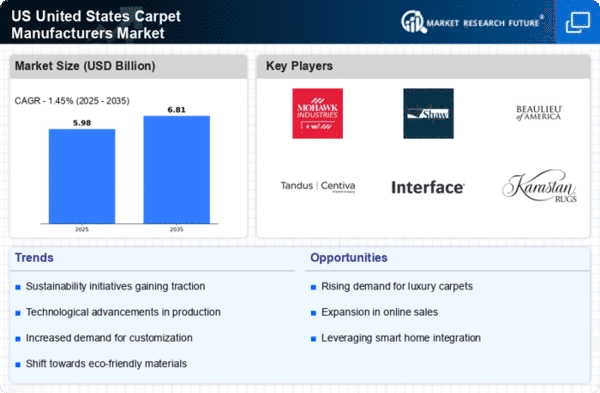

The Carpet Manufacturers Market in the US is characterized by a competitive landscape that is both dynamic and multifaceted. Key growth drivers include increasing consumer demand for sustainable flooring solutions, technological advancements in manufacturing processes, and a growing emphasis on design aesthetics. Major players such as Mohawk Industries (US), Shaw Industries (US), and Interface, Inc. (US) are strategically positioned to leverage these trends. Mohawk Industries (US) focuses on innovation through the development of eco-friendly products, while Shaw Industries (US) emphasizes regional expansion and digital transformation to enhance customer engagement. Interface, Inc. (US) is notable for its commitment to sustainability, which shapes its operational focus and market positioning, collectively influencing the competitive environment towards a more environmentally conscious approach.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. The market structure appears moderately fragmented, with several key players exerting considerable influence. This fragmentation allows for niche players to thrive, while larger companies consolidate their market share through strategic acquisitions and partnerships. The collective influence of these key players fosters a competitive atmosphere that encourages innovation and responsiveness to consumer preferences.

In December 2025, Mohawk Industries (US) announced a partnership with a leading technology firm to enhance its digital marketing capabilities. This strategic move is likely to bolster its online presence and improve customer interaction, aligning with the growing trend of digitalization in the industry. By investing in technology, Mohawk Industries (US) aims to streamline its operations and enhance customer experience, which could provide a competitive edge in a rapidly evolving market.

In November 2025, Shaw Industries (US) launched a new line of sustainable carpets made from recycled materials. This initiative not only reflects the company’s commitment to environmental stewardship but also positions it favorably among eco-conscious consumers. The introduction of this product line is expected to attract a broader customer base, thereby enhancing Shaw Industries' (US) market share and reinforcing its reputation as a leader in sustainable flooring solutions.

In October 2025, Interface, Inc. (US) unveiled its latest innovation in modular carpet tiles, which incorporate advanced AI technology for improved design customization. This strategic action underscores Interface, Inc.'s (US) focus on integrating technology into its product offerings, potentially setting a new standard in the industry. By leveraging AI, the company aims to enhance customer satisfaction through personalized solutions, which may lead to increased loyalty and repeat business.

As of January 2026, current competitive trends in the Carpet Manufacturers Market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the landscape, enabling companies to pool resources and expertise to drive innovation. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident. Moving forward, competitive differentiation is likely to evolve, with companies that prioritize innovation and sustainability standing to gain a significant advantage in the marketplace.