Increased Focus on Data Security

In the US Business Intelligence Bi Vendors Market, data security has emerged as a pivotal driver of growth. With the increasing frequency of data breaches and cyber threats, organizations are prioritizing the protection of sensitive information. A recent survey indicates that over 60% of US companies consider data security a top concern when selecting BI solutions. This heightened focus on security is prompting BI vendors to enhance their security features, including encryption, access controls, and compliance with regulations such as GDPR and CCPA. As businesses navigate the complexities of data governance, the demand for secure BI solutions is expected to rise. This trend not only influences vendor offerings but also shapes customer expectations, as organizations seek partners who can ensure the integrity and confidentiality of their data. The emphasis on data security is likely to remain a driving force in the US Business Intelligence Bi Vendors Market.

Expansion of Self-Service BI Tools

The US Business Intelligence Bi Vendors Market is witnessing a significant expansion in self-service BI tools. These tools empower non-technical users to access and analyze data independently, thereby democratizing data insights across organizations. Recent statistics reveal that nearly 65% of US businesses are adopting self-service BI solutions to enhance data accessibility and foster a data-driven culture. This trend is particularly appealing to small and medium-sized enterprises (SMEs) that may lack extensive IT resources. By enabling users to create reports and dashboards without relying on IT departments, self-service BI tools streamline workflows and accelerate decision-making processes. As the demand for user-friendly analytics solutions continues to grow, BI vendors are likely to invest in developing intuitive interfaces and robust training resources. The proliferation of self-service BI tools is poised to reshape the dynamics of the US Business Intelligence Bi Vendors Market.

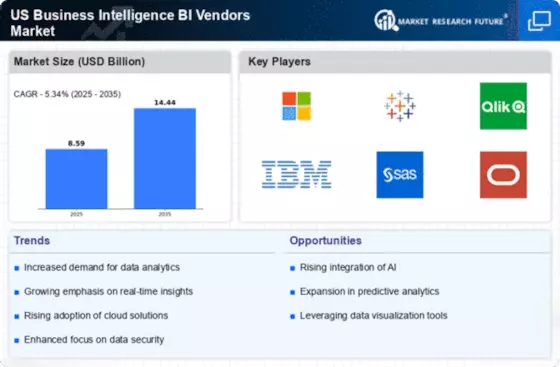

Growing Demand for Real-Time Analytics

The US Business Intelligence Bi Vendors Market is experiencing a notable surge in demand for real-time analytics. Organizations are increasingly recognizing the value of immediate data insights to drive decision-making processes. According to recent data, approximately 70% of enterprises in the US prioritize real-time analytics capabilities in their BI solutions. This trend is largely driven by the need for agility in responding to market changes and customer preferences. As businesses strive to enhance operational efficiency, the ability to analyze data in real-time becomes paramount. Consequently, BI vendors are adapting their offerings to meet this demand, leading to a competitive landscape where speed and accuracy are critical. The growing emphasis on real-time data processing is likely to shape the future of the US Business Intelligence Bi Vendors Market, as companies seek to leverage data for strategic advantages.

Rising Importance of Data Visualization

Data visualization is increasingly recognized as a vital component of the US Business Intelligence Bi Vendors Market. As organizations grapple with vast amounts of data, the ability to present information visually is becoming essential for effective communication and decision-making. Recent studies suggest that approximately 80% of decision-makers in the US prefer visual data representations over traditional reports. This preference is driving BI vendors to enhance their visualization capabilities, offering interactive dashboards and customizable reports that facilitate data interpretation. The emphasis on data visualization not only aids in identifying trends and anomalies but also enhances stakeholder engagement. As the demand for intuitive and impactful data presentations grows, BI vendors are likely to prioritize the development of advanced visualization tools. The rising importance of data visualization is expected to significantly influence the trajectory of the US Business Intelligence Bi Vendors Market.

Integration of Advanced Analytics Capabilities

The integration of advanced analytics capabilities is becoming a crucial driver in the US Business Intelligence Bi Vendors Market. Organizations are increasingly seeking to leverage predictive and prescriptive analytics to gain deeper insights from their data. Recent market analysis indicates that the adoption of advanced analytics tools is projected to grow by over 25% in the next few years. This shift is driven by the desire to not only understand historical data but also to forecast future trends and optimize business strategies. BI vendors are responding by incorporating machine learning algorithms and statistical modeling into their offerings, enabling users to uncover patterns and make data-driven predictions. As businesses strive for competitive advantage, the integration of advanced analytics is likely to play a pivotal role in shaping the future landscape of the US Business Intelligence Bi Vendors Market.