Geopolitical Tensions

Geopolitical tensions are a critical factor influencing The Global Defense Market Overview Overview Industry. Ongoing conflicts and territorial disputes, particularly in regions such as Eastern Europe and the South China Sea, are prompting nations to reassess their defense postures. The resurgence of state-based threats has led to increased military readiness and strategic alliances, further driving defense expenditures. For instance, NATO member states have committed to enhancing their defense capabilities in response to perceived threats from Russia. This environment of uncertainty is likely to sustain demand for advanced military systems and technologies, as countries seek to bolster their deterrence capabilities. The Global Defense Market Overview Overview Industry is thus positioned to benefit from heightened defense spending driven by these geopolitical dynamics.

Cybersecurity Concerns

The escalating concerns surrounding cybersecurity are significantly impacting The Global Defense Market Overview Overview Industry. As nations increasingly rely on digital infrastructure, the threat of cyberattacks has become a paramount concern for national security. Governments are investing heavily in cybersecurity measures to protect critical assets and information systems. The market for cybersecurity solutions in defense is projected to grow substantially, with estimates indicating a potential increase of over 20% annually. This trend underscores the necessity for robust cyber defense strategies, which are becoming integral to military operations. The Global Defense Market Overview Overview Industry is thus witnessing a surge in demand for advanced cybersecurity technologies, as nations strive to safeguard their digital frontiers against evolving threats.

Increased Defense Budgets

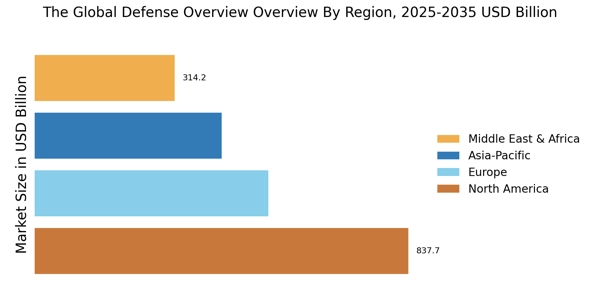

The rise in defense budgets across various nations appears to be a pivotal driver in The Global Defense Market Overview Overview Industry. Countries are allocating more resources to enhance their military capabilities, reflecting a growing emphasis on national security. For instance, defense spending in regions such as Asia-Pacific has seen a notable increase, with countries like India and Japan significantly boosting their military expenditures. This trend is likely to continue, as nations prioritize modernization and technological advancements in their defense strategies. The Global Defense Market Overview Overview Industry is thus witnessing a surge in demand for advanced weaponry, surveillance systems, and cyber defense solutions, as governments seek to fortify their military readiness in an increasingly complex geopolitical landscape.

Technological Advancements

Technological advancements are transforming the landscape of The Global Defense Market Overview Overview Industry. Innovations in artificial intelligence, unmanned systems, and cyber capabilities are reshaping defense strategies and operational effectiveness. For example, the integration of AI in military applications is enhancing decision-making processes and operational efficiency. The market for unmanned aerial vehicles (UAVs) is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 15% in the coming years. This technological evolution not only improves combat capabilities but also drives the demand for sophisticated training and simulation systems. As nations invest in cutting-edge technologies, The Global Defense Market Overview Overview Industry is likely to experience a paradigm shift, emphasizing the need for continuous innovation and adaptation.

International Defense Collaborations

International defense collaborations are emerging as a vital driver in The Global Defense Market Overview Overview Industry. Countries are increasingly engaging in joint military exercises, technology sharing, and collaborative defense projects to enhance their capabilities. Such partnerships not only foster interoperability among allied forces but also facilitate the development of advanced defense technologies. For instance, initiatives like the Joint Strike Fighter program exemplify how nations can pool resources and expertise to achieve common defense objectives. This collaborative approach is likely to expand, as countries recognize the benefits of shared knowledge and resources in addressing complex security challenges. The Global Defense Market Overview Overview Industry is thus poised to benefit from the growth of international defense collaborations, which enhance collective security and operational effectiveness.