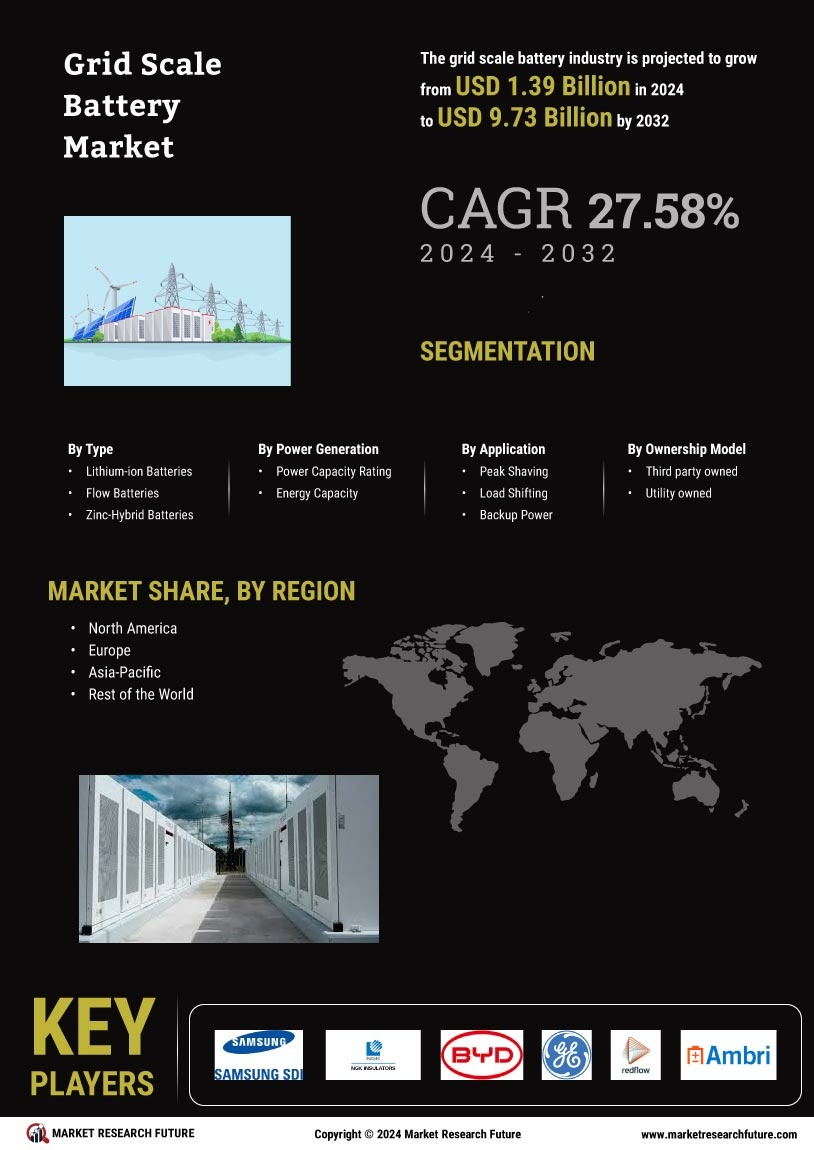

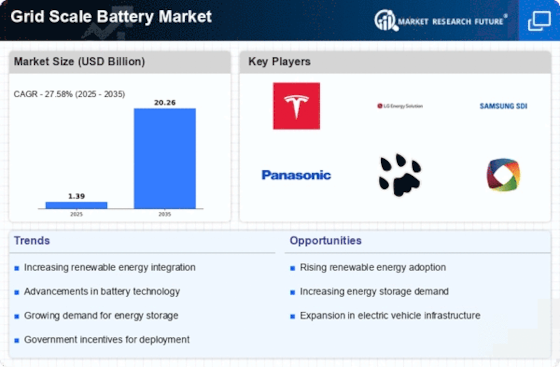

Rising Demand for Energy Storage Solutions

The Grid Scale Battery Market is experiencing a notable surge in demand for energy storage solutions. This demand is primarily driven by the increasing need for reliable and efficient energy management systems. As energy consumption patterns evolve, utilities and energy providers are seeking ways to balance supply and demand effectively. The International Energy Agency indicates that energy storage capacity is expected to grow significantly, with projections suggesting a potential increase of over 200 gigawatt-hours by 2030. This trend highlights the critical role of grid scale batteries in stabilizing energy supply, particularly during peak demand periods. Furthermore, the integration of energy storage systems is becoming essential for enhancing grid resilience and reliability, thereby fostering a more sustainable energy landscape.

Supportive Government Policies and Incentives

Government policies and incentives play a pivotal role in shaping the Grid Scale Battery Market. Many countries are implementing supportive frameworks aimed at promoting energy storage technologies. These policies often include tax credits, grants, and subsidies that encourage investment in grid scale battery projects. For instance, recent legislative measures in various regions have allocated substantial funding for energy storage initiatives, which could exceed billions of dollars over the next decade. Such financial support not only reduces the initial capital burden on developers but also stimulates innovation within the sector. As governments increasingly recognize the importance of energy storage in achieving climate goals, the regulatory landscape is likely to evolve further, creating a more favorable environment for the growth of the grid scale battery market.

Increasing Investment in Energy Infrastructure

Investment in energy infrastructure is a significant factor propelling the Grid Scale Battery Market. As countries strive to modernize their energy systems, substantial capital is being directed towards enhancing grid capabilities and integrating advanced energy storage solutions. Recent reports indicate that investments in energy storage infrastructure could exceed 100 billion dollars by 2030, reflecting