Expansion of 5G Technology

The rollout of 5G technology across the United States is poised to revolutionize the US Mobile Gaming Market. With significantly faster download speeds and lower latency, 5G enables seamless online gaming experiences, which is crucial for multiplayer and real-time games. As of January 2026, major carriers have expanded their 5G networks to cover over 70 percent of the US population, facilitating a more immersive gaming environment. This technological advancement allows developers to create more complex and graphically intensive games that were previously limited by slower network speeds. The potential for enhanced connectivity and user engagement indicates that 5G will play a pivotal role in shaping the future landscape of the US Mobile Gaming Market.

Growing Popularity of Esports

The rise of esports is significantly impacting the US Mobile Gaming Market, as competitive gaming continues to attract a large audience. As of January 2026, the esports market in the US is projected to reach over 1 billion dollars, with mobile games playing a crucial role in this growth. Titles such as PUBG Mobile and Call of Duty Mobile have established competitive scenes, drawing in players and spectators alike. This trend encourages developers to invest in mobile esports, creating tournaments and events that further engage the gaming community. The increasing visibility and legitimacy of mobile esports suggest that this segment will continue to thrive, contributing to the overall expansion of the US Mobile Gaming Market.

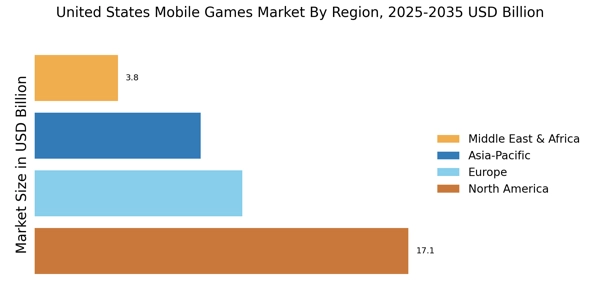

Diverse Monetization Strategies

The US Mobile Gaming Market is witnessing a shift in monetization strategies, which is driving growth and innovation. Developers are increasingly adopting diverse revenue models, including in-app purchases, subscriptions, and ad-based monetization. As of January 2026, it is estimated that in-app purchases account for over 70 percent of mobile gaming revenue in the US. This trend allows players to access free-to-play games while offering optional purchases for enhanced experiences. Additionally, subscription models are gaining traction, providing players with ad-free experiences and exclusive content. This diversification in monetization strategies not only increases revenue potential for developers but also enhances user engagement, suggesting a dynamic and evolving market landscape.

Increased Smartphone Penetration

The US Mobile Gaming Market is experiencing a surge in growth due to the increasing penetration of smartphones. As of January 2026, approximately 85 percent of the US population owns a smartphone, which serves as a primary device for gaming. This widespread accessibility enables a larger audience to engage with mobile games, thereby expanding the market. The proliferation of affordable smartphones with advanced features, such as high-resolution displays and powerful processors, further enhances the gaming experience. Consequently, developers are increasingly targeting this demographic, leading to a diverse range of games that cater to various preferences. The combination of high smartphone ownership and improved technology suggests a robust future for the US Mobile Gaming Market.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) in mobile gaming is transforming the US Mobile Gaming Market by enhancing user experiences and game design. AI technologies are being utilized to create more personalized gaming experiences, such as adaptive difficulty levels and tailored content recommendations. As of January 2026, many popular mobile games are employing AI to analyze player behavior and preferences, allowing developers to refine their offerings. This not only improves player retention but also fosters a more engaging environment. Furthermore, AI-driven analytics provide valuable insights into market trends and player demographics, enabling developers to make informed decisions. The ongoing integration of AI suggests a promising future for innovation within the US Mobile Gaming Market.