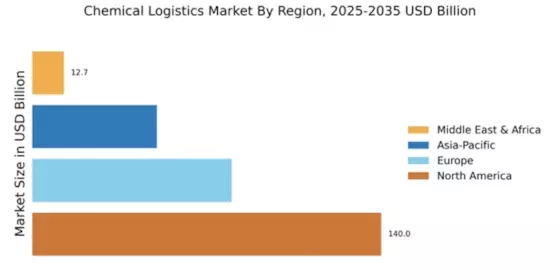

North America : Market Leader in Chemical Logistics

Chemical Logistics Market analysis reveals that North America is poised to maintain its leadership in the regional segment, holding a significant share of 120.0 million. The region's growth is driven by robust demand from the chemical manufacturing sector, stringent regulatory frameworks, and advancements in logistics technology. The increasing focus on sustainability and safety in chemical transportation further propels market expansion, with companies adapting to meet evolving regulations and consumer expectations. The United States stands out as the primary market, supported by key players such as C.H. Robinson Worldwide, Inc. and XPO Logistics, Inc. The competitive landscape is characterized by a mix of established firms and emerging players, all vying for market share. The presence of major logistics hubs and a well-developed infrastructure enhances operational efficiency, making North America a focal point for chemical logistics activities.

Europe : Emerging Hub for Chemical Logistics

Europe Chemical Logistics Market is experiencing significant growth, with a market size of 80.0 million. The region benefits from a strong regulatory environment that emphasizes safety and environmental standards, driving demand for efficient logistics solutions. The increasing complexity of supply chains and the need for specialized transportation services are key factors contributing to this growth, as companies seek to optimize their operations and comply with regulations. Germany and France are leading countries in this sector, hosting major players like BASF SE and Geodis. The competitive landscape is marked by innovation, with companies investing in technology to enhance service delivery. The European market is also witnessing collaborations and partnerships aimed at improving logistics efficiency and sustainability, positioning it as a dynamic player in the global chemical logistics arena.

Asia-Pacific : Growing Demand in Chemical Logistics

The Asia-Pacific region is witnessing a burgeoning chemical logistics market, with a size of 50.0 million. This growth is fueled by rapid industrialization, increasing urbanization, and a rising demand for chemicals in various sectors, including pharmaceuticals and agriculture. Regulatory support for safe transportation and handling of chemicals is also a significant driver. The region's logistics infrastructure is improving, facilitating better supply chain efficiency and responsiveness to market needs. China and Japan are the leading countries in this market, with key players like Nippon Express Co., Ltd. and Sinotrans Limited making substantial contributions. The competitive landscape is evolving, with both local and international firms vying for market share. The emphasis on technological advancements, such as automation and real-time tracking, is expected to enhance operational efficiency and safety in chemical logistics operations.

Middle East and Africa : Emerging Market with Potential

The Middle East and Africa region is gradually emerging in the chemical logistics market, currently valued at 12.7 million. The growth is driven by increasing investments in the chemical sector, coupled with a rising demand for logistics services. Regulatory frameworks are evolving to support the safe transportation of chemicals, which is crucial for market development. The region's strategic location also offers significant advantages for global trade and logistics operations. Countries like South Africa and the UAE are at the forefront of this market, with a growing number of logistics providers entering the space. The competitive landscape is characterized by a mix of established players and new entrants, all aiming to capitalize on the region's growth potential. The focus on enhancing logistics infrastructure and adopting advanced technologies is expected to drive future growth in chemical logistics.