Rising Demand for Nutritional Products

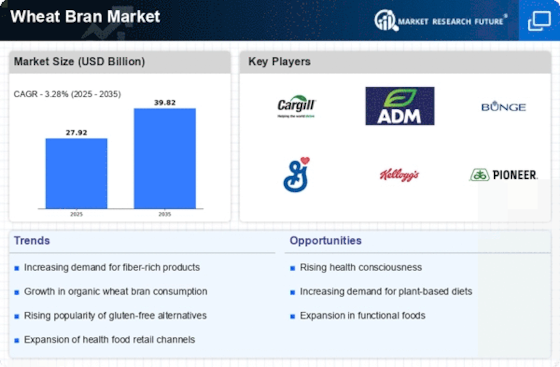

The Wheat Bran Market is experiencing a notable increase in demand for nutritional products, driven by a growing awareness of health and wellness among consumers. As individuals seek to incorporate more fiber into their diets, wheat bran, known for its high fiber content, becomes a preferred choice. Recent data indicates that The Wheat Bran Market is projected to reach USD 5.5 billion by 2026, with wheat bran playing a crucial role in this growth. This trend is further supported by the rising prevalence of lifestyle-related diseases, prompting consumers to opt for healthier food options. Consequently, manufacturers in the Wheat Bran Market are innovating to create products that cater to this health-conscious demographic, thereby enhancing their market presence.

Expansion of Bakery and Snack Industries

The Wheat Bran Market is significantly influenced by the expansion of the bakery and snack industries. As consumers increasingly gravitate towards healthier snack options, the incorporation of wheat bran into baked goods and snacks is becoming more prevalent. Data suggests that The Wheat Bran Market is expected to grow at a CAGR of 3.5% from 2021 to 2026, with whole grain and high-fiber products leading the charge. This trend is indicative of a broader shift towards healthier eating habits, where wheat bran serves as a key ingredient in enhancing the nutritional profile of various products. Manufacturers are thus leveraging this opportunity to innovate and diversify their offerings, ensuring that they meet the evolving preferences of consumers in the Wheat Bran Market.

Sustainability and Environmental Concerns

Sustainability is emerging as a pivotal driver in the Wheat Bran Market, as consumers and manufacturers alike become increasingly aware of environmental issues. The demand for sustainable agricultural practices is on the rise, with wheat bran being a byproduct of wheat milling that contributes to reducing waste. This aligns with the growing consumer preference for products that are not only healthy but also environmentally friendly. Recent studies indicate that sustainable food production could reduce greenhouse gas emissions by up to 70%. As a result, companies in the Wheat Bran Market are focusing on sustainable sourcing and production methods, which not only appeal to eco-conscious consumers but also enhance brand loyalty and market competitiveness.

Regulatory Support for Whole Grain Products

The Wheat Bran Market is benefiting from regulatory support aimed at promoting whole grain consumption. Governments and health organizations worldwide are advocating for increased intake of whole grains due to their associated health benefits, such as reduced risk of chronic diseases. For instance, dietary guidelines in various countries recommend that at least half of all grain consumption should come from whole grains. This regulatory push is likely to bolster the demand for wheat bran, as it is a key component of whole grain products. Consequently, manufacturers are encouraged to develop and market wheat bran-based products, thereby expanding their reach within the Wheat Bran Market and contributing to public health initiatives.

Technological Advancements in Food Processing

Technological advancements in food processing are playing a crucial role in shaping the Wheat Bran Market. Innovations in milling and processing techniques have enhanced the quality and functionality of wheat bran, making it more appealing to manufacturers and consumers. For instance, advancements in extrusion technology allow for the production of high-fiber snacks that retain the nutritional benefits of wheat bran while improving taste and texture. This is particularly relevant as the demand for convenient and healthy food options continues to rise. Data indicates that the food processing technology market is projected to grow at a CAGR of 5.2% through 2027. As a result, the Wheat Bran Market stands to benefit from these technological developments, which facilitate the creation of innovative products that meet consumer demands.