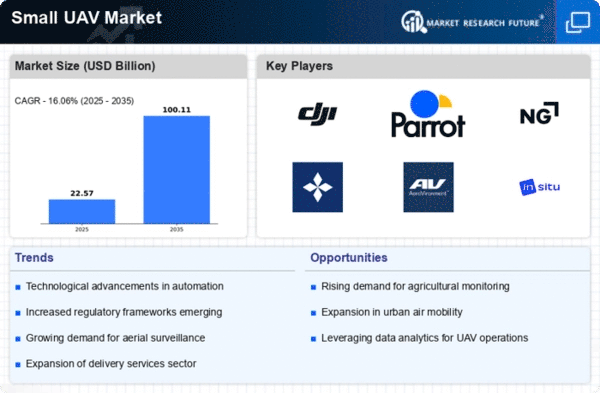

Market Growth Projections

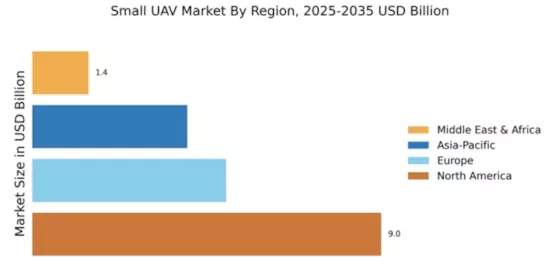

The Global Small UAV Industry is poised for substantial growth, with projections indicating a market value of 19.4 USD Billion in 2024 and an anticipated increase to 100.1 USD Billion by 2035. This growth trajectory suggests a robust CAGR of 16.07% from 2025 to 2035. Factors contributing to this expansion include technological advancements, regulatory support, and increasing applications across various sectors. The market's evolution reflects the growing recognition of small UAVs as essential tools for efficiency and innovation in diverse industries, positioning them as a pivotal component of future technological landscapes.

Technological Advancements

The Global Small UAV Industry experiences rapid growth driven by continuous technological advancements. Innovations in battery life, sensor capabilities, and autonomous flight systems enhance the functionality and efficiency of small UAVs. For instance, the integration of AI and machine learning algorithms allows for improved navigation and obstacle avoidance. These advancements not only increase operational efficiency but also expand the applications of small UAVs across various sectors, including agriculture, surveillance, and logistics. As a result, the market is projected to reach 19.4 USD Billion in 2024, reflecting the increasing reliance on advanced technologies in the Global Small UAV Industry.

Growing Demand in Agriculture

The agricultural sector significantly contributes to the expansion of the Global Small UAV Industry. Farmers increasingly adopt small UAVs for precision agriculture, enabling them to monitor crop health, optimize irrigation, and manage pests effectively. The ability to gather real-time data enhances decision-making processes, leading to improved yields and reduced costs. According to industry estimates, the use of UAVs in agriculture could lead to a 20% increase in crop productivity. This growing demand is expected to propel the market value to approximately 100.1 USD Billion by 2035, highlighting the transformative impact of small UAVs in modern farming practices.

Regulatory Support and Frameworks

Regulatory support plays a crucial role in shaping the Global Small UAV Industry. Governments worldwide are establishing frameworks that facilitate the safe integration of small UAVs into national airspaces. For example, the Federal Aviation Administration in the United States has implemented regulations that allow for commercial drone operations, fostering innovation and investment in the sector. Such regulatory clarity encourages businesses to explore UAV applications across various industries, including delivery services and infrastructure inspection. As these frameworks evolve, they are likely to stimulate market growth, contributing to a projected CAGR of 16.07% from 2025 to 2035.

Increased Investment in Defense and Security

The defense and security sectors are significant drivers of the Global Small UAV Industry. Governments are investing heavily in small UAV technology for surveillance, reconnaissance, and tactical operations. The ability of small UAVs to provide real-time intelligence and support military operations enhances their appeal to defense agencies. For instance, the use of small UAVs in border surveillance and counter-terrorism operations demonstrates their effectiveness in modern warfare. This increased investment is expected to sustain market growth, with the Global Small UAV Market projected to reach 19.4 USD Billion in 2024, reflecting the heightened focus on security and defense applications.

Emerging Applications in Logistics and Delivery

The logistics and delivery sectors are increasingly adopting small UAVs, significantly impacting the Global Small UAV Industry. Companies are exploring drone technology for last-mile delivery solutions, aiming to enhance efficiency and reduce operational costs. For instance, major retailers are testing drone deliveries to expedite shipping times and improve customer satisfaction. The potential for small UAVs to navigate urban environments and deliver goods directly to consumers presents a transformative opportunity for the logistics industry. As these applications gain traction, the market is anticipated to grow substantially, potentially reaching 100.1 USD Billion by 2035.