Military Applications

The military sector is a substantial contributor to the Global Vertical Take-off and Landing (VTOL) UAV Industry. Armed forces worldwide are increasingly adopting VTOL UAVs for reconnaissance, surveillance, and logistics operations. These UAVs provide strategic advantages, such as the ability to operate in confined spaces and perform missions without the need for traditional runways. Countries are investing heavily in developing advanced VTOL systems to enhance their operational capabilities. This trend is likely to propel market growth, as military budgets continue to allocate funds toward innovative UAV technologies.

Market Growth Projections

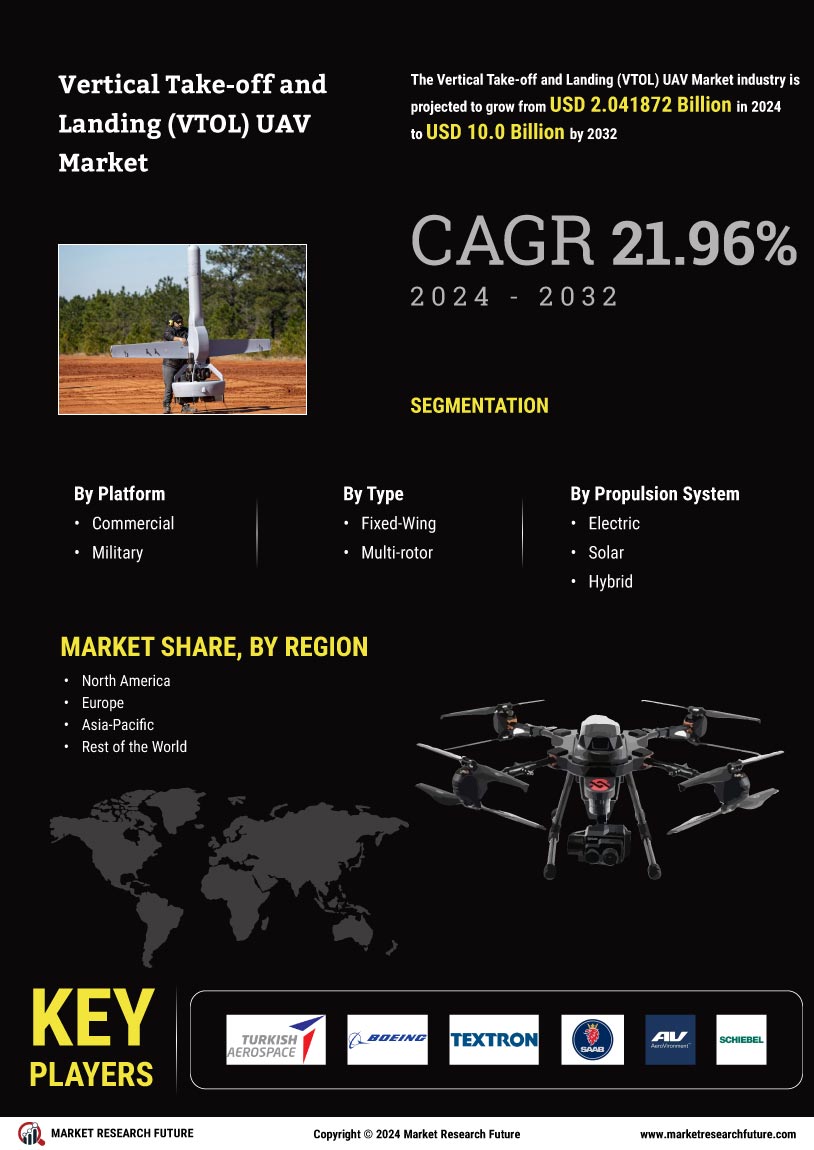

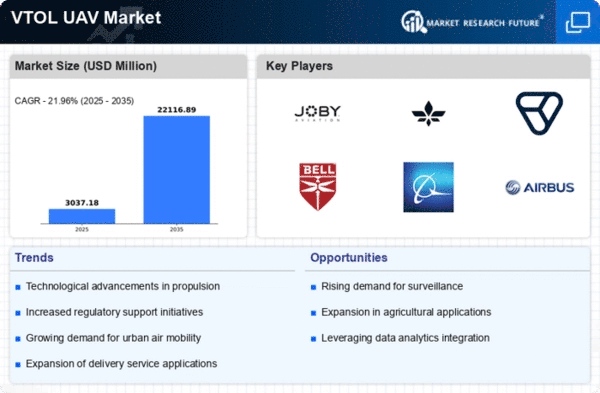

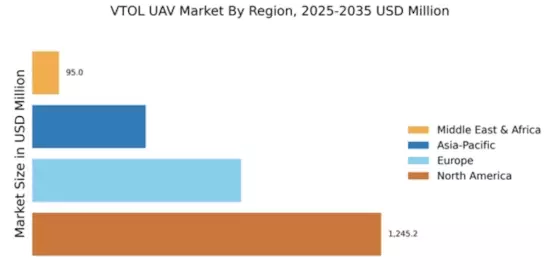

The Global Vertical Take-off and Landing (VTOL) UAV Industry is poised for substantial growth, with projections indicating a rise from 2.49 USD Billion in 2024 to 22.1 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 21.96% from 2025 to 2035, reflecting increasing investments in technology and infrastructure. The expanding applications of VTOL UAVs across various sectors, including military, commercial, and urban air mobility, are likely to contribute to this upward trend. As the market evolves, stakeholders must remain vigilant to capitalize on emerging opportunities.

Technological Advancements

The Global Vertical Take-off and Landing (VTOL) UAV Industry is experiencing rapid technological advancements, particularly in battery efficiency and autonomous flight systems. Innovations in electric propulsion systems are enhancing flight duration and payload capacity, making VTOL UAVs more viable for commercial applications. For instance, companies are developing hybrid-electric models that can operate in diverse environments, which could potentially expand their market reach. As a result, the market is projected to grow from 2.49 USD Billion in 2024 to an impressive 22.1 USD Billion by 2035, indicating a robust demand driven by these technological improvements.

Commercial Delivery Services

The rise of e-commerce and the need for efficient delivery systems are driving the Global Vertical Take-off and Landing (VTOL) UAV Industry. Companies are exploring the use of VTOL UAVs for last-mile delivery, which could significantly reduce delivery times and costs. With the increasing demand for rapid delivery solutions, logistics firms are investing in VTOL technology to enhance their service offerings. This trend is likely to create new market opportunities, as the logistics sector adapts to evolving consumer expectations and seeks innovative ways to streamline operations.

Increased Demand for Urban Air Mobility

Urban air mobility is emerging as a critical driver for the Global Vertical Take-off and Landing (VTOL) UAV Industry. As cities become increasingly congested, the need for efficient transportation solutions is paramount. VTOL UAVs offer a potential solution for urban commuting, logistics, and emergency services. Governments and private sectors are investing in infrastructure to support these aerial vehicles, which may lead to regulatory frameworks that facilitate their integration into urban environments. This trend suggests a significant market opportunity, with projections indicating a compound annual growth rate of 21.96% from 2025 to 2035.

Environmental Regulations and Sustainability

Growing environmental concerns and stringent regulations are influencing the Global Vertical Take-off and Landing (VTOL) UAV Industry. Governments are promoting the use of electric and hybrid UAVs to reduce carbon emissions and noise pollution. This shift towards sustainable aviation solutions is encouraging manufacturers to innovate and develop eco-friendly VTOL designs. As urban areas seek to comply with environmental standards, the demand for green technologies in aviation is expected to rise. Consequently, this trend may drive market growth as stakeholders prioritize sustainability in their operational strategies.