Top Industry Leaders in the VTOL UAV Market

Key Players in the VTOL UAV Market

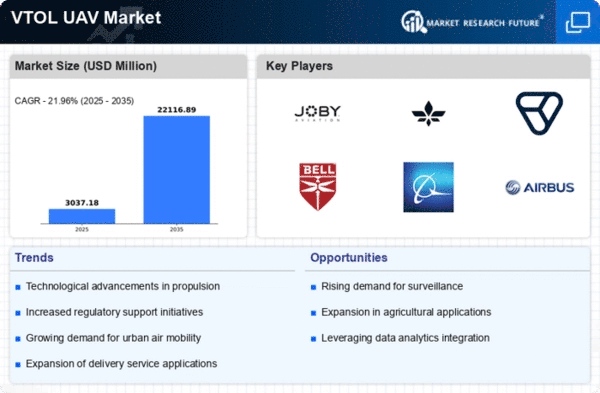

At the forefront of the VTOL UAV market are established players such as DJI, Lockheed Martin, Northrop Grumman, Boeing, and Airbus. DJI, a Chinese technology company, holds a substantial share owing to its consumer-oriented drones, while aerospace giants like Lockheed Martin and Boeing leverage their expertise in defense applications. Airbus, with its experience in commercial aviation, is also a formidable player. The entry of defense contractors into the VTOL UAV market underscores the convergence of military and civilian applications.

Strategies Adopted

Companies in the VTOL UAV market are deploying a mix of strategies to gain a competitive edge. Innovation remains a focal point, with players investing heavily in research and development to enhance the capabilities of their UAVs. DJI, for instance, consistently introduces cutting-edge features and performance upgrades to its consumer drones. Lockheed Martin and Boeing, on the other hand, concentrate on developing military-grade VTOL UAVs equipped with advanced sensors and communication systems.

Strategic partnerships and collaborations are another avenue for market players to fortify their positions. Boeing's collaboration with artificial intelligence and data analytics firms has allowed it to integrate advanced technologies into its UAV systems. Such alliances not only enhance the technological prowess of VTOL UAVs but also broaden the market reach of the involved parties.

Factors for Market Share Analysis

Market share analysis in the VTOL UAV sector encompasses various factors. Technological innovation, manufacturing capabilities, regulatory compliance, and global distribution networks play crucial roles. Companies investing in research and development to create UAVs with longer endurance, improved payload capacity, and enhanced autonomy tend to capture larger market shares. Additionally, effective supply chain management and adherence to evolving regulatory standards are imperative for sustained growth.

The ability to offer a diverse product portfolio catering to different industry verticals is another significant factor. Players that can seamlessly adapt their VTOL UAVs for applications such as agriculture, infrastructure inspection, and environmental monitoring gain a competitive advantage. Understanding the unique requirements of each sector and customizing UAV solutions accordingly allows companies to position themselves as comprehensive providers.

New and Emerging Companies

While established players dominate the VTOL UAV market, new and emerging companies are making noteworthy strides. These companies often focus on niche markets, developing specialized UAV solutions for specific applications. Quantum Systems, for example, has gained recognition for its VTOL fixed-wing UAVs designed for mapping and surveying. These emerging companies bring agility and fresh perspectives to the market, challenging established players and contributing to overall industry dynamism.

Industry News and Current Company Investment Trends

Industry news in the VTOL UAV market reflects a dynamic landscape characterized by mergers and acquisitions, strategic investments, and breakthrough technological developments. Notably, there has been a trend of traditional aerospace companies acquiring or partnering with drone startups to augment their UAV capabilities. This trend is indicative of a shift toward agility and adaptability in the face of evolving market demands.

Investment trends highlight a growing interest in technologies that enhance the operational capabilities of VTOL UAVs. Artificial intelligence, machine learning, and edge computing solutions are becoming focal points for investment, aiming to improve UAV navigation, object recognition, and data processing in real-time. Companies are also exploring environmentally sustainable solutions, with electric propulsion systems and lightweight materials gaining prominence to extend flight durations and reduce environmental impact.

Overall Competitive Scenario

The competitive scenario in the VTOL UAV market is characterized by a delicate balance between established players, new entrants, and technological innovators. Established companies leverage their brand reputation, extensive resources, and experience to maintain dominance, while new entrants disrupt the market with specialized offerings and nimble operations. Technological innovation remains the primary driver of competition, with companies striving to deliver UAVs that surpass current capabilities.

Regulatory developments also influence the competitive landscape. Companies adept at navigating and adapting to evolving regulations gain a competitive edge, as compliance is crucial for market entry and sustained operations. The convergence of military and civilian applications further complicates the competitive scenario, requiring companies to cater to diverse and stringent requirements.

the VTOL UAV market is witnessing fierce competition fueled by technological advancements, strategic collaborations, and a dynamic regulatory landscape. Established players face challenges from emerging companies that bring innovation and specialization to the forefront. The industry's future will likely be shaped by those who can seamlessly integrate cutting-edge technologies, adapt to evolving regulations, and meet the diverse needs of an expanding market.

he VTOL UAV market is rapidly evolving, and new developments occur frequently. These are just some of the recent highlights, and I encourage you to stay updated on the latest news and advancements in this dynamic field.

EHang:

- Development of next-generation passenger eVTOL with extended range: EHang's VT-30 model boasts a longer flight time and larger passenger capacity, catering to longer-distance routes and increased travel demand.

- Expansion into drone-based medical delivery services: EHang partners with healthcare providers to deliver essential medical supplies and samples, improving healthcare access in remote areas.

- Collaboration with Chinese authorities for smart city transportation applications: EHang integrates its drones into smart city initiatives, exploring autonomous cargo delivery and aerial surveillance for traffic management.

Archer Aviation:

- Successful completion of initial test flights for its Maker aircraft: These test flights validated the design and key performance parameters of Archer's eVTOL prototype, paving the way for further development and certification.

- Announcement of plans for manufacturing facilities in the US and Europe: Archer is securing resources and infrastructure for large-scale production of its eVTOL aircraft, aiming for a 2025 market entry.

- Focus on sustainable manufacturing practices: Archer prioritizes utilizing recycled and recyclable materials in its aircraft production, minimizing environmental impact.