Diverse Application Areas

The versatility of Fixed Wing VTOL UAVs is a key driver in the market, as they find applications across various sectors. In the Fixed Wing VTOL UAV Market, these UAVs are utilized for tasks ranging from aerial surveying and mapping to disaster response and environmental monitoring. Their ability to operate in diverse environments and perform multiple functions makes them attractive to both commercial and governmental entities. For instance, in agriculture, they are employed for crop monitoring and precision farming, while in logistics, they facilitate last-mile delivery. This broad applicability suggests that the Fixed Wing VTOL UAV Market will continue to expand as new use cases emerge, potentially leading to a market size exceeding several billion dollars by the end of the decade.

Enhanced Operational Efficiency

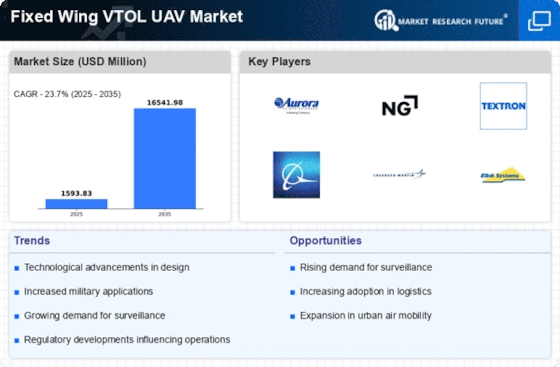

The Fixed Wing VTOL UAV Market is experiencing a surge in demand due to the enhanced operational efficiency these systems provide. Fixed Wing VTOL UAVs combine the advantages of both fixed-wing and rotary-wing aircraft, allowing for longer flight durations and greater payload capacities. This efficiency is particularly appealing to sectors such as agriculture, logistics, and surveillance, where operational costs are critical. The ability to take off and land vertically while maintaining the speed and range of fixed-wing aircraft makes these UAVs a preferred choice. As organizations seek to optimize their operations, the Fixed Wing VTOL UAV Market is likely to see continued growth, with projections indicating a compound annual growth rate of over 15% in the coming years.

Regulatory Support and Frameworks

Regulatory support and the establishment of frameworks are crucial drivers for the Fixed Wing VTOL UAV Market. As governments recognize the potential of UAV technology, they are developing regulations that facilitate safe and efficient operations. This regulatory clarity encourages investment and innovation within the industry, as companies can operate with a clearer understanding of compliance requirements. Furthermore, the establishment of designated airspace for UAV operations enhances the feasibility of deploying Fixed Wing VTOL UAVs for commercial purposes. The Fixed Wing VTOL UAV Market is likely to benefit from these regulatory advancements, which may lead to increased market participation and a more structured growth trajectory.

Advancements in Battery Technology

Battery technology advancements are playing a pivotal role in the Fixed Wing VTOL UAV Market. As energy density improves, UAVs can achieve longer flight times and greater operational ranges, which are essential for various applications. The integration of high-capacity batteries allows for more efficient energy use, enabling these UAVs to carry heavier payloads without compromising performance. This trend is particularly relevant in sectors such as delivery services and surveillance, where extended flight duration is crucial. The Fixed Wing VTOL UAV Market is likely to benefit from ongoing research and development in battery technologies, which may lead to innovations that further enhance the capabilities of these UAVs.

Growing Interest in Autonomous Systems

The increasing interest in autonomous systems is significantly influencing the Fixed Wing VTOL UAV Market. As technology evolves, the demand for UAVs capable of autonomous operations is rising, driven by the need for efficiency and safety in various applications. Autonomous Fixed Wing VTOL UAVs can perform complex missions without human intervention, which is particularly beneficial in hazardous environments or remote locations. This trend is evident in sectors such as military operations, where UAVs are deployed for reconnaissance and surveillance missions. The Fixed Wing VTOL UAV Market is expected to see a substantial increase in the adoption of autonomous systems, potentially leading to a market transformation as more organizations recognize the benefits of automation.