Increasing Industrial Demand for LNG

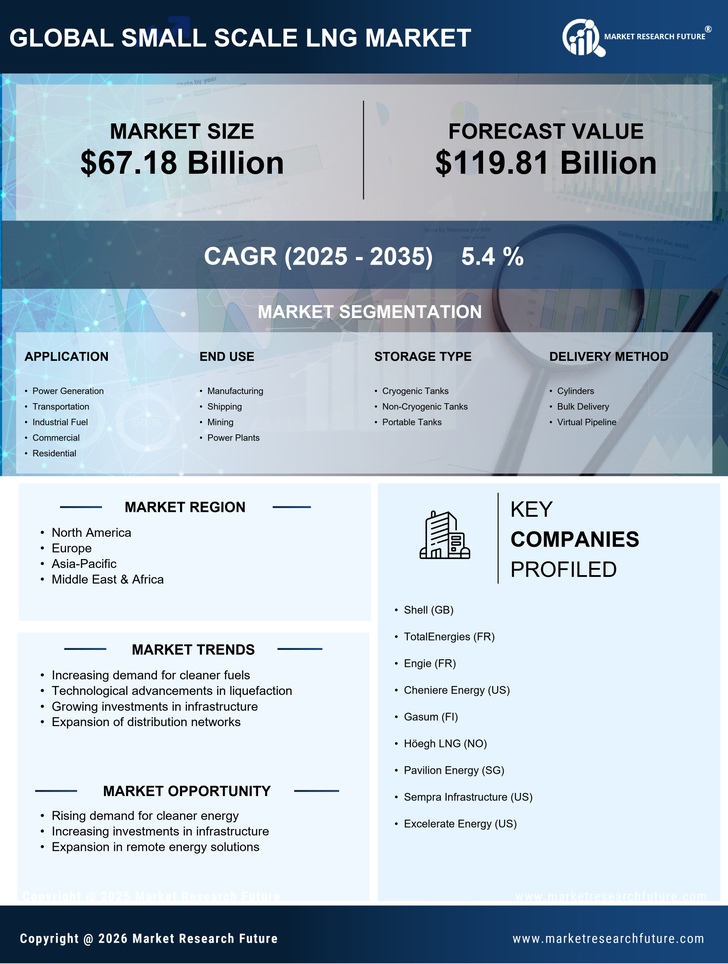

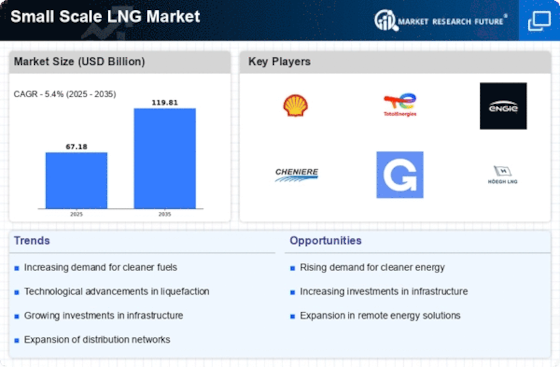

The Small Scale LNG Market is experiencing a notable surge in demand from various industrial sectors. Industries such as manufacturing, chemicals, and transportation are increasingly adopting LNG as a cleaner alternative to traditional fuels. This shift is driven by the need to reduce carbon emissions and comply with stringent environmental regulations. For instance, the industrial sector's consumption of LNG is projected to grow at a compound annual growth rate of approximately 5% over the next five years. This trend indicates a robust potential for the Small Scale LNG Market, as companies seek to enhance their sustainability profiles while maintaining operational efficiency.

Expansion of LNG Distribution Networks

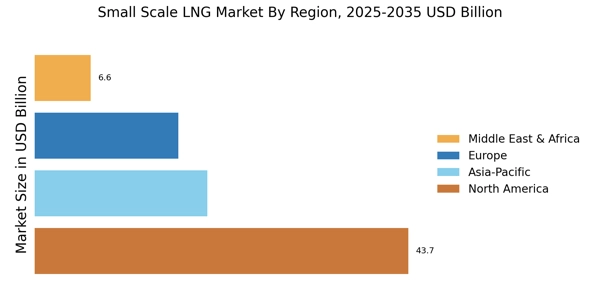

The Small Scale LNG Market is benefiting from the expansion of LNG distribution networks, which facilitates access to LNG in remote and underserved regions. Investments in infrastructure, such as small-scale liquefaction plants and distribution terminals, are crucial for meeting the rising demand for LNG. According to recent data, the number of small-scale LNG facilities is expected to increase by 30% by 2027, enhancing supply chain efficiency. This expansion not only supports local economies but also promotes the adoption of LNG as a viable energy source, thereby bolstering the Small Scale LNG Market.

Rising Adoption of LNG in Transportation

The Small Scale LNG Market is witnessing a significant shift towards the adoption of LNG in the transportation sector. As governments and companies aim to reduce greenhouse gas emissions, LNG is emerging as a preferred fuel for heavy-duty vehicles and marine applications. The International Maritime Organization has set ambitious targets for reducing emissions, which is likely to drive the demand for LNG as a marine fuel. The transportation sector's transition to LNG could potentially increase the Small Scale LNG Market's share, with projections indicating a growth rate of 6% annually in this segment.

Technological Innovations in LNG Production

The Small Scale LNG Market is experiencing advancements in technology that enhance the efficiency and cost-effectiveness of LNG production. Innovations such as modular liquefaction systems and improved cryogenic processes are making it feasible to produce LNG at smaller scales. These technologies not only reduce capital expenditures but also enable quicker deployment of LNG facilities in various locations. As a result, the Small Scale LNG Market is poised for growth, with an anticipated increase in the number of small-scale LNG projects, potentially reaching a market size of USD 15 billion by 2030.

Supportive Government Policies and Incentives

The Small Scale LNG Market is positively influenced by supportive government policies and incentives aimed at promoting cleaner energy sources. Many countries are implementing tax breaks, subsidies, and grants to encourage the development and utilization of LNG infrastructure. These initiatives are designed to facilitate the transition from coal and oil to natural gas, thereby enhancing energy security and reducing environmental impact. As a result, the Small Scale LNG Market is likely to see increased investments and growth opportunities, particularly in regions where such policies are actively promoted.