The Scale Inhibitors Market is currently characterized by a competitive landscape that is both dynamic and multifaceted. Key growth drivers include the increasing demand for water treatment solutions across various industries, particularly in oil and gas, power generation, and manufacturing. Major players such as BASF SE (DE), Dow Inc. (US), and Ecolab Inc. (US) are strategically positioned to leverage their extensive product portfolios and technological innovations. BASF SE (DE) focuses on sustainable solutions, while Dow Inc. (US) emphasizes digital transformation and operational efficiency. Ecolab Inc. (US) is known for its strong emphasis on partnerships and customer-centric solutions, which collectively shape a competitive environment that is increasingly reliant on innovation and sustainability.In terms of business tactics, companies are localizing manufacturing to enhance supply chain resilience and optimize costs. The market structure appears moderately fragmented, with several key players exerting considerable influence. This fragmentation allows for niche players to thrive, while larger corporations consolidate their market share through strategic acquisitions and partnerships. The collective influence of these key players fosters a competitive atmosphere where agility and responsiveness to market demands are paramount.

In November Ecolab Inc. (US) announced a strategic partnership with a leading technology firm to develop AI-driven solutions for water treatment processes. This move is significant as it underscores Ecolab's commitment to integrating advanced technologies into its offerings, potentially enhancing operational efficiencies and customer satisfaction. The partnership may also position Ecolab as a frontrunner in the digital transformation of the water treatment sector, aligning with current market trends.

In October BASF SE (DE) launched a new line of eco-friendly scale inhibitors aimed at reducing environmental impact while maintaining high performance. This initiative reflects BASF's strategic focus on sustainability, which is increasingly becoming a critical factor in customer decision-making. By prioritizing environmentally friendly products, BASF may strengthen its market position and appeal to a broader customer base that values sustainability.

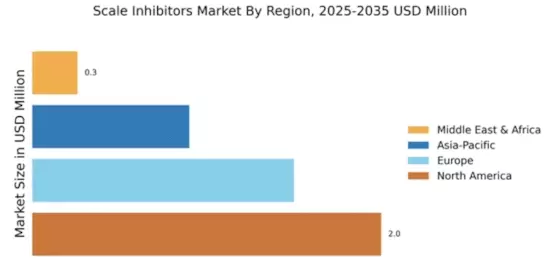

In September Dow Inc. (US) expanded its manufacturing capabilities in Asia to meet the growing demand for scale inhibitors in the region. This expansion is indicative of Dow's strategy to enhance its supply chain efficiency and responsiveness to regional market needs. By localizing production, Dow could potentially reduce lead times and costs, thereby improving its competitive edge in the Asian market.

As of December current competitive trends in the Scale Inhibitors Market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the landscape, allowing companies to pool resources and expertise to drive innovation. The competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological advancements, sustainability, and supply chain reliability. This shift suggests that companies that prioritize innovation and customer-centric solutions will be better positioned to thrive in the future.