E-commerce Growth

The surge in e-commerce activities is significantly influencing the Germany commercial printing market. As online retail continues to expand, businesses require various printed materials, including packaging, promotional materials, and labels. In 2025, the e-commerce sector in Germany was projected to reach a value of 100 billion euros, creating a substantial demand for printed products. This trend suggests that companies in the commercial printing sector must adapt to the evolving needs of e-commerce businesses. Furthermore, the integration of print and digital marketing strategies is becoming increasingly important, as brands seek to create cohesive customer experiences. Consequently, the Germany commercial printing market is likely to benefit from this growth, as it aligns its offerings with the requirements of the burgeoning e-commerce landscape.

Sustainability Regulations

Sustainability regulations are becoming a driving force in the Germany commercial printing market. The German government has implemented stringent environmental policies aimed at reducing carbon footprints and promoting eco-friendly practices. For example, the Packaging Act mandates that companies minimize packaging waste and utilize recyclable materials. This regulatory environment encourages printing companies to adopt sustainable practices, such as using eco-friendly inks and paper sourced from responsibly managed forests. As a result, businesses that prioritize sustainability are likely to gain a competitive edge in the market. In 2025, approximately 40% of consumers in Germany expressed a preference for products from environmentally responsible companies, indicating a shift in consumer behavior. Thus, the Germany commercial printing market must adapt to these regulations to remain relevant and meet the expectations of environmentally conscious consumers.

Technological Advancements

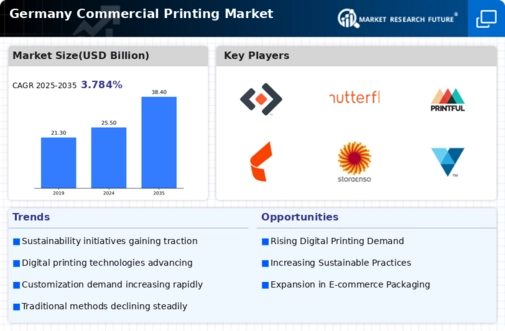

The Germany commercial printing market is experiencing a notable transformation due to rapid technological advancements. Innovations in printing technology, such as digital printing and automation, are enhancing efficiency and reducing production costs. For instance, the adoption of high-speed inkjet printers has increased output capabilities, allowing businesses to meet growing demand. In 2025, the market for digital printing in Germany was valued at approximately 3 billion euros, indicating a robust growth trajectory. These advancements not only streamline operations but also enable the production of high-quality prints, catering to diverse customer needs. As companies invest in state-of-the-art equipment, the competitive landscape of the Germany commercial printing market is likely to evolve, fostering a culture of innovation and responsiveness.

Global Supply Chain Dynamics

The germany commercial printing market. The interconnectedness of global markets means that fluctuations in raw material availability and pricing can directly affect printing companies. For instance, disruptions in the supply of paper and ink due to geopolitical tensions or trade policies can lead to increased costs for printing businesses. In 2025, the price of paper in Germany saw a notable increase of 15% due to supply chain challenges, prompting companies to seek alternative materials and suppliers. This situation necessitates that businesses in the Germany commercial printing market adopt agile supply chain strategies to mitigate risks and ensure continuity. By diversifying suppliers and exploring local sourcing options, companies can enhance their resilience against global supply chain disruptions.

Customization and Personalization

The demand for customization and personalization is reshaping the Germany commercial printing market. Consumers increasingly seek tailored products that reflect their individual preferences, prompting businesses to offer personalized printing solutions. This trend is particularly evident in sectors such as marketing and packaging, where unique designs can enhance brand identity. In 2025, the market for personalized printed products in Germany was estimated to be worth over 1 billion euros, highlighting the lucrative opportunities in this segment. Companies that leverage data analytics to understand customer preferences can create targeted marketing campaigns and personalized products, thereby fostering customer loyalty. As the demand for customized solutions continues to rise, the Germany commercial printing market is likely to evolve, with businesses investing in technologies that facilitate personalization.