Healthcare Cold Chain Logistics Market Summary

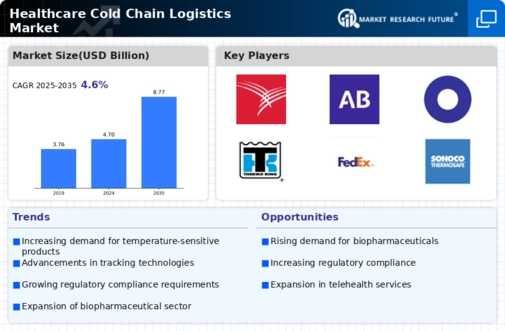

As per Market Research Future Analysis, the Healthcare Cold Chain Logistics Market was valued at USD 4.70 billion in 2024 and is projected to reach USD 7.72 billion by 2035, growing at a CAGR of 4.62% from 2025 to 2035. Key drivers include the expansion of biopharma distribution networks, increased adoption of automated systems, and a shift towards biosimilars and biologic drugs. The market is characterized by rising transportation of temperature-sensitive pharmaceuticals, necessitating advanced cold chain logistics solutions to maintain product integrity during transport.

Key Market Trends & Highlights

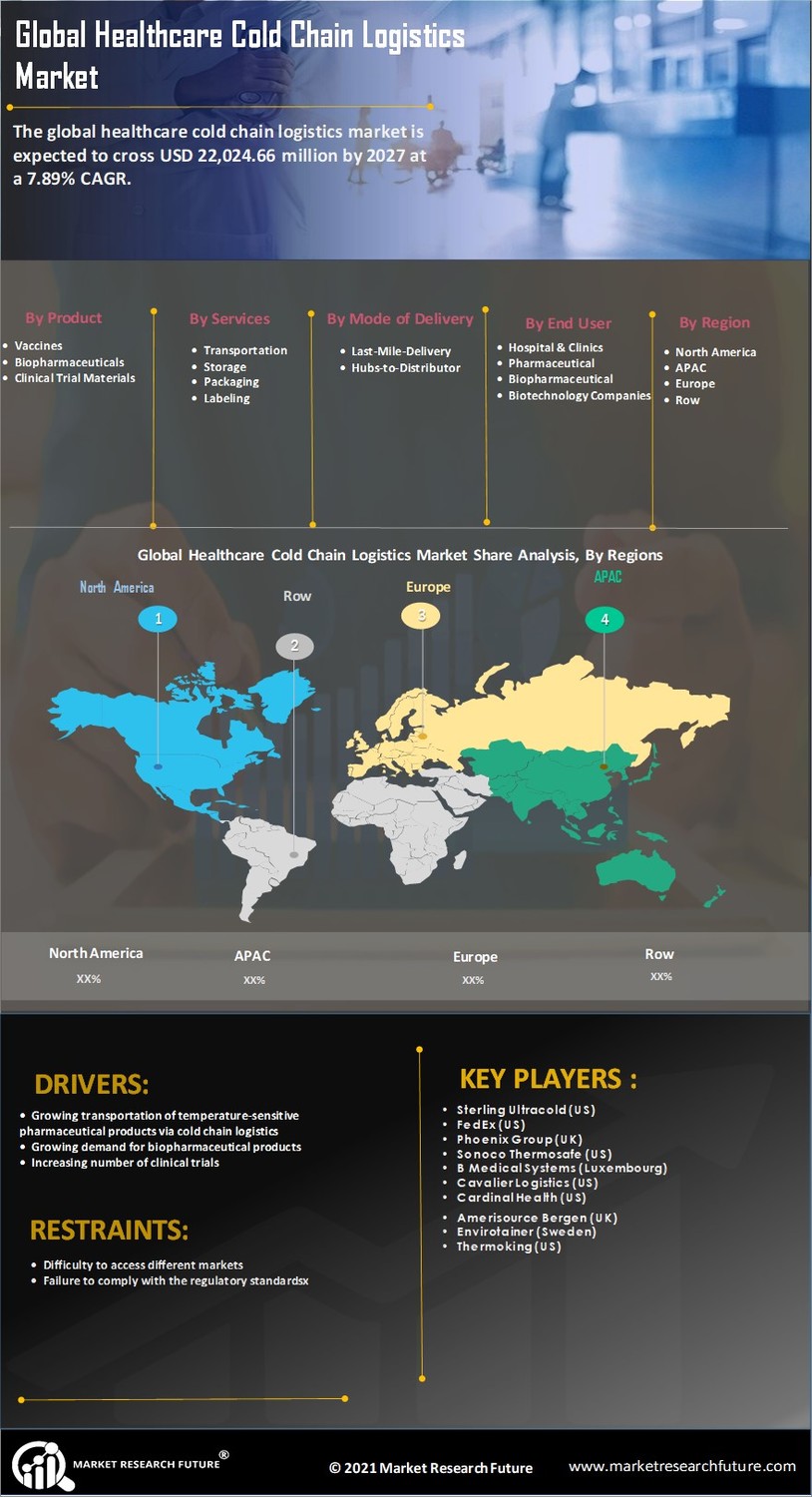

The healthcare cold chain logistics market is witnessing significant growth driven by technological advancements and increasing demand for temperature-sensitive products.

- Vaccines segment contributed ~32-35% to market revenue in 2022.

- Biopharmaceutical segment expected to grow fastest between 2024 and 2035.

- Transportation services dominated the market in 2022 and projected to grow rapidly during the forecast period.

- North America accounted for USD 6.36 billion in 2022, driven by high pharmaceutical and biologic medication demand.

Market Size & Forecast

| 2024 Market Size | USD 4.70 Billion |

| 2035 Market Size | USD 7.72 Billion |

| CAGR (2024-2035) | 4.62% |

Major Players

Key companies include Cardinal Health, Amerisource Bergen, Envirotainer, Thermoking, FedEx, Sonoco Thermosafe, Phoenix Group, B Medical Systems, Agility, and Dokasch.