Growing Investment in Energy Infrastructure

Investment in energy infrastructure is a crucial driver for the Grid Scale Battery Storage Market. As nations modernize their energy systems, there is a concerted effort to incorporate advanced storage technologies. The Grid Scale Battery Storage is projected to attract over $100 billion in investments by 2030, reflecting the increasing recognition of battery storage as a key component of energy transition strategies. This influx of capital is likely to facilitate the development of new grid-scale projects, enhancing the overall capacity and efficiency of energy systems. Consequently, the Grid Scale Battery Storage Market stands to benefit significantly from this trend, as stakeholders seek to optimize energy delivery and reliability.

Rising Energy Storage Needs for Grid Stability

The need for enhanced grid stability is a driving force behind the Grid Scale Battery Storage Market. As electricity demand fluctuates, utilities require reliable storage solutions to manage peak loads and maintain grid integrity. The increasing frequency of extreme weather events further exacerbates the need for resilient energy systems. According to the U.S. Energy Information Administration, energy storage capacity is expected to double by 2025, underscoring the urgency for effective storage solutions. This trend indicates that the Grid Scale Battery Storage Market will play a pivotal role in ensuring that energy systems can adapt to changing conditions and continue to deliver reliable power.

Supportive Regulatory Frameworks and Incentives

The Grid Scale Battery Storage Market is benefiting from supportive regulatory frameworks and financial incentives. Governments are increasingly recognizing the importance of energy storage in achieving energy security and sustainability goals. Policies that promote the deployment of battery storage systems, such as tax credits and grants, are becoming more prevalent. For instance, the U.S. Department of Energy has allocated substantial funding for energy storage research and development. This regulatory support is likely to stimulate investment in grid-scale battery projects, thereby accelerating market growth. As a result, the Grid Scale Battery Storage Market is poised to thrive in an environment that encourages innovation and investment.

Increasing Demand for Renewable Energy Integration

The Grid Scale Battery Storage Market is experiencing a surge in demand due to the increasing integration of renewable energy sources. As countries strive to meet ambitious carbon reduction targets, the reliance on solar and wind energy has escalated. However, these energy sources are inherently intermittent, necessitating robust storage solutions to ensure a stable energy supply. The International Energy Agency indicates that energy storage capacity is projected to reach 1,200 GWh by 2040, highlighting the critical role of grid-scale batteries in balancing supply and demand. This trend suggests that the Grid Scale Battery Storage Market will continue to expand as utilities and energy providers seek to enhance grid reliability and efficiency.

Technological Innovations in Energy Storage Solutions

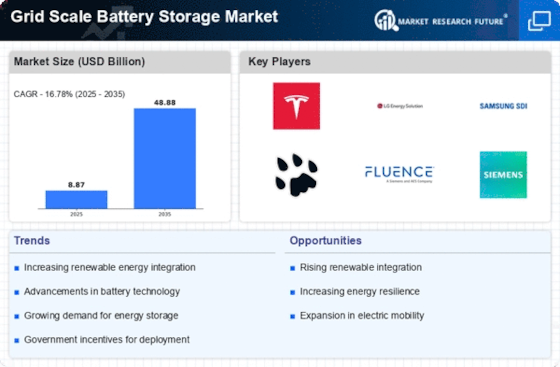

Technological advancements are propelling the Grid Scale Battery Storage Market forward. Innovations in battery chemistry, such as lithium-ion and flow batteries, are enhancing energy density and cycle life, making them more viable for large-scale applications. The market is witnessing a shift towards solid-state batteries, which promise improved safety and efficiency. According to recent estimates, the energy storage market is expected to grow at a compound annual growth rate of 20% through 2030. This growth is indicative of the increasing investments in research and development aimed at optimizing battery performance and reducing costs, thereby making grid-scale storage solutions more accessible and attractive to energy providers.