North America : Market Leader in Distribution

North America is poised to maintain its leadership in the chemical distribution and logistics market, holding a significant market share of 90.0 in 2024. The region's growth is driven by robust demand across various sectors, including pharmaceuticals and agriculture, alongside favorable regulatory frameworks that promote safety and efficiency. The increasing focus on sustainability and innovation further propels market expansion, as companies adapt to evolving environmental standards.

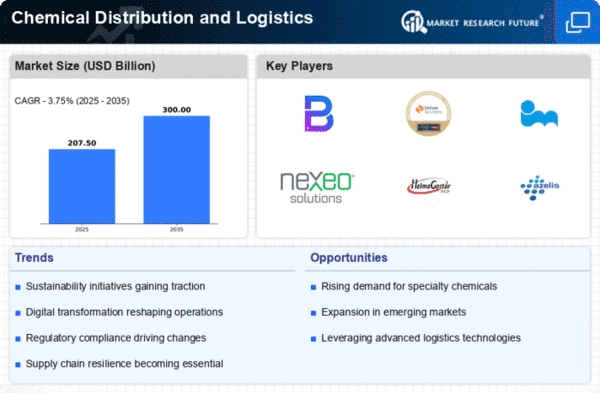

The competitive landscape in North America is characterized by the presence of major players such as Brenntag, Univar Solutions, and Nexeo Solutions. These companies leverage advanced logistics networks and technology to enhance service delivery and operational efficiency. The U.S. remains the largest market, supported by a strong industrial base and significant investments in infrastructure. As the region continues to innovate, it is expected to attract further investments, solidifying its position as a global leader in chemical distribution.

Europe : Emerging Regulatory Frameworks

Europe's chemical distribution and logistics market is projected to grow, with a market size of 50.0 in 2024. The region is experiencing a shift towards stricter regulatory frameworks aimed at enhancing safety and environmental sustainability. These regulations are driving demand for compliant logistics solutions, as companies seek to align with EU directives. The focus on green chemistry and sustainable practices is also influencing market dynamics, encouraging innovation and investment in eco-friendly technologies.

Leading countries in this region include Germany, France, and the Netherlands, where key players like Brenntag and IMCD Group operate. The competitive landscape is marked by a mix of established firms and emerging players, all vying for market share. The presence of a well-developed infrastructure and a strong emphasis on R&D further bolster the region's market potential. As companies adapt to regulatory changes, the market is expected to witness significant growth opportunities.

Asia-Pacific : Rapid Growth and Demand

The Asia-Pacific region is witnessing rapid growth in the chemical distribution and logistics market, with a market size of 45.0 in 2024. This growth is fueled by increasing industrialization, urbanization, and rising demand for chemicals in sectors such as automotive, electronics, and consumer goods. Additionally, favorable government policies and investments in infrastructure are enhancing logistics capabilities, making the region an attractive market for chemical distribution.

Countries like China, India, and Japan are leading the charge, with significant contributions from local and international players. Companies such as Azelis and Barentz are expanding their operations to meet the growing demand. The competitive landscape is evolving, with a mix of established firms and new entrants striving to capture market share. As the region continues to develop, it presents numerous opportunities for growth and innovation in chemical logistics.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is gradually emerging in the chemical distribution and logistics market, with a market size of 15.0 in 2024. The growth is driven by increasing industrial activities, particularly in oil and gas, and a rising demand for chemicals in various sectors. Government initiatives aimed at diversifying economies and enhancing infrastructure are also contributing to market expansion, creating a favorable environment for logistics services.

Key countries in this region include South Africa, Saudi Arabia, and the UAE, where companies are beginning to establish a stronger presence. The competitive landscape is still developing, with both local and international players vying for market share. As investments in infrastructure and technology continue, the region is expected to see significant growth in chemical distribution and logistics, presenting new opportunities for stakeholders.