a growing recognition of the importance of grid scale batteries in achieving energy security and sustainability. This influx of capital is likely to drive innovation and competition within the market, leading to the development of more efficient and cost-effective battery technologies. Furthermore, as utilities and private investors collaborate on large-scale projects, the overall capacity and deployment of grid scale batteries are expected to expand, thereby reinforcing their role in the energy landscape.

Technological Innovations in Battery Chemistry

Technological innovations in battery chemistry are significantly influencing the Grid Scale Battery Market. Advances in materials science and engineering are leading to the development of more efficient and longer-lasting battery technologies. For example, lithium-ion batteries have become the dominant technology due to their high energy density and decreasing costs. Recent research indicates that the cost of lithium-ion batteries has dropped by nearly 90% over the past decade, making them more accessible for large-scale applications. Additionally, emerging technologies such as solid-state batteries and flow batteries are gaining traction, offering potential advantages in terms of safety and scalability. These innovations not only enhance the performance of grid scale batteries but also contribute to the overall reduction of energy costs, thereby facilitating broader adoption across various sectors.

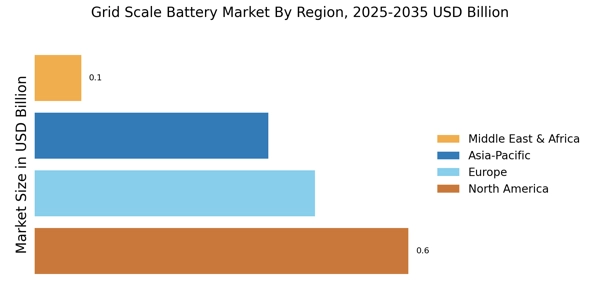

Growing Integration of Renewable Energy Sources

The integration of renewable energy sources is a key driver for the Grid Scale Battery Market. As the share of renewables in the energy mix continues to rise, the need for effective energy storage solutions becomes increasingly critical. Grid scale batteries serve as a vital component in managing the intermittent nature of renewable energy generation, such as solar and wind. According to recent data, the share of renewables in electricity generation is projected to reach 50% by 2030 in several regions. This shift necessitates robust energy storage systems to ensure a stable and reliable power supply. By enabling the smooth integration of renewables, grid scale batteries not only enhance grid stability but also support the transition towards a more sustainable energy future.