Research Methodology on the Unmanned Aerial Vehicle Market

1. Introduction

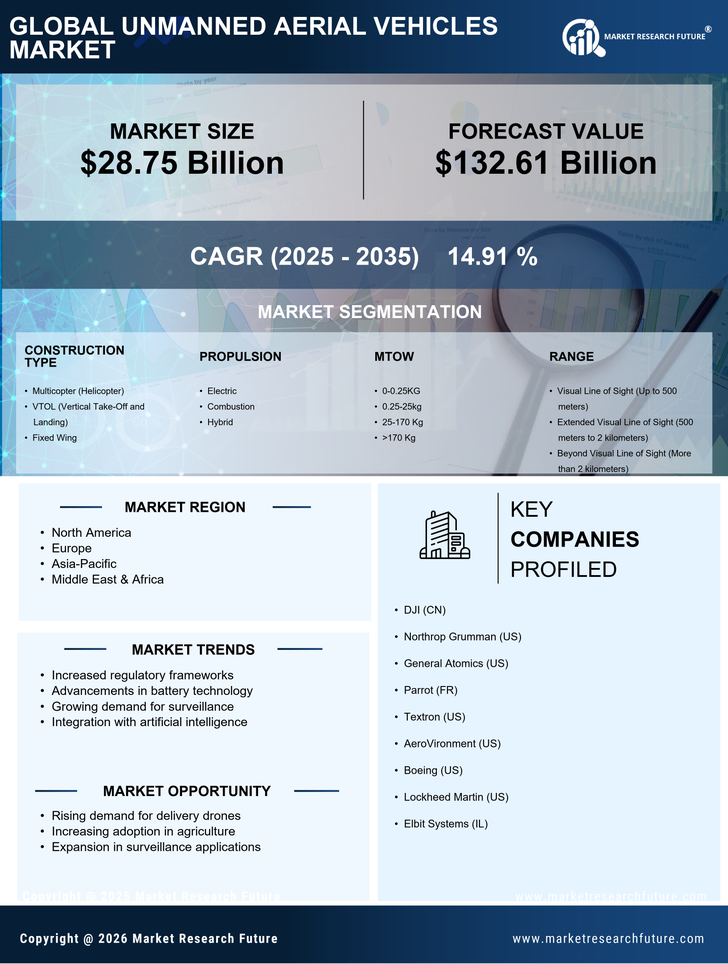

This research paper aims to provide a comprehensive analysis of the Unmanned Aerial Vehicle UAV market and assess its potential for growth and expansion. The market has been analysed from various perspectives, including its competitive landscape, market landscape, pricing, legal regulations, and forecasted market size. Through market research, in-depth analyses of the existing UAV market, and an extensive review of the legal regulations and policies, this research paper presents a detailed understanding of the UAV market and the potential for its development.

2. Problem Definition

The UAV market is an emerging industry with great growth potential. With the technological advancements in this field, the applications of UAVs are rapidly growing, and it is expected that the market will continue to see strong growth in the near future. There is potential in this market to offer significant value to businesses in different sectors and industries. With this potential, it is also important to understand the legal and regulatory aspects of the industry and evaluate the potential risks and opportunities of entering this market.

3. Research Objectives

The primary objective of this research is to provide a comprehensive analysis of the UAV market and its growth potential. Through this research, we aim to:

- Conduct an in-depth analysis of the UAV market landscape and its competitive landscape.

- Review the existing legal framework for the UAV market and assess the potential regulatory risks.

- Evaluate the potential for growth and expansion in the UAV market.

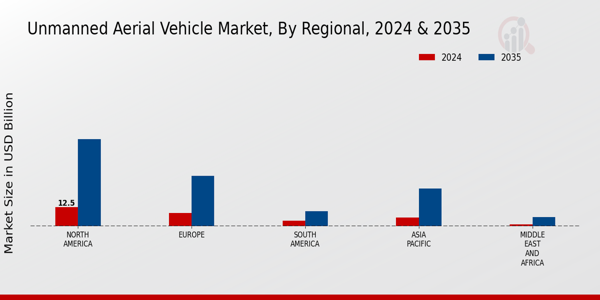

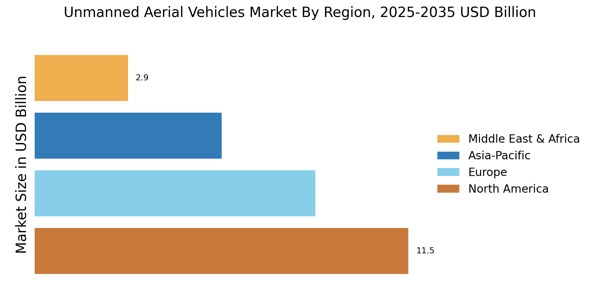

- Estimate the forecasted size of the UAV market.

4. Research Methodology

We use primary and secondary sources of information to conduct our research. The primary sources of information include interviews with experts and industry analysts, surveys of market participants, and focus groups. We also use existing databases of market information, such as the UAV Market Report from Market Research Future and other sources. Secondary sources of information include industry surveys, reports, and publications.

To evaluate the potential for growth in the UAV market, we will review market data, industry trends and forecasts, and analyze the competitive landscape. We also assess the legal framework and potential regulatory risks associated with the market.

We will use qualitative and quantitative research methods to collect and analyze data. Qualitative methods such as interviews, surveys, focus groups, and interviews with experts will provide insights into the opinions and perspectives of industry participants. We will use quantitative methods such as statistical modelling and econometric analysis to estimate the size of the UAV market and its growth potential.

We will use a combination of quantitative and qualitative methods to ensure an accurate and comprehensive understanding of the UAV market.

5. Data Analysis

We will use a variety of data analysis tools to analyze the collected data and arrive at valid research findings. We will use basic descriptive analysis and statistical tests such as ANOVA, Pearson's correlation, and regression analysis to analyze the data. Additionally, we will use predictive analytics tools such as machine learning algorithms to forecast the potential for growth in the UAV market.

6. Ethical Considerations

We will adhere to the ethical and legal considerations in our research. We will ensure that all the relevant laws and regulations are followed when conducting our research.

The research participants' privacy will be respected and all their personal and sensitive information will be kept confidential. We will also ensure that our research findings are not misused by any third parties.

We will actively refrain from any kind of unethical practices such as plagiarism, misrepresentation, and other inappropriate behaviour in conducting and sharing the research results.

7. Conclusion

This research paper aims to provide a comprehensive analysis of the UAV market and assess its potential for growth and expansion. Through market research, in-depth analyses of the existing UAV market, and an extensive review of the legal regulations and policies, this research paper presents a detailed understanding of the UAV market and the potential for its development.