Technological Advancements

The UK commercial printing market is experiencing a notable transformation driven by technological advancements. Innovations such as digital printing, automation, and artificial intelligence are reshaping production processes, enhancing efficiency, and reducing turnaround times. For instance, the adoption of high-speed inkjet printing technology has allowed companies to produce high-quality prints at lower costs. This shift not only meets the growing demand for personalized and short-run printing but also enables businesses to respond swiftly to market changes. As a result, the UK commercial printing market is likely to witness increased competitiveness, with firms investing in state-of-the-art equipment to stay ahead. Furthermore, the integration of software solutions for workflow management is streamlining operations, thereby improving overall productivity and customer satisfaction.

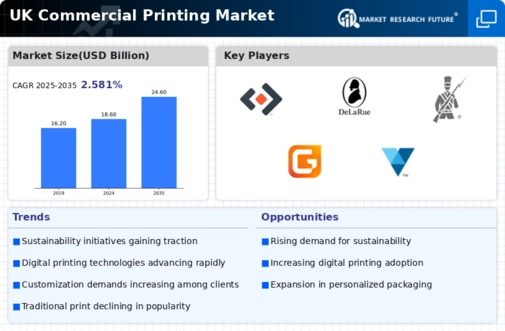

Economic Recovery and Investment

The UK commercial printing market is poised for growth as the economy shows signs of recovery. Increased consumer spending and business investments are driving demand for printed materials across various sectors, including advertising, publishing, and packaging. Recent economic indicators suggest a positive outlook, with GDP growth projected to stabilize in the coming years. This economic environment encourages businesses to invest in marketing and promotional activities, thereby boosting the demand for printed products. Additionally, as companies seek to enhance their brand presence, they are likely to allocate budgets towards high-quality print materials. Consequently, the UK commercial printing market may experience a resurgence in orders, prompting printers to expand their capabilities and explore new market opportunities.

Regulatory Compliance and Standards

In the UK commercial printing market, adherence to regulatory compliance and industry standards is becoming increasingly critical. The implementation of stringent environmental regulations, such as the UK Packaging Waste Regulations, compels printing companies to adopt sustainable practices. This includes the use of eco-friendly inks and recyclable materials, which not only align with consumer preferences but also mitigate environmental impact. Additionally, compliance with data protection laws, such as the General Data Protection Regulation (GDPR), is essential for businesses handling sensitive information. As companies navigate these regulations, they may invest in training and technology to ensure compliance, thereby enhancing their reputation and trustworthiness in the market. Consequently, the UK commercial printing market is likely to see a shift towards more responsible and transparent practices, which could attract environmentally conscious clients.

Growing Demand for Packaging Solutions

The UK commercial printing market is witnessing a surge in demand for packaging solutions, driven by the expansion of e-commerce and retail sectors. As online shopping continues to grow, businesses require innovative packaging designs that not only protect products but also enhance brand visibility. According to recent data, the UK packaging market is projected to reach approximately 12 billion GBP by 2026, indicating a robust growth trajectory. This trend presents significant opportunities for commercial printers to diversify their offerings and cater to the evolving needs of clients. Moreover, the emphasis on sustainable packaging solutions is prompting printers to explore biodegradable and recyclable materials, aligning with consumer preferences for environmentally friendly options. As a result, the UK commercial printing market is likely to adapt by investing in new technologies and materials to meet this burgeoning demand.

Customization and Personalization Trends

Customization and personalization are emerging as pivotal trends within the UK commercial printing market. As consumers increasingly seek unique and tailored products, businesses are responding by offering personalized printing solutions. This trend is particularly evident in sectors such as marketing, where companies utilize variable data printing to create targeted campaigns that resonate with specific audiences. The ability to produce customized materials, from business cards to promotional items, enhances customer engagement and loyalty. Furthermore, advancements in digital printing technology facilitate short-run production, making it economically viable for businesses to offer personalized options. As a result, the UK commercial printing market is likely to see a rise in demand for bespoke printing services, prompting companies to innovate and differentiate themselves in a competitive landscape.