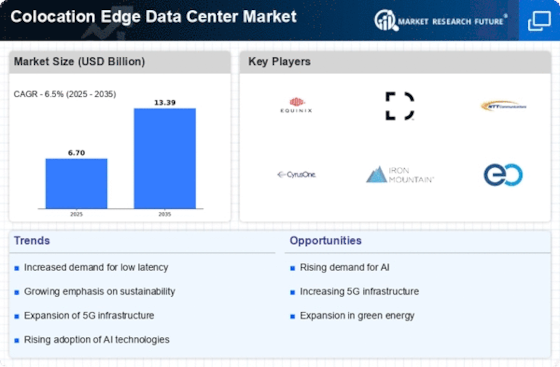

Increased Demand for Low Latency Solutions

The Colocation Edge Data Center Market is experiencing heightened demand for low latency solutions, driven by the proliferation of real-time applications. Industries such as finance, gaming, and autonomous vehicles require instantaneous data processing, which edge data centers can provide. As organizations increasingly rely on data-driven decision-making, the need for proximity to end-users becomes paramount. According to recent estimates, the edge computing market is projected to grow significantly, with a compound annual growth rate (CAGR) of over 30% in the coming years. This growth indicates a robust appetite for colocation services that can facilitate low latency and high-speed connectivity, thereby enhancing user experiences and operational efficiencies.