E-commerce Growth

The rapid expansion of e-commerce is a pivotal driver for the Global Logistics Market. As online shopping continues to gain traction, logistics providers are adapting to meet the increasing demand for fast and efficient delivery services. In 2024, the market is projected to reach 1006.9 USD Billion, largely fueled by the need for robust logistics solutions that can handle the complexities of e-commerce supply chains. Companies are investing in technology and infrastructure to enhance last-mile delivery capabilities, which is crucial for customer satisfaction. This trend is expected to persist, with the market anticipated to grow significantly as consumer preferences shift towards online purchasing.

Urbanization Trends

Urbanization is a key factor influencing the Global Logistics Industry, as more people migrate to urban areas, creating challenges and opportunities for logistics providers. The concentration of populations in cities increases demand for efficient transportation and distribution networks. Logistics Market companies are responding by developing urban logistics strategies that address the complexities of last-mile delivery in densely populated areas. This trend is expected to drive market growth, with the industry projected to reach 1006.9 USD Billion in 2024. As urbanization continues, logistics providers must innovate to meet the evolving needs of urban consumers, ensuring timely and effective delivery solutions.

Global Trade Dynamics

The evolving landscape of global trade is a significant driver for the Global Logistics Industry. Trade agreements and geopolitical developments influence logistics operations, as companies must navigate tariffs, regulations, and supply chain disruptions. The increasing interconnectedness of markets necessitates efficient logistics solutions to facilitate cross-border trade. As countries engage in trade partnerships, the demand for logistics services is likely to rise, contributing to the market's expansion. The anticipated growth to 1500 USD Billion by 2035 underscores the importance of adapting logistics strategies to align with changing trade dynamics and global economic conditions.

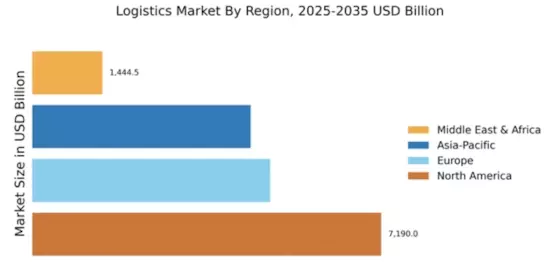

Market Growth Projections

The Global Logistics Industry is poised for substantial growth, with projections indicating a market size of 1006.9 USD Billion in 2024 and a potential increase to 1500 USD Billion by 2035. This growth reflects a compound annual growth rate (CAGR) of 3.69% from 2025 to 2035, driven by various factors such as e-commerce expansion, technological advancements, and changing consumer preferences. The increasing complexity of supply chains necessitates innovative logistics solutions, further propelling market dynamics. As the industry evolves, stakeholders must remain agile to capitalize on emerging opportunities and navigate potential challenges.

Sustainability Initiatives

Sustainability is becoming a crucial focus within the Global Logistics Market Industry as companies seek to reduce their carbon footprints and comply with environmental regulations. The push for greener logistics solutions is prompting investments in alternative fuels, electric vehicles, and eco-friendly packaging. As consumers increasingly prioritize sustainability, logistics providers are adapting their operations to meet these expectations. This shift may lead to a competitive advantage for companies that successfully implement sustainable practices. The market's growth trajectory, with a projected CAGR of 3.69% from 2025 to 2035, indicates that sustainability will play a significant role in shaping the future of logistics.

Technological Advancements

Technological innovations are reshaping the Global Logistics Market Industry, enhancing operational efficiency and reducing costs. Automation, artificial intelligence, and data analytics are increasingly integrated into logistics operations, enabling companies to optimize routes, manage inventory, and predict demand more accurately. For instance, the use of AI-driven predictive analytics can lead to a reduction in delivery times and improved resource allocation. As the industry evolves, the adoption of these technologies is likely to drive growth, contributing to the projected market size of 1500 USD Billion by 2035. This technological shift not only streamlines processes but also enhances the overall customer experience.