Declining Battery Costs

The grid scale-battery market is significantly influenced by the declining costs of battery technologies. Over the past few years, the price of lithium-ion batteries has decreased by nearly 80%, making large-scale energy storage more economically viable. This trend is likely to continue, as advancements in manufacturing processes and economies of scale further reduce costs. As a result, utilities are increasingly investing in grid scale-battery systems, which are projected to account for a substantial share of the energy storage market by 2030. The affordability of these systems enhances their attractiveness for grid operators looking to optimize energy management and reduce operational costs.

Growing Energy Storage Needs

The increasing demand for reliable energy storage solutions is a primary driver for the grid scale-battery market. As the energy landscape evolves, utilities and grid operators are seeking ways to enhance grid stability and manage peak loads. The grid scale-battery market is projected to grow as energy storage systems become essential for integrating renewable energy sources. In 2025, the total installed capacity of energy storage in the US is expected to reach approximately 30 GW, indicating a robust growth trajectory. This need for energy storage is further amplified by the rising frequency of extreme weather events, which necessitate resilient energy systems capable of maintaining supply during outages.

Supportive Policy Frameworks

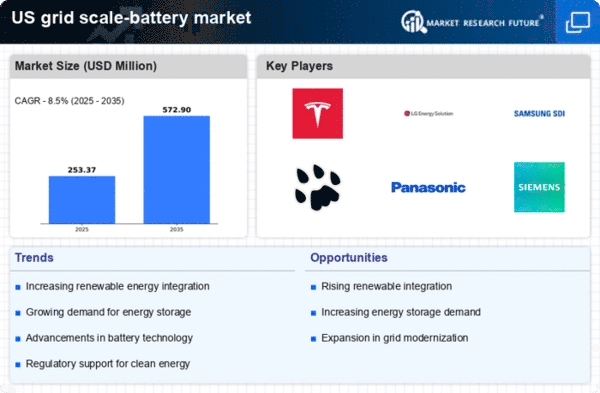

Supportive policy frameworks play a vital role in shaping the grid scale-battery market. Federal and state-level initiatives aimed at promoting energy storage technologies are likely to drive market growth. For instance, the Investment Tax Credit (ITC) and various state incentives encourage the adoption of battery storage systems. These policies not only provide financial support but also create a favorable regulatory environment for the grid scale-battery market. As more states implement energy storage mandates, the market is expected to expand, with projections indicating a compound annual growth rate (CAGR) of over 20% through 2030.

Rising Demand for Grid Resilience

The increasing demand for grid resilience is a significant driver for the grid scale-battery market. As the US faces challenges related to aging infrastructure and climate change, the need for robust energy systems becomes more pronounced. Grid scale-battery systems offer a solution by providing backup power during outages and enhancing the overall reliability of the grid. The grid scale-battery market is likely to see growth as utilities invest in these technologies to improve service reliability. In 2025, it is estimated that investments in grid resilience initiatives will exceed $100 billion, further underscoring the importance of energy storage in modernizing the grid.

Increased Investment in Renewable Integration

Investment in renewable energy integration is a crucial driver for the grid scale-battery market. As the US transitions towards a cleaner energy future, the need for effective energy storage solutions becomes paramount. The grid scale-battery market is expected to benefit from the anticipated $1 trillion investment in renewable energy infrastructure over the next decade. This investment will likely facilitate the deployment of battery storage systems that can store excess energy generated from renewable sources, such as solar and wind. Consequently, the ability to balance supply and demand will enhance grid reliability and support the overall growth of the energy sector.