E-commerce Expansion

The rapid expansion of e-commerce in the United States is significantly impacting the US chemical logistics market. With online sales projected to grow by over 15% annually, logistics providers are increasingly tasked with delivering chemical products directly to consumers and businesses. This shift necessitates the development of efficient supply chain solutions that can handle the complexities of chemical transportation. Companies are investing in technology and infrastructure to streamline their logistics processes, ensuring timely and safe delivery of chemical products. As e-commerce continues to evolve, the demand for innovative logistics solutions within the US chemical logistics market is expected to intensify.

Growing Demand for Specialty Chemicals

The US chemical logistics market is experiencing a notable increase in demand for specialty chemicals, driven by various sectors such as pharmaceuticals, agriculture, and electronics. This growth is projected to reach approximately 10% annually over the next five years. Specialty chemicals often require precise handling and transportation conditions, which necessitates advanced logistics solutions. As companies strive to meet the evolving needs of their customers, the demand for specialized logistics services is likely to rise. This trend indicates that logistics providers must adapt their operations to accommodate the unique requirements of specialty chemicals, thereby enhancing their service offerings in the US chemical logistics market.

Increased Focus on Supply Chain Resilience

In light of recent disruptions, the US chemical logistics market is witnessing a heightened emphasis on supply chain resilience. Companies are reevaluating their logistics strategies to mitigate risks associated with supply chain vulnerabilities. This trend is prompting investments in diversified transportation networks and enhanced inventory management systems. According to industry reports, nearly 70% of chemical companies are prioritizing supply chain resilience as a key strategic objective. By adopting more robust logistics frameworks, businesses aim to ensure continuity in the supply of chemicals, thereby reinforcing their position within the US chemical logistics market.

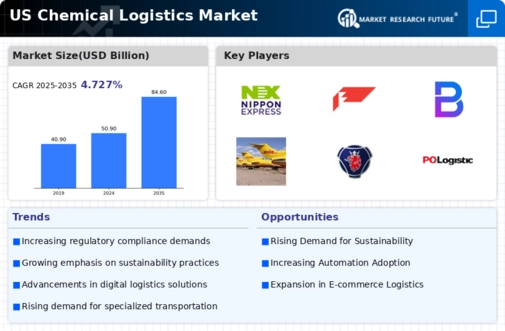

Advancements in Digital Logistics Solutions

The integration of digital technologies is transforming the US chemical logistics market. Innovations such as real-time tracking, automated inventory management, and data analytics are enhancing operational efficiency. Companies are increasingly adopting digital platforms to optimize their logistics processes, resulting in reduced costs and improved service levels. The market for digital logistics solutions is expected to grow by approximately 12% annually, reflecting the industry's commitment to modernization. As logistics providers leverage these advancements, they are better equipped to meet the demands of the US chemical logistics market, ensuring timely and secure delivery of chemical products.

Sustainability and Green Logistics Initiatives

Sustainability is becoming a central theme in the US chemical logistics market. Companies are increasingly adopting green logistics practices to minimize their environmental impact. This includes optimizing transportation routes, utilizing eco-friendly packaging, and investing in energy-efficient vehicles. According to recent studies, over 60% of chemical companies are implementing sustainability initiatives within their logistics operations. This shift not only aligns with regulatory requirements but also meets the growing consumer demand for environmentally responsible practices. As sustainability becomes a priority, the US chemical logistics market is likely to see a rise in innovative logistics solutions that promote eco-friendly operations